In the dynamic world of investing, certain stocks capture the attention of both seasoned traders and novices alike. One such stock is ATA Creativity Global American Depositary Shares (ATAI). This article delves into the recent trends of this cyclical stock, exploring its new highs and lows, and why it remains a key player in the market.

Understanding ATA Creativity Global American Depositary Shares

ATA Creativity Global is a leading provider of innovative technology solutions. The company's American Depositary Shares (ADS) are traded on the NASDAQ under the ticker symbol ATAI. This stock is known for its cyclical nature, often experiencing significant price fluctuations based on market conditions and economic cycles.

New Highs and Lows

Over the past few years, ATAI has seen its share price reach new highs and lows, reflecting the volatile nature of cyclical stocks. In recent months, the stock has been on an upward trajectory, reaching new highs due to several factors.

Factors Contributing to New Highs

- Strong Earnings Reports: ATA Creativity Global has consistently reported strong financial results, with revenue and profit margins growing year over year. This has bolstered investor confidence and driven the stock price higher.

- Expansion into New Markets: The company has been successful in expanding its operations into new markets, diversifying its revenue streams and increasing its market share.

- Positive Industry Trends: The technology sector, in which ATAI operates, has been experiencing strong growth, driven by increasing demand for innovative solutions.

New Lows and the Impact of Economic Cycles

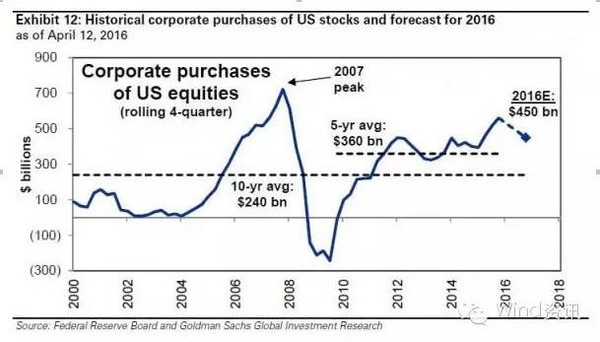

Despite the recent upward trend, ATAI has also experienced periods of new lows. These lows are often a result of economic cycles and market volatility. For instance, during the global financial crisis of 2008, ATAI's share price plummeted, reflecting the broader market's decline.

Cyclical Nature of the Stock

The cyclical nature of ATAI is a key factor to consider for investors. The stock's performance is closely tied to the overall economic cycle, with strong growth during periods of economic expansion and weakness during recessions.

Case Study: ATA Creativity Global's Response to the COVID-19 Pandemic

One notable example of ATAI's cyclical nature is its response to the COVID-19 pandemic. As the pandemic hit, many companies faced significant challenges. However, ATAI was able to adapt quickly, leveraging its technology solutions to help businesses navigate the crisis. This agility and resilience contributed to the stock's resilience during the downturn and its subsequent recovery.

Conclusion

ATA Creativity Global American Depositary Shares (ATAI) is a cyclical stock that has seen its share price reach new highs and lows. Understanding the factors driving these trends and the company's cyclical nature is crucial for investors looking to capitalize on this dynamic stock. With a strong track record of innovation and a focus on expansion, ATAI remains a key player in the technology sector.

BZQIY Stock: The Ultimate Investment Opport? Us stocks plummet