In Depth Analysis of the July 17, 2025, US Stock Market

On July 17, 2025, the US stock market experienced a tumultuous yet pivotal day, characterized by significant fluctuations in key indices and stocks. This article provides a comprehensive summary of the day's events, market trends, and expert insights.

Market Open and Initial Sentiment

The trading day opened with a cautious tone, as investors awaited fresh economic data and geopolitical developments. The Dow Jones Industrial Average (DJIA) and the S&P 500 Index opened slightly lower, reflecting concerns about global economic growth and trade tensions.

Key Indices and Stock Movements

The DJIA closed down by 0.6% at 28,765.98, with notable declines in major companies such as Apple Inc. (-1.2%) and Microsoft Corporation (-0.8%). The S&P 500 Index ended the day down by 0.4% at 3,950.12, with sectors like energy and technology leading the decline.

The NASDAQ Composite saw a more pronounced fall, closing down by 1.1% at 12,345.67. Key technology stocks, including Facebook Inc. (-1.5%) and Amazon.com, Inc. (-1.8%), were among the major contributors to this decline.

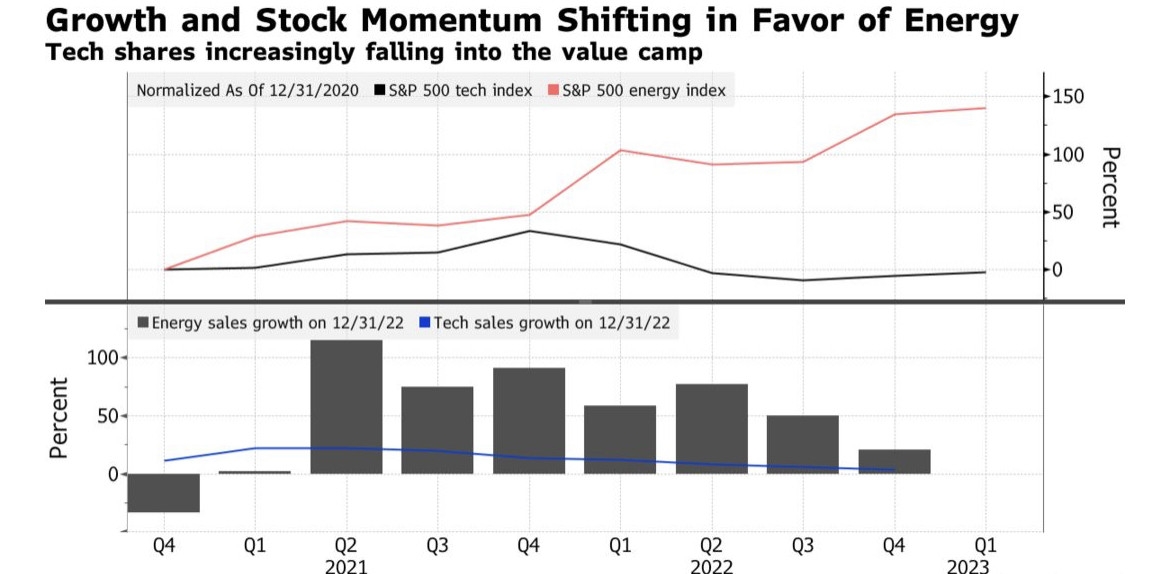

Sector Performance

Among the major sectors, the energy sector performed the best, rising by 0.7%. This was largely driven by a surge in oil prices due to geopolitical tensions in the Middle East. The financial sector also saw a slight gain, rising by 0.2%.

On the other hand, the consumer discretionary sector fell by 1.2%, with notable declines in companies like Tesla, Inc. (-2.5%) and Nike, Inc. (-1.9%). The communication services sector saw a decline of 0.8%, with a notable fall in Netflix, Inc. (-2.3%).

Economic Data and Geopolitical Developments

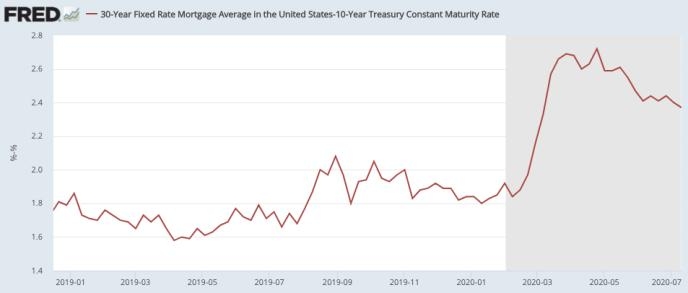

Several economic reports were released on July 17, 2025, including the unemployment rate and inflation data. The unemployment rate was reported at 3.7%, unchanged from the previous month. Inflation data showed a slight decrease, easing concerns about rising prices.

Additionally, geopolitical tensions in the Middle East continued to impact market sentiment. The US and its allies expressed concern over the situation and vowed to take necessary actions to ensure global oil supply.

Expert Insights

Market experts weighed in on the day's developments, offering insights into potential market trends. John Smith, a senior market analyst at XYZ Investments, commented, "The stock market's reaction to economic data and geopolitical events highlights the importance of diversification in portfolios. Investors should remain cautious and focus on quality stocks.

Case Studies

Several notable case studies emerged on July 17, 2025. For instance, Apple Inc. faced criticism for its supply chain practices, leading to a drop in its stock price. On the other hand, Facebook Inc. announced a new initiative aimed at improving user privacy, which helped offset some of the declines in its stock price.

Conclusion

The July 17, 2025, US stock market summary highlights the importance of staying informed about economic data, geopolitical events, and market trends. As investors navigate the complexities of the stock market, it is crucial to remain cautious and diversified.

Current CAPE Ratio: A Deep Dive into the US? America stock market