On August 4, 2025, the US stock market experienced a rollercoaster of emotions, with investors reacting to a mix of economic data and geopolitical tensions. This article provides a comprehensive summary of the key events and market movements of the day.

Stock Market Opening: Mixed Reactions

The trading day opened with a mix of reactions from investors. The Dow Jones Industrial Average (DJIA) opened slightly lower, while the S&P 500 and Nasdaq Composite Indexes showed modest gains. This initial uncertainty was due to a combination of factors, including the release of the latest jobs report and tensions in the Middle East.

Jobs Report: Mixed Bag

The US Department of Labor released the July jobs report, showing that the economy added 187,000 jobs, slightly below the consensus estimate of 200,000. The unemployment rate remained unchanged at 3.8%. While the report was considered a mixed bag, investors were primarily focused on the wage growth component.

Wage Growth: A Key Driver

The wage growth component of the report was particularly important. The average hourly wage increased by 0.3% in July, which was slightly below expectations. However, when adjusted for inflation, the real wage growth was 0.2%. This suggests that the labor market remains tight, but wage growth is not accelerating as quickly as some had hoped.

Tech Sector: Leading the Charge

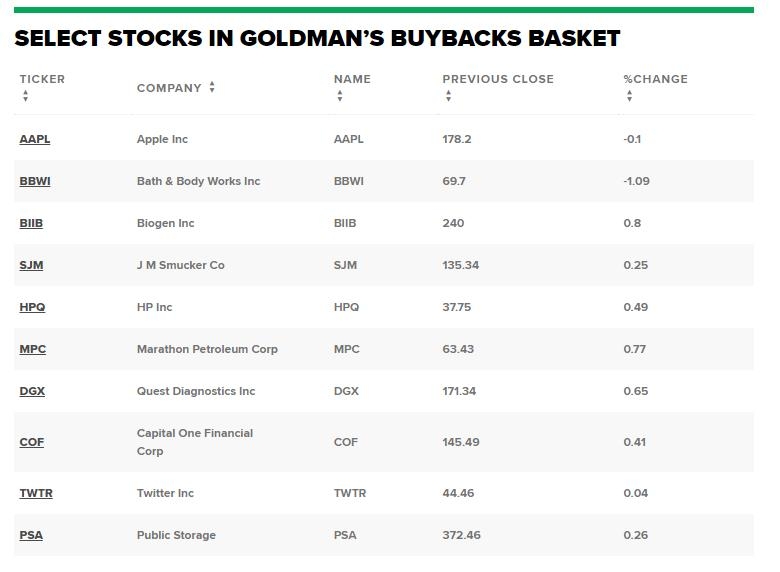

In a surprising turn of events, the tech sector led the charge higher on the day. Companies like Apple, Microsoft, and Amazon all reported strong earnings, boosting investor confidence. The Nasdaq Composite Index closed up over 1%, marking its best day in weeks.

Energy Sector: Impacted by Geopolitical Tensions

The energy sector was significantly impacted by geopolitical tensions in the Middle East. News of a potential conflict in the region sent oil prices soaring, with the West Texas Intermediate (WTI) crude oil futures closing above $70 per barrel. This surge in oil prices had a positive impact on energy stocks, with the Energy Select Sector SPDR Fund (XLE) closing up over 2%.

Consumer Discretionary Sector: Under Pressure

On the flip side, the consumer discretionary sector came under pressure due to concerns about rising inflation and interest rates. Companies like Disney and Home Depot reported weaker-than-expected earnings, leading to declines in their respective stock prices.

Market Wrap-Up: Mixed Results

By the end of the trading day, the US stock market showed mixed results. The DJIA closed down slightly, while the S&P 500 and Nasdaq Composite Indexes ended higher. This mixed performance reflects the complex nature of the current market environment, where investors are balancing economic data, geopolitical tensions, and corporate earnings.

Case Study: Apple's Earnings Beat

One of the standout stories of the day was Apple's earnings report. The tech giant reported strong revenue and earnings growth, driven by strong demand for its iPhone and services. Apple's stock closed up over 3%, adding to its recent rally.

In conclusion, August 4, 2025, was a day of mixed emotions in the US stock market. While the tech sector led the charge higher, other sectors were impacted by economic data and geopolitical tensions. As investors continue to navigate this complex market environment, it will be interesting to see how these trends evolve in the coming weeks and months.

WACLY Stock: The Ultimate Guide to Understa? America stock market