In recent years, cryptocurrency has become a hot topic in the financial world. As a result, many investors are looking to invest in cryptocurrency stocks in the US. This article provides a comprehensive guide to help you understand the ins and outs of investing in cryptocurrency stocks in the US.

Understanding Cryptocurrency Stocks

Cryptocurrency stocks are stocks of companies that are involved in the cryptocurrency industry. This includes companies that mine cryptocurrencies, develop blockchain technology, and provide cryptocurrency-related services. Some of the most popular cryptocurrency stocks in the US include Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

Top Cryptocurrency Stocks in the US

Bitcoin (BTC): Bitcoin is the most popular cryptocurrency in the world, and many companies are involved in mining and trading Bitcoin. Some of the top Bitcoin stocks include MicroStrategy (MSTR), which has invested heavily in Bitcoin, and Riot Blockchain (RIOT), a Bitcoin mining company.

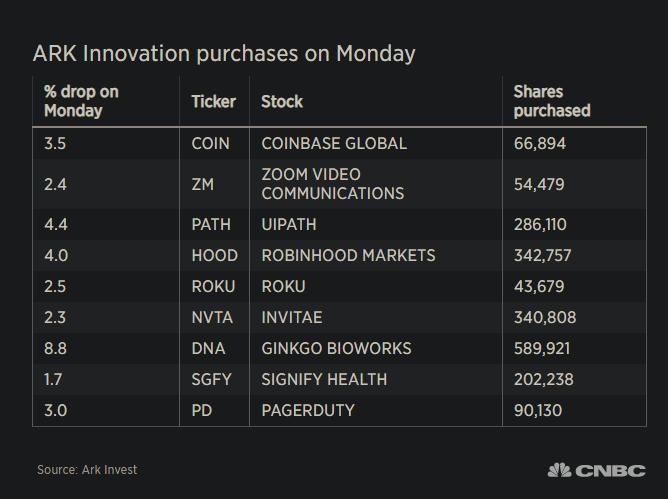

Ethereum (ETH): Ethereum is another popular cryptocurrency that has seen significant growth in recent years. Companies like Coinbase (COIN), a cryptocurrency exchange platform, and Ethereum Foundation, which supports the Ethereum network, are some of the top Ethereum stocks.

Ripple (XRP): Ripple is a cryptocurrency that is often used for international money transfers. Companies like Ripple Labs (XRP), which developed Ripple, and XRP II, a subsidiary of Ripple Labs, are some of the top Ripple stocks.

How to Invest in Cryptocurrency Stocks

Investing in cryptocurrency stocks in the US is relatively straightforward. Here are the steps you need to follow:

Choose a Broker: The first step is to choose a broker that offers cryptocurrency stocks. Many traditional brokers, such as Robinhood and E*TRADE, now offer cryptocurrency trading.

Open an Account: Once you have chosen a broker, you will need to open an account. This typically involves providing personal information and verifying your identity.

Fund Your Account: After opening an account, you will need to fund it with money. You can do this by transferring funds from your bank account or using a credit/debit card.

Research and Analyze: Before investing, it's important to research and analyze the cryptocurrency stocks you are interested in. Look at factors such as the company's financial health, market share, and growth potential.

Buy and Sell: Once you have done your research, you can buy and sell cryptocurrency stocks through your broker's platform.

Risks and Considerations

While investing in cryptocurrency stocks can be profitable, it's important to be aware of the risks involved. Cryptocurrency markets are highly volatile, and prices can fluctuate rapidly. Additionally, the cryptocurrency industry is still relatively new and unregulated, which can make it risky for investors.

Case Study: Coinbase

One of the most notable cryptocurrency stocks in the US is Coinbase (COIN). Coinbase is a cryptocurrency exchange platform that allows users to buy, sell, and trade cryptocurrencies. Since its IPO in April 2021, Coinbase has seen significant growth, with its stock price reaching an all-time high of over $400.

Conclusion

Investing in cryptocurrency stocks in the US can be a lucrative opportunity, but it's important to do your research and understand the risks involved. By following the steps outlined in this guide, you can make informed decisions and potentially profit from the growing cryptocurrency market.

Unlocking Opportunities: Understanding the ? America stock market