The recent volatility in the US stock market has left many investors questioning whether the market will recover. With the ongoing economic uncertainties and the impact of the COVID-19 pandemic, this question is more relevant than ever. In this article, we will delve into the factors that could influence the recovery of the US stock market and provide a comprehensive analysis.

Economic Recovery and Stock Market Performance

One of the primary factors that will determine the recovery of the US stock market is the overall economic recovery. As the economy begins to reopen, businesses will start to generate revenue, which could lead to an increase in stock prices. However, the pace of economic recovery will vary across different sectors.

Technology and Healthcare Sectors

The technology and healthcare sectors have been the standout performers during the pandemic. These sectors have seen significant growth due to increased demand for technology and medical supplies. As the economy recovers, these sectors are expected to continue their growth trajectory. Companies such as Apple, Amazon, and Microsoft are likely to benefit from this trend.

Impact of the Federal Reserve

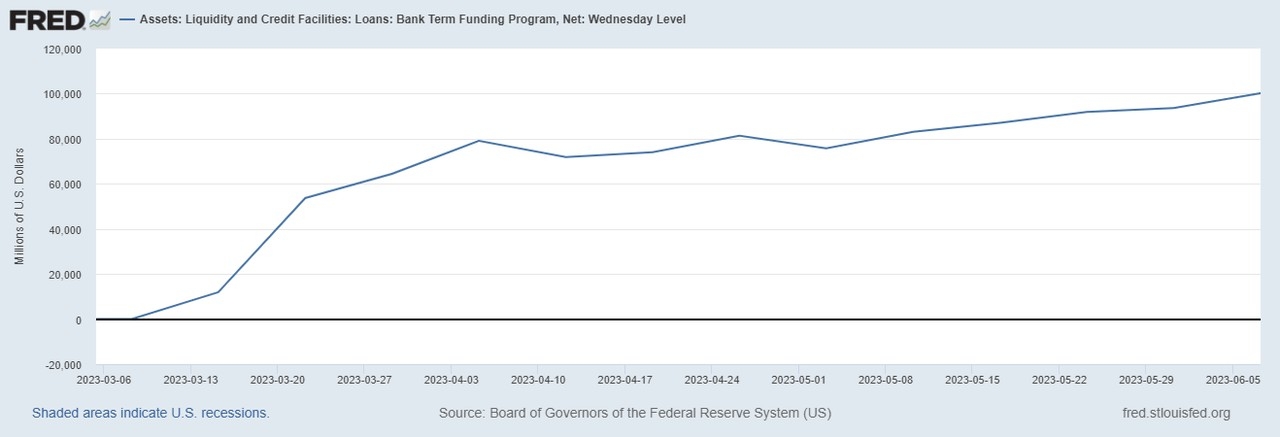

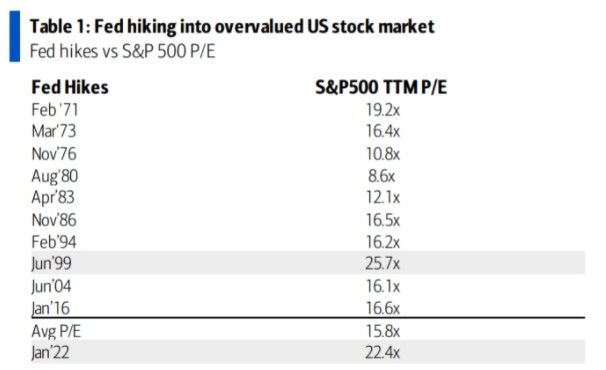

The Federal Reserve plays a crucial role in the stock market's recovery. By adjusting interest rates and implementing quantitative easing, the Federal Reserve can influence the stock market's performance. The recent decision to keep interest rates near zero has provided a strong support for the stock market.

Geopolitical Factors

Geopolitical tensions can also impact the US stock market. Tensions between the US and China, for example, have caused market volatility. However, as both countries work towards resolving their differences, the stock market could stabilize.

Impact of the COVID-19 Pandemic

The COVID-19 pandemic has had a significant impact on the US stock market. While the market has recovered from its initial downturn, the virus continues to pose a threat. The effectiveness of vaccines and the pace of vaccination campaigns will play a crucial role in determining the market's recovery.

Case Study: The S&P 500 Index

The S&P 500 index is a widely followed benchmark for the US stock market. During the pandemic, the index experienced a significant downturn, but it has since recovered. The index's performance can be attributed to the strong performance of the technology and healthcare sectors, as well as the support from the Federal Reserve.

Conclusion

The US stock market's recovery will depend on a combination of factors, including economic recovery, sector performance, Federal Reserve policies, geopolitical tensions, and the impact of the COVID-19 pandemic. While there are uncertainties, the market's strong performance in recent months suggests that a recovery is possible. Investors should remain vigilant and stay informed about the latest developments to make informed decisions.

AllianceBernstein Holding L.P. Units News H? America stock market