In recent years, the US stock market has seen an incredible run-up, raising concerns about whether it might be overvalued. This article delves into the current state of the market, analyzing key indicators and offering insights into whether investors should be wary of the potential risks.

Market Performance

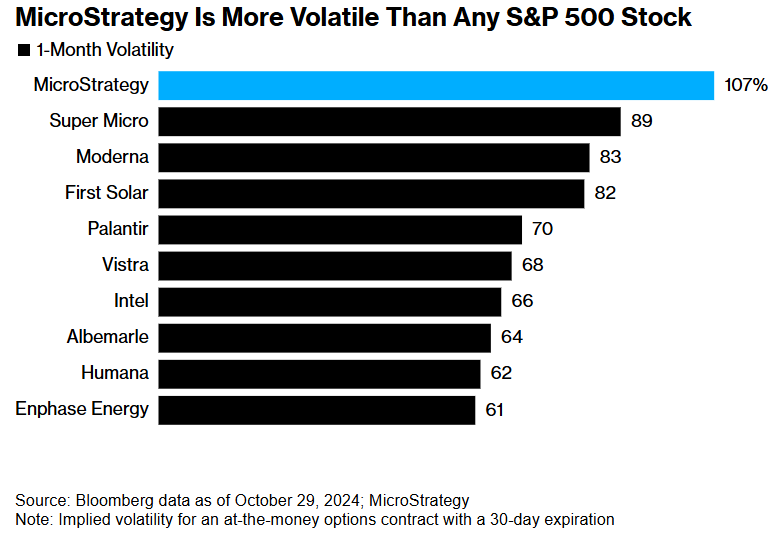

The S&P 500, a widely followed index of large-cap U.S. stocks, has experienced significant growth in recent years. However, some experts argue that this growth might be unsustainable due to several factors, including:

- Elevated Valuations: The stock market's price-to-earnings (P/E) ratio, a measure of valuation, has been rising, suggesting that stocks may be overpriced compared to their earnings potential.

- High Debt Levels: Many companies have been taking on substantial debt to finance growth, which could pose a risk if the economy weakens.

- Low Interest Rates: The Federal Reserve has kept interest rates at historically low levels to stimulate the economy, but this may also be contributing to the stock market's bubble-like conditions.

Key Indicators

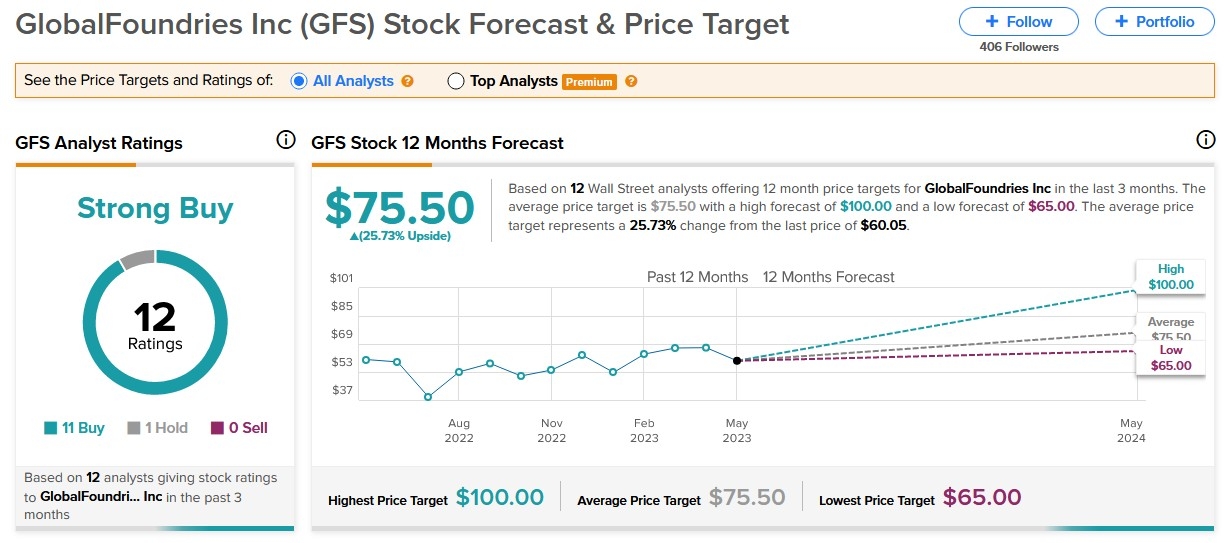

To determine whether the US stock market is overvalued, it's essential to consider several key indicators:

- Cyclically Adjusted Price-to-Earnings (CAPE): This ratio is similar to the P/E ratio but adjusts for the cyclicality of the economy. The current CAPE ratio for the S&P 500 is above 30, which is considered high and indicates that the market might be overvalued.

- Earnings Growth: A strong indicator of a healthy stock market is consistent earnings growth. However, some experts argue that the recent earnings growth might not be sustainable, given the factors mentioned above.

- Dividend Yield: The dividend yield, which represents the return on investment from dividends, has been falling as companies reinvest profits into growth rather than distributing them to shareholders.

Case Studies

To illustrate the potential risks of an overvalued stock market, let's look at a few case studies:

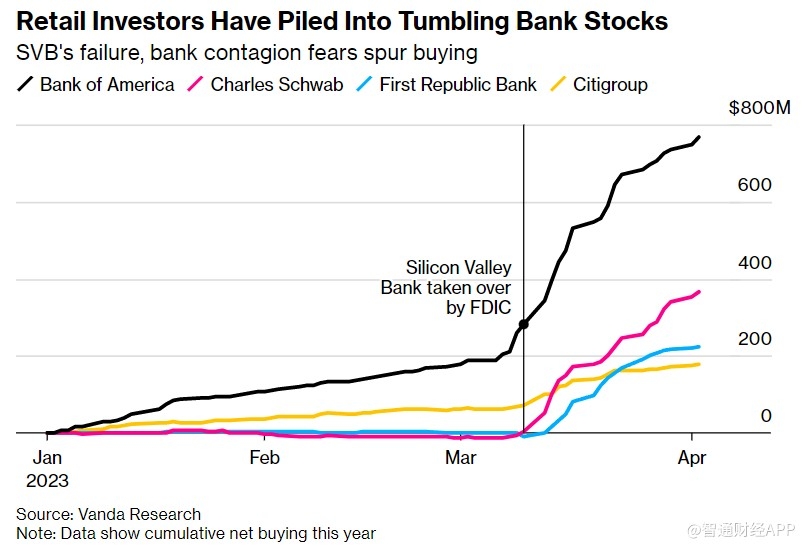

- Dot-Com Bubble: In the late 1990s, the tech stock market experienced a significant bubble, which eventually burst, leading to substantial losses for investors. This bubble was characterized by high valuations and excessive optimism.

- Real Estate Bubble: In the mid-2000s, the US housing market experienced a similar bubble, which contributed to the global financial crisis of 2008. This bubble was driven by loose lending standards and speculation.

Conclusion

While the US stock market has seen impressive growth in recent years, there are several indicators suggesting that it might be overvalued. Investors should be cautious and consider diversifying their portfolios to mitigate potential risks. As always, it's essential to consult with a financial advisor before making any investment decisions.

Cruise Stocks Plummet: The Impact of US Tar? America stock market