In today's fast-paced financial world, investors are constantly seeking ways to gauge the risk and volatility associated with their investments. One such tool that has gained prominence is the Acadian Asset Management Inc. Common Stock Volatility Index Class B Shares. This index serves as a critical resource for investors looking to assess the market's potential for volatility and make informed decisions. Let's delve into what this index is all about and how it can benefit investors.

What is the Acadian Asset Management Inc. Common Stock Volatility Index Class B Shares?

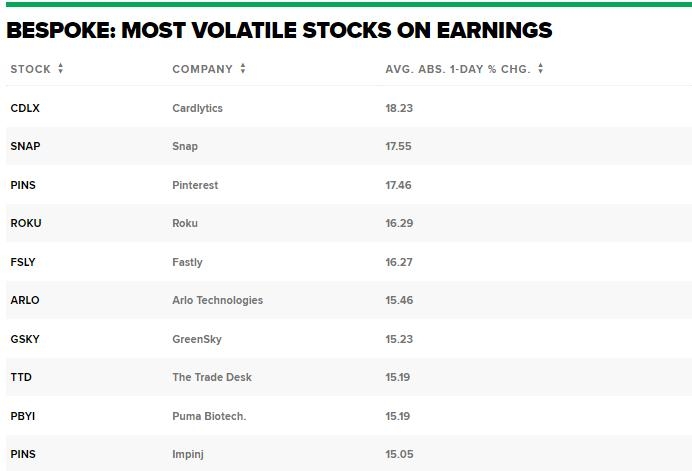

The Acadian Asset Management Inc. Common Stock Volatility Index Class B Shares is a benchmark that measures the volatility of a basket of U.S. common stocks. It is designed to provide investors with a clear and concise indicator of the market's potential for price fluctuations. By tracking the volatility of a diverse group of stocks, this index offers a comprehensive view of the market's overall risk profile.

How Does the Index Work?

The index is constructed using a rules-based methodology that selects a representative sample of U.S. common stocks. These stocks are chosen based on various criteria, including market capitalization, liquidity, and industry representation. Once selected, the stocks are weighted according to their market capitalization, providing a balanced view of the market.

Benefits of Using the Index

Risk Assessment: The Acadian Asset Management Inc. Common Stock Volatility Index Class B Shares allows investors to quickly gauge the market's risk level. This is particularly useful for those who are risk-averse and prefer to avoid high-volatility investments.

Investment Strategy: The index can be used to inform investment strategies. For instance, investors may choose to adjust their portfolio allocation based on the index's reading, moving towards more conservative assets during periods of high volatility.

Market Timing: By monitoring the index, investors can potentially time their market entries and exits more effectively. This can lead to better risk-adjusted returns over time.

Case Study: The 2020 Market Volatility

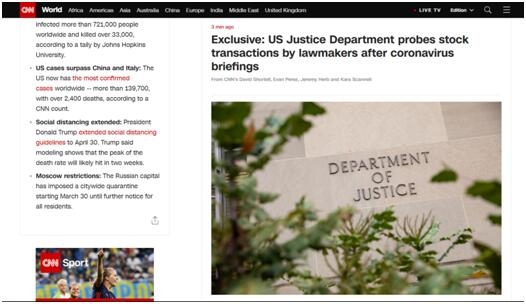

A prime example of how the Acadian Asset Management Inc. Common Stock Volatility Index Class B Shares can be utilized is during the 2020 market volatility, driven by the COVID-19 pandemic. As the index registered high levels of volatility, investors who followed its readings were able to take proactive measures to protect their portfolios.

Conclusion

The Acadian Asset Management Inc. Common Stock Volatility Index Class B Shares is a valuable tool for investors looking to understand and navigate the market's risk landscape. By providing a clear indicator of market volatility, this index can help investors make informed decisions and potentially enhance their investment performance.

Artius II Acquisition Inc. RightsECNGrowth ? America stock market