Are you considering investing in the US stock market but feeling overwhelmed by the vast array of options and strategies? You're not alone. Many investors are eager to capitalize on the potential growth and stability that the US stock market offers, but they often lack the knowledge and confidence to make informed decisions. This guide will provide you with essential information to help you navigate the US stock market and make strategic investments.

Understanding the US Stock Market

The US stock market is one of the largest and most influential in the world. It's a place where companies can raise capital by selling shares of their stock to investors. These shares are then traded on various exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. By investing in the US stock market, you can potentially earn significant returns on your investment.

Types of Stocks to Consider

When investing in the US stock market, it's crucial to understand the different types of stocks available:

- Common Stocks: These represent ownership in a company and come with voting rights. They also offer the potential for dividends and capital gains.

- Preferred Stocks: These provide fixed dividends and typically have a higher claim on assets and earnings than common stocks. However, preferred stockholders generally do not have voting rights.

- Blue-Chip Stocks: These are shares of well-established, financially stable companies with a history of reliable performance. They are often considered lower-risk investments.

Strategies for Success

To maximize your returns and minimize your risks, consider the following strategies:

- Diversification: Invest in a variety of stocks across different sectors and industries to spread out your risk.

- Long-Term Investing: Focus on long-term growth rather than short-term gains. Historically, the US stock market has provided positive returns over the long term.

- Research and Education: Educate yourself on the companies you're considering investing in, as well as the broader market trends and economic indicators.

Case Study: Apple Inc.

One of the most successful companies in the US stock market is Apple Inc. (AAPL). Since its initial public offering (IPO) in 1980, Apple has grown to become the world's largest company by market capitalization. By investing in Apple stock, investors have seen significant returns over the years. This case study highlights the potential of long-term investing in a well-established company.

Risks to Consider

While the US stock market offers numerous opportunities for growth, it's essential to be aware of the risks involved:

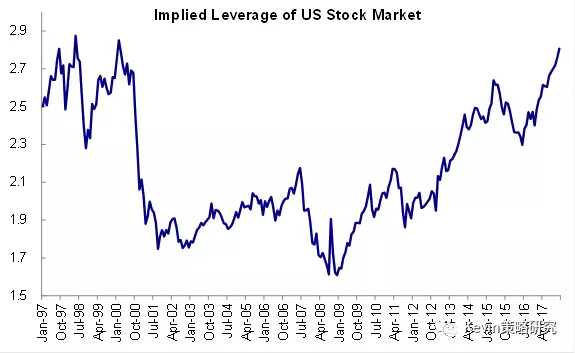

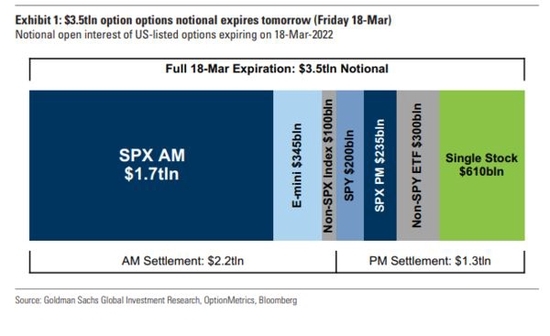

- Market Volatility: Stock prices can fluctuate significantly, leading to potential losses.

- Economic Factors: Economic downturns, such as recessions, can impact the performance of stocks.

- Company-Specific Risks: Issues within a company, such as poor financial performance or product recalls, can negatively affect its stock price.

Conclusion

Investing in the US stock market can be a lucrative opportunity, but it requires careful planning and research. By understanding the types of stocks available, implementing successful strategies, and being aware of the risks involved, you can increase your chances of achieving success. Remember to diversify your investments, focus on long-term growth, and educate yourself on the market and the companies you're considering investing in. With the right approach, investing in the US stock market can be a rewarding experience.

AAON Inc. Common Stock Trading: A Comprehen? America stock market