In recent years, the financial world has witnessed an unprecedented surge in market values, leading to what many are calling an "all-time high market." This article delves into the factors contributing to this surge, the potential risks involved, and how investors can navigate this volatile landscape.

The Surge in Market Values

Several key factors have contributed to the current all-time high market. Firstly, the global economic recovery from the COVID-19 pandemic has led to increased investor confidence. As economies reopen, businesses are thriving, and this has translated into higher stock prices.

Secondly, central banks around the world have implemented aggressive monetary policies to stimulate economic growth. This has resulted in low-interest rates and increased liquidity in the markets, making it easier for investors to borrow money and invest in stocks.

Lastly, the rise of technology and innovation has created numerous opportunities for growth. Companies in sectors like technology, healthcare, and renewable energy are leading the charge, driving up market values.

Risks Involved

While the all-time high market is a positive sign for many investors, it also comes with its own set of risks. One of the primary risks is the potential for a market correction. With stock prices at record highs, there is a heightened risk of a sudden drop in values.

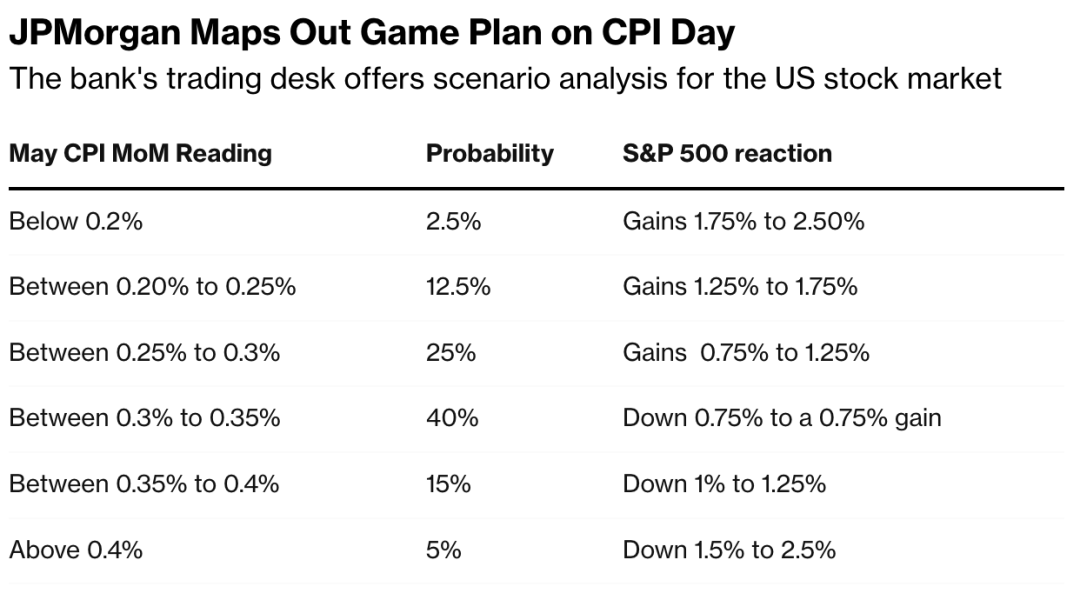

Another risk is the increasing level of market volatility. As markets become more interconnected, a single event can have a ripple effect on global markets, leading to significant price swings.

Lastly, investors need to be aware of the potential for overvaluation. With some stocks trading at premium prices, there is a risk that these companies may not be able to sustain their growth rates in the long term.

Navigating the All-Time High Market

Despite the risks involved, there are ways investors can navigate the all-time high market successfully. Here are a few tips:

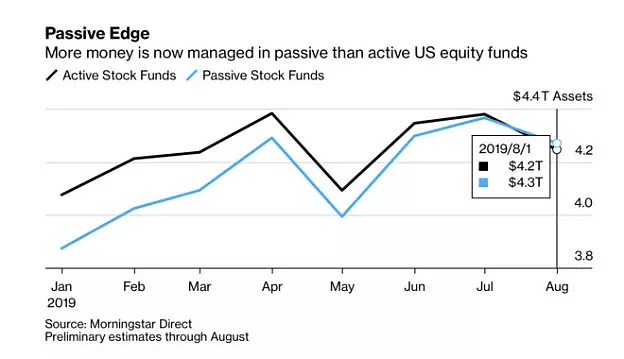

Diversify Your Portfolio: Diversification is key to mitigating risk. By investing in a variety of sectors and asset classes, you can reduce the impact of market volatility on your portfolio.

Stay Informed: Keep up-to-date with market trends and economic news. This will help you make informed decisions and avoid making impulsive investments.

Focus on Long-Term Growth: Instead of focusing on short-term gains, look for companies with strong fundamentals and long-term growth potential.

Consider Risk Management Strategies: Implement risk management strategies such as stop-loss orders to protect your investments.

Seek Professional Advice: If you are unsure about making investment decisions, consider seeking advice from a financial advisor.

Case Studies

One notable case study is the tech sector, which has seen significant growth over the past few years. Companies like Apple, Microsoft, and Amazon have seen their stock prices soar, contributing to the all-time high market. However, it's important to note that not all tech stocks are performing well. Investors need to be selective and focus on companies with strong fundamentals.

Another case study is the renewable energy sector. With the increasing focus on sustainability, companies in this sector are seeing significant growth. However, as with any emerging sector, there are risks involved, and investors need to conduct thorough research before investing.

In conclusion, the all-time high market presents both opportunities and challenges. By understanding the factors contributing to this surge, being aware of the risks involved, and implementing effective strategies, investors can navigate this volatile landscape successfully.

PFBX Stock: A Comprehensive Guide to Unders? America stock market