In the dynamic world of investment, short US stock ETFs have gained significant traction among both experienced traders and newcomers alike. These exchange-traded funds offer a unique way to capitalize on market downturns and potentially mitigate losses during volatile periods. In this article, we'll delve into what short US stock ETFs are, how they work, and their potential impact on your investment portfolio.

What is a Short US Stock ETF?

A short US stock ETF is designed to track the performance of a basket of U.S. stocks but in reverse. When the underlying index or stock increases in value, the short ETF falls, and vice versa. This means investors can profit from bearish market conditions or even from falling stocks within the selected index.

How Does a Short US Stock ETF Work?

Short US stock ETFs work through leveraging financial instruments, such as derivatives, which allow the fund to sell shares of a stock it does not own. When the stock price declines, the ETF profits, as it bought the shares at a higher price and sells them at a lower one. This process can amplify gains, but it also increases the risk of significant losses if the stock price rises unexpectedly.

Popular Short US Stock ETFs

Several popular short US stock ETFs have gained attention over the years. One example is the ProShares Short S&P 500 (SH), which is designed to move inversely to the S&P 500 index. Another is the ProShares Short Russell 2000 (ARCA:ARKW), which targets the Russell 2000 index of small-cap U.S. stocks.

Benefits of Short US Stock ETFs

Short US stock ETFs offer several potential benefits, including:

- Hedging Against Market Downturns: These ETFs can be used to hedge your portfolio against market downturns, reducing the potential for significant losses.

- Profit from Declining Markets: They provide an opportunity to profit from bearish market conditions, allowing investors to capitalize on market declines.

- Leverage: Short ETFs can amplify gains when the market moves against the investor's forecast.

Potential Risks

Despite the potential benefits, it's crucial to be aware of the risks associated with short US stock ETFs:

- Leverage Risk: As mentioned earlier, the use of leverage can amplify gains but also increase the risk of significant losses.

- Market Illiquidity: During periods of market stress, certain short ETFs may face liquidity issues, making it challenging to sell positions at desired prices.

- Tracking Errors: There can be discrepancies between the actual performance of a short ETF and the performance of its underlying index.

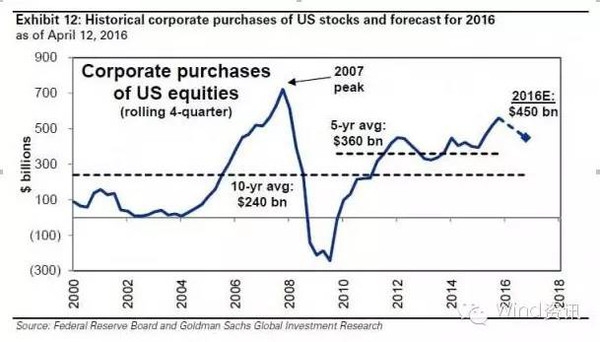

Case Study: The 2008 Financial Crisis

A notable case study demonstrating the effectiveness of short US stock ETFs is the 2008 financial crisis. During this period, many stocks and the overall market plummeted. Investors who had exposure to short ETFs experienced substantial gains, as the prices of these funds moved inversely to the market's downward trend.

Conclusion

Short US stock ETFs provide a powerful tool for investors looking to profit from bearish market conditions. However, as with any investment vehicle, they come with inherent risks. It's crucial for investors to thoroughly research and understand the potential implications of short ETFs before incorporating them into their investment strategy.

FURUKAWA CO LTD: A Leading Force in Japan&#? America stock market