Are you looking to diversify your investment portfolio? Consider adding American Airlines Group Inc. Common Stock, Index Fund, and Defensive Stock to your watchlist. This article delves into the intricacies of these investment options, offering valuable insights for both beginners and seasoned investors.

Understanding American Airlines Group Inc. Common Stock

American Airlines Group Inc. (AAL) is one of the largest airlines in the United States, offering domestic and international flights. Investing in AAL common stock means owning a piece of the company, which can provide potential dividends and capital gains. However, it's essential to understand the risks involved, such as fluctuations in the stock price and the airline industry's volatility.

Index Fund: A Diversified Approach

An index fund is a type of mutual fund that tracks the performance of a specific market index, such as the S&P 500. Investing in an index fund like the American Airlines Group Inc. Common Stock Index Fund allows investors to gain exposure to the airline industry without having to buy individual stocks. This diversification can help mitigate risks and potentially increase returns.

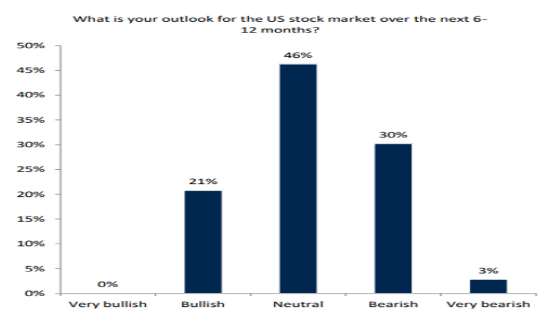

Defensive Stock: A Safe Haven During Market Downturns

Defensive stocks are known for their stability and consistent performance during market downturns. American Airlines Group Inc. Common Stock can be considered a defensive stock due to its resilience in the face of economic challenges. Investing in defensive stocks can help protect your portfolio from significant losses and preserve your wealth.

Case Study: American Airlines Group Inc. Common Stock Performance

In the past few years, American Airlines Group Inc. has demonstrated resilience in the face of the COVID-19 pandemic. While many airlines faced significant financial difficulties, AAL managed to navigate the crisis and maintain its position as a leading airline in the United States. This resilience is a testament to the company's strong financial health and management.

Investing in Index Fund and Defensive Stock: A Balanced Approach

To maximize your investment returns, consider a balanced approach that includes American Airlines Group Inc. Common Stock, Index Fund, and Defensive Stock. This diversification can help you mitigate risks and potentially increase your returns.

Conclusion

Incorporating American Airlines Group Inc. Common Stock, Index Fund, and Defensive Stock into your investment portfolio can provide a balanced and diversified approach. By understanding the risks and potential rewards associated with these investment options, you can make informed decisions that align with your financial goals.

Artius II Acquisition Inc. RightsECNGrowth ? America stock market