Title: US Snap Stocks: A Comprehensive Analysis

In the fast-paced world of finance, staying ahead of the curve is crucial. The latest buzz in the market is all about US Snap Stocks, a term that has caught the attention of investors and analysts alike. This article delves into the intricacies of US Snap Stocks, providing a comprehensive analysis of what they are, how they work, and why they have become a hot topic in the financial world.

What are US Snap Stocks?

US Snap Stocks refer to a unique trading strategy where investors buy or sell stocks at a predetermined price within a specific timeframe. This strategy is designed to capitalize on market movements, aiming to profit from the price difference between the purchase and sale of the stock. The key to success in this strategy lies in understanding market trends and having a keen sense of timing.

Understanding the Strategy

The Snap Stock strategy involves identifying stocks that are expected to experience rapid price movements. Investors then set a target price at which they wish to enter or exit the market. If the stock reaches this target price within the specified timeframe, the investor executes the trade, thereby profiting from the price difference.

Key Factors to Consider

Several factors contribute to the success of the Snap Stock strategy:

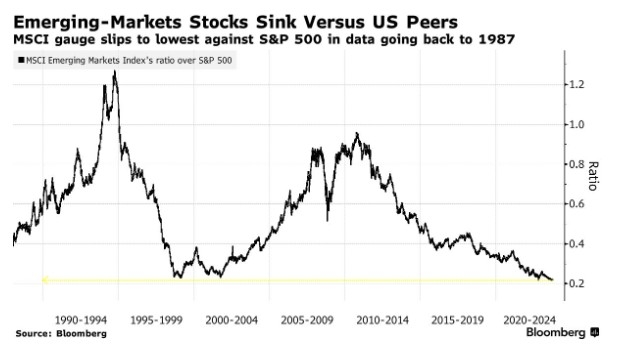

- Market Trends: Understanding the overall market trend is crucial. Investors need to analyze whether the market is bullish or bearish and position their trades accordingly.

- Volume: High trading volume indicates significant interest in a stock, which can lead to rapid price movements.

- News and Events: Stay informed about news and events that can impact stock prices. These can range from earnings reports to political developments.

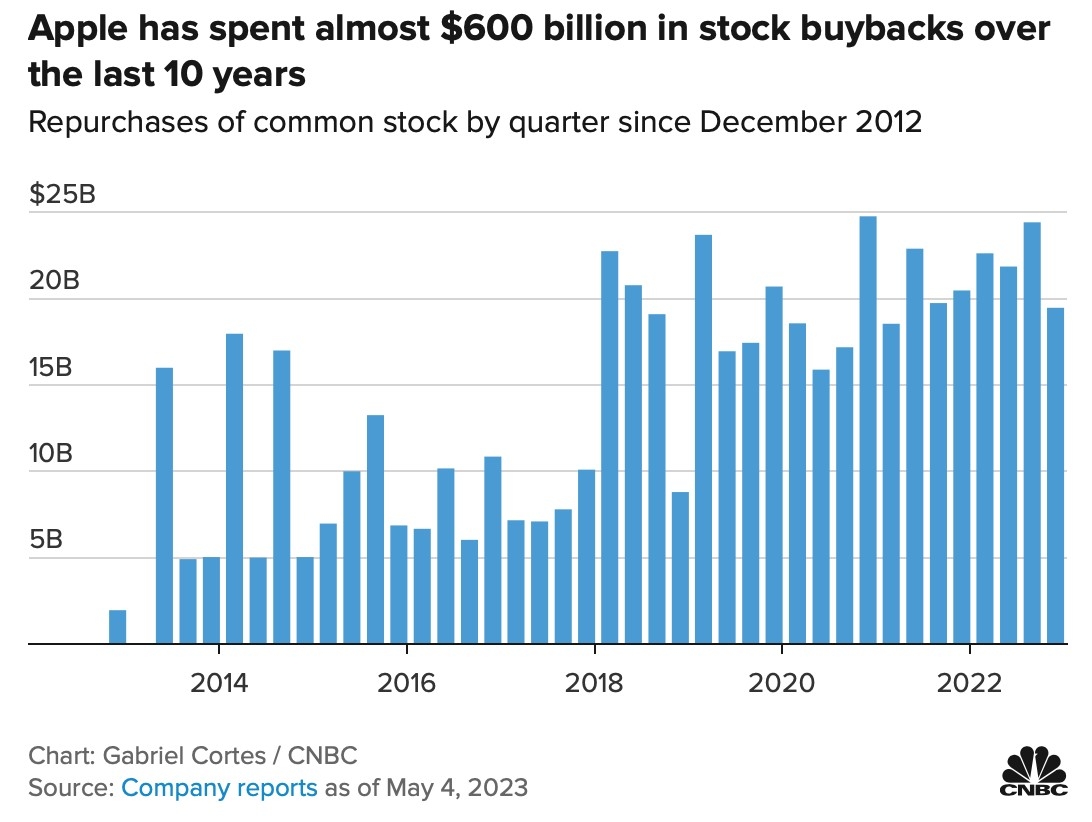

Case Study: Apple Inc. (AAPL)

A prime example of the Snap Stock strategy in action is the trading of Apple Inc. (AAPL) shares. In the days leading up to Apple's quarterly earnings report, investors closely monitored the stock. When the report was released, the stock experienced a significant price surge. Investors who had set a target price based on market trends and news were able to capitalize on this movement, making substantial profits.

Challenges and Risks

While the Snap Stock strategy can be lucrative, it is not without its challenges and risks:

- Market Volatility: The strategy requires investors to be on their toes, as market volatility can lead to unexpected price movements.

- Execution Risk: There is always a risk that the stock may not reach the target price within the specified timeframe, leading to potential losses.

- Liquidity: Some stocks may not be liquid enough to support the Snap Stock strategy, making it difficult to enter or exit the market at the desired price.

Conclusion

US Snap Stocks represent a unique and potentially profitable trading strategy. However, it is essential for investors to conduct thorough research and understand the associated risks before implementing this strategy. By staying informed about market trends, analyzing news and events, and exercising disciplined risk management, investors can increase their chances of success in the Snap Stock market.

Title: VALTERRA PLATINUM LTD Stock Technica? America stock market