Introduction: Investing in the stock market can be a complex and challenging endeavor, especially when dealing with companies that operate through secondary markets and dual-class share structures. In this article, we delve into the American Assets Trust Inc. Common Stock, providing valuable insights into its secondary market dynamics and dual-class share structure. Understanding these aspects can empower investors to make informed decisions when considering adding this stock to their portfolios.

Understanding American Assets Trust Inc. Common Stock: American Assets Trust Inc. (AATI) is a real estate investment trust (REIT) focused on owning, operating, and developing high-quality properties in major U.S. markets. As a REIT, AATI distributes a substantial portion of its taxable income to shareholders as dividends. The common stock of AATI is traded on the New York Stock Exchange (NYSE) under the ticker symbol AATI.

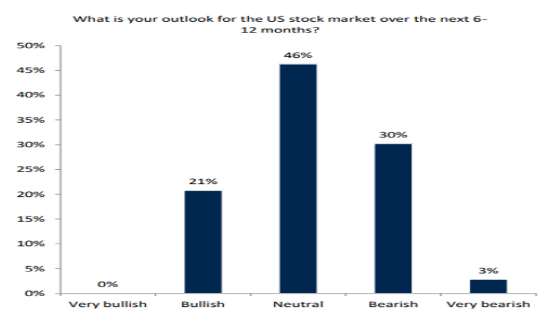

Secondary Market Dynamics: The secondary market for AATI common stock is where shares are bought and sold by investors after the initial public offering (IPO). This market is influenced by various factors, including the company's financial performance, economic conditions, and market sentiment.

One crucial aspect to consider when analyzing the secondary market for AATI common stock is the presence of dual-class shares. Dual-class share structures can lead to discrepancies in voting rights and dividend payouts between classes, which can affect the overall performance of the stock.

Dual-class Share Structure: American Assets Trust Inc. employs a dual-class share structure, which divides its shares into Class A and Class B shares. Class A shares, which represent the common stock, have one vote per share, while Class B shares have ten votes per share. This disparity in voting rights allows the founders and key management personnel of AATI to maintain a significant level of control over the company.

The dual-class share structure also affects dividend payouts. While Class A shareholders receive dividends on a pro-rata basis, Class B shareholders receive a higher dividend yield due to their increased voting power. This disparity can create a potential imbalance between the interests of common shareholders and Class B shareholders.

Case Study: The Impact of Dual-class Shares on AATI's Stock Performance Consider the example of an investor who purchased AATI common stock during its IPO at $25 per share. Over the past five years, the company has consistently delivered strong financial results, with revenue growth and dividend increases. However, the investor's returns may have been less impressive compared to those who held Class B shares, given the higher voting power and dividend yield associated with this class.

This case study highlights the importance of understanding the dual-class share structure when investing in companies like American Assets Trust Inc. By recognizing the potential imbalances in voting rights and dividend payouts, investors can better assess the risks and rewards associated with holding these stocks.

Conclusion: American Assets Trust Inc. Common Stock presents an interesting opportunity for investors interested in the real estate sector. However, understanding the secondary market dynamics and dual-class share structure is crucial for making informed decisions. By considering factors such as financial performance, economic conditions, and the impact of dual-class shares, investors can identify potential risks and rewards associated with AATI common stock.

Artius II Acquisition Inc. RightsECNGrowth ? America stock market