In the ever-fluctuating world of finance, investors often find themselves pondering whether the US stock market is in a bull or bear phase. Understanding the market's current state is crucial for making informed investment decisions. In this article, we delve into the current trends and factors that determine whether the US stock market is in a bull or bear market.

Understanding Bull and Bear Markets

A bull market is characterized by rising stock prices, optimism among investors, and economic growth. Conversely, a bear market is marked by falling stock prices, pessimism, and economic downturn. Identifying the market's phase is essential for investors looking to capitalize on market trends or mitigate potential losses.

Current Market Trends

As of early 2023, the US stock market exhibits several indicators that suggest a bull market phase. Here are some key trends:

Strong Economic Growth: The US economy has shown robust growth in recent quarters, driven by factors like low unemployment rates, increasing consumer spending, and strong corporate earnings.

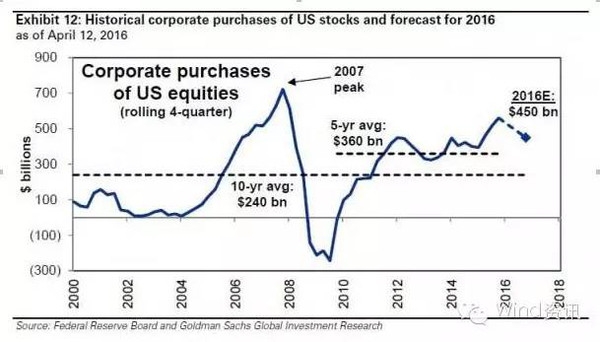

Record Corporate Profits: Many companies have reported strong earnings, which have contributed to a rise in stock prices.

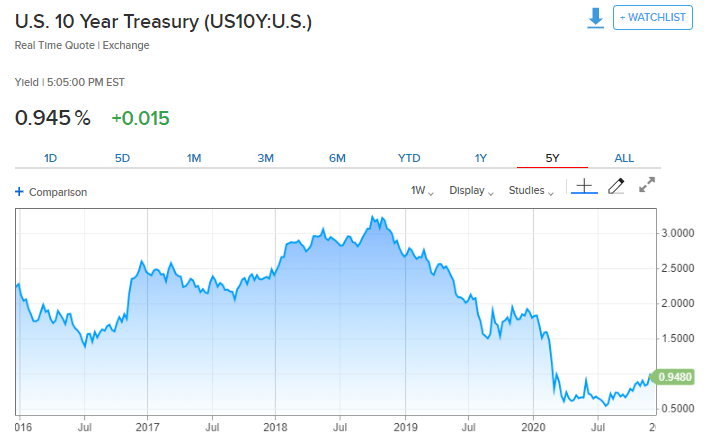

Low Interest Rates: The Federal Reserve has kept interest rates low to stimulate economic growth, which has benefited the stock market.

Technological Advancements: The tech sector, which accounts for a significant portion of the stock market, has continued to grow, driven by advancements in artificial intelligence, cloud computing, and 5G technology.

Government Policies: The Biden administration's infrastructure spending bill and other stimulus measures have also contributed to the market's upward trend.

Factors Influencing the Market

Several factors can influence whether the US stock market is in a bull or bear phase. Here are some key factors to consider:

Economic Indicators: Economic indicators like GDP growth, inflation rates, and consumer spending can indicate the market's direction.

Political Events: Political events, such as elections or policy changes, can impact investor sentiment and market trends.

Global Events: Global events, such as trade disputes or geopolitical tensions, can also influence the US stock market.

Market Sentiment: Investor sentiment plays a significant role in determining market trends. Optimism can drive a bull market, while pessimism can lead to a bear market.

Case Studies

To illustrate the impact of market trends and factors on the stock market, let's consider a few case studies:

2020 Stock Market Crash: The COVID-19 pandemic led to a significant drop in stock prices, marking a bear market phase. However, the market quickly recovered as the economy started to reopen, showcasing the resilience of the stock market.

2008 Financial Crisis: The 2008 financial crisis led to a severe bear market, with the S&P 500 falling by more than 50%. However, the market eventually recovered, driven by government intervention and stimulus measures.

In conclusion, the US stock market is currently in a bull market phase, driven by factors like strong economic growth, record corporate profits, and low interest rates. However, it's important for investors to remain vigilant and consider the various factors that can influence the market's direction. By staying informed and adapting their strategies accordingly, investors can navigate the stock market's fluctuations and make informed investment decisions.

Artius II Acquisition Inc. Class A Ordinary? America stock market