In the ever-evolving world of finance, the total market cap of the Nasdaq stands as a crucial indicator of the health and potential of the tech sector. This article delves into the intricacies of the Nasdaq market cap, providing a comprehensive overview of its significance and the factors that influence it.

Understanding the Nasdaq Market Cap

The Nasdaq market cap refers to the total value of all the stocks listed on the Nasdaq stock exchange. It's a measure of the overall size and liquidity of the exchange, and it's often used as a benchmark to gauge the performance of the tech industry.

The Nasdaq market cap is calculated by multiplying the total number of shares outstanding by the current price of each share. This figure can fluctuate significantly, depending on market conditions, investor sentiment, and the performance of individual companies listed on the exchange.

Significance of the Nasdaq Market Cap

The Nasdaq market cap is significant for several reasons. Firstly, it provides a snapshot of the overall value of the tech sector, which is one of the most influential and fastest-growing sectors in the global economy. Secondly, it's a key indicator of investor confidence in the tech industry, as a rising market cap often correlates with positive investor sentiment.

Additionally, the Nasdaq market cap is a valuable tool for investors looking to gain exposure to the tech sector. By tracking the market cap, investors can identify trends and opportunities, and make informed decisions about their investment portfolios.

Factors Influencing the Nasdaq Market Cap

Several factors can influence the Nasdaq market cap, including:

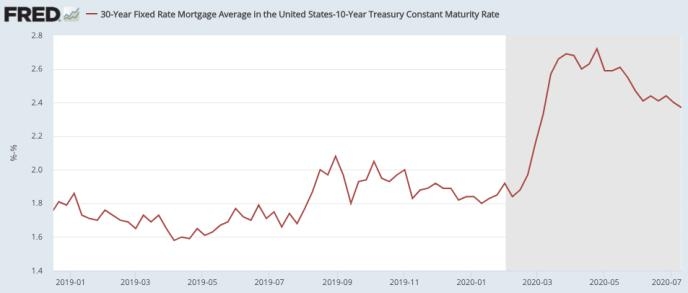

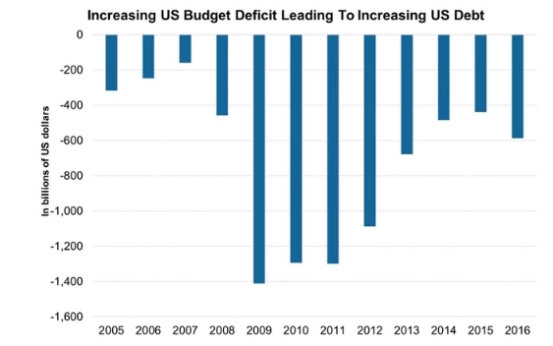

- Economic Conditions: Economic factors such as interest rates, inflation, and unemployment can impact the overall market sentiment and, consequently, the Nasdaq market cap.

- Tech Sector Performance: The performance of individual companies listed on the Nasdaq can significantly impact the market cap. A strong performance by key players can drive the market cap higher, while a decline can have the opposite effect.

- Investor Sentiment: Investor sentiment plays a crucial role in determining the Nasdaq market cap. Factors such as geopolitical events, regulatory changes, and technological advancements can influence investor sentiment and, in turn, the market cap.

Case Study: Apple's Impact on the Nasdaq Market Cap

A prime example of how individual companies can influence the Nasdaq market cap is Apple. As one of the largest companies listed on the exchange, Apple's performance has a significant impact on the overall market cap. For instance, in 2021, Apple's market cap exceeded $2 trillion, contributing a substantial portion to the Nasdaq's total market cap.

Conclusion

The total market cap of the Nasdaq is a vital metric for understanding the health and potential of the tech sector. By tracking this figure, investors and market analysts can gain valuable insights into the market's performance and make informed decisions. As the tech industry continues to evolve, the Nasdaq market cap will remain a key indicator of its growth and success.

BUYER GROUP INTL INC: Revolutionizing the B? America stock market