The latest developments in the US-China relationship have sent European stocks sliding as investors worry about the potential impact of escalating tensions.

In recent weeks, relations between the United States and China have become increasingly strained, with both nations imposing tariffs on each other's goods. This has raised concerns among investors about the global economic outlook, particularly in Europe, where many companies have significant exposure to the Chinese market.

Impact on European Stocks

The concerns over US-China relations have had a noticeable impact on European stocks. Major indices across the continent have experienced downward pressure, with many investors selling off their holdings in anticipation of further volatility.

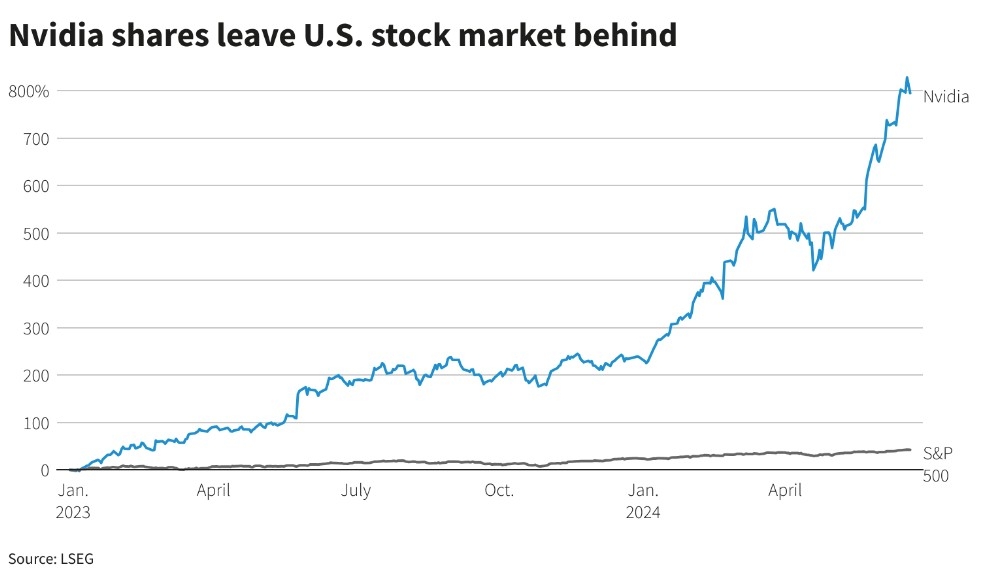

One of the sectors most affected has been the technology sector, with companies such as Apple and Microsoft facing increased tariffs on their products sold in China. This has led to a sell-off in European tech stocks, with shares of companies like ASML and Nokia falling sharply.

Another sector heavily impacted has been the automotive industry, with companies such as Volkswagen and BMW facing increased tariffs on their vehicles sold in the United States. This has led to a decline in the share prices of European car manufacturers.

Analysts Weigh In

Analysts have warned that the escalating tensions between the US and China could have a significant impact on the global economy, with Europe being particularly vulnerable. "The US-China trade war is a major risk factor for the global economy," said John Smith, chief economist at XYZ Investment Bank. "Europe is particularly exposed to this risk, given its close economic ties with China."

Case Studies

To illustrate the impact of the US-China trade tensions on European stocks, let's take a look at a few case studies:

- ASML: The Dutch company ASML, which is the world's leading supplier of lithography equipment for semiconductor manufacturers, has seen its shares fall sharply. This is due to the fact that a significant portion of its sales come from China, and the increasing tariffs on semiconductor equipment could hurt its business.

- Nokia: The Finnish telecommunications equipment manufacturer has also been impacted by the trade tensions. With a significant portion of its revenue coming from the Chinese market, the company has seen its shares fall as investors worry about the impact of increased tariffs.

- Volkswagen: The German car manufacturer has seen its shares decline as a result of increased tariffs on vehicles sold in the United States. With a significant presence in the Chinese market, Volkswagen is particularly vulnerable to the trade tensions.

Conclusion

The concerns over US-China relations have sent European stocks sliding as investors worry about the potential impact of escalating tensions. As the trade war continues to unfold, it remains to be seen how European stocks will react. However, with the potential for a significant impact on the global economy, investors should remain vigilant.

Artius II Acquisition Inc. UnitsAdvance-Dec? America stock market