Introduction: In the dynamic world of the stock market, small-cap stocks often fly under the radar, but they can be a goldmine for investors looking for significant growth potential. Apple Inc. (AAPL) common stock, listed on the New York Stock Exchange (NYSE), is one such small-cap stock that has been turning heads. In this article, we'll delve into the fascinating world of Apple's common stock, exploring its growth potential, market position, and how it fits into the small-cap category.

Understanding Small-cap Stocks:

Before we dive into Apple's common stock, let's clarify what defines a small-cap stock. Small-cap stocks are generally characterized by companies with a market capitalization of between

Apple Inc. and Its Common Stock: Apple Inc. (AAPL), one of the most influential technology companies in the world, has a long-standing presence on the NYSE. Its common stock has a market capitalization of approximately $2.5 trillion, which, at the time of writing, makes it the highest-valued company in the world. However, for the purposes of this article, we'll focus on Apple's common stock within the small-cap category.

Apple's Growth Potential: Despite its massive market capitalization, Apple's common stock continues to attract investors due to its substantial growth potential. Over the years, the company has expanded its product line to include the iPhone, iPad, Mac, Apple Watch, and a range of services such as Apple Music, iCloud, and Apple TV+. This diversification has not only driven sales but also increased the company's revenue streams.

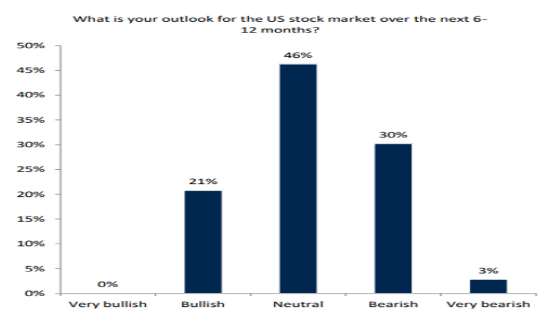

Market Position and Performance: Apple's common stock has consistently outperformed the market, delivering strong returns to investors. Over the past decade, the stock has experienced significant growth, with a compounded annual growth rate (CAGR) of around 7%. This performance has solidified Apple's position as a leader in the technology industry and has made it an attractive investment for both individual and institutional investors.

Case Studies: To illustrate the potential of Apple's common stock, let's consider two case studies:

iPhone X Launch: In 2017, Apple launched the iPhone X, which marked the first time the company introduced a new product with a price tag above $1,000. Despite the high price point, the iPhone X was a major success, with Apple selling millions of units. This launch was a testament to the company's ability to innovate and captivate consumers, driving growth in its common stock.

Services Segment Growth: Apple has also been successful in expanding its services segment, which includes Apple Music, iCloud, and Apple TV+. In the fiscal year 2020, the services segment accounted for approximately 11% of Apple's revenue. This growth has played a significant role in driving the overall performance of Apple's common stock.

Conclusion: Apple Inc. common stock, listed on the NYSE, has established itself as a strong player within the small-cap category. With its diverse product line, innovative approach, and impressive performance, Apple's common stock continues to attract investors looking for growth potential. As the technology industry evolves, Apple's ability to adapt and thrive makes it a compelling investment opportunity.

Artius II Acquisition Inc. RightsECNGrowth ? America stock market