The stock market is often a source of anxiety for investors, with many wondering if today will be the day of a potential crash. In this article, we delve into the factors that could lead to a stock market crash and provide insights into the current market conditions.

Understanding Market Volatility

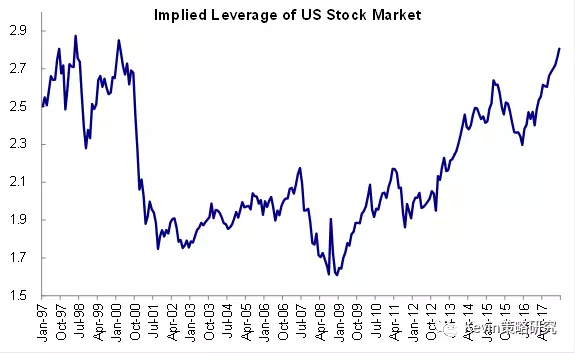

The stock market is inherently volatile, and it's essential to understand that fluctuations are a normal part of the market cycle. While a crash is always a possibility, it's crucial to differentiate between normal market volatility and a potential market crash.

Key Factors Influencing Stock Market Crashes

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation can significantly impact the stock market. A sudden decline in these indicators can lead to a market crash.

Political Events: Political instability, such as elections or policy changes, can cause uncertainty in the market, leading to a potential crash.

Market Manipulation: Unethical practices such as insider trading or market manipulation can destabilize the market and lead to a crash.

Technological Advancements: The rapid pace of technological advancements can disrupt traditional industries, causing stock prices to plummet.

Market Speculation: Excessive speculation in the market can lead to irrational price movements, potentially causing a crash.

Current Market Conditions

As of the latest data, the stock market is showing signs of volatility but not necessarily heading towards a crash. While there are concerns about economic indicators and political events, the market remains relatively stable.

Case Study: The 2008 Financial Crisis

One of the most significant stock market crashes in history was the 2008 financial crisis. The crisis was primarily caused by the collapse of the housing market, excessive risk-taking by financial institutions, and a lack of regulatory oversight. This crash resulted in a significant loss of investor confidence and a global economic downturn.

What Investors Should Do

If you're concerned about a potential stock market crash, here are some steps you can take:

Diversify Your Portfolio: Diversification can help mitigate the impact of a market crash by spreading your investments across various asset classes.

Stay Informed: Keep up-to-date with economic indicators, political events, and market trends to make informed decisions.

Review Your Investments: Regularly review your investments to ensure they align with your financial goals and risk tolerance.

Seek Professional Advice: Consider consulting with a financial advisor to help navigate the market and make informed decisions.

In conclusion, while a stock market crash is always a possibility, it's essential to understand the factors that can lead to such an event. By staying informed and taking proactive steps, investors can mitigate the risk of a crash and protect their investments.

Ascentage Pharma Group International Americ? America stock market