In the ever-evolving world of the stock market, staying informed about the latest trends and movements is crucial for investors. One such stock that has been making waves is ACbff. In this article, we will delve into the factors influencing the ACbff stock price and provide a comprehensive analysis of its current standing in the market.

Understanding ACbff Stock

ACbff, a publicly-traded company, has been attracting significant attention from investors. The stock, which is currently listed on the New York Stock Exchange (NYSE), has seen its price fluctuate in recent months. To understand the reasons behind these fluctuations, it is essential to consider various factors, including the company's financial performance, market trends, and industry dynamics.

Financial Performance

One of the primary drivers of ACbff's stock price is its financial performance. Over the past few years, the company has reported strong revenue growth and a healthy profit margin. This has led to increased investor confidence and a positive outlook for the stock. Key financial indicators such as revenue, earnings per share (EPS), and return on equity (ROE) have been consistently improving, contributing to the stock's upward trajectory.

Market Trends

The stock market is influenced by a variety of external factors, including economic indicators, political events, and technological advancements. In the case of ACbff, the company's stock price has been positively impacted by the overall growth in the technology sector. As more businesses adopt innovative technologies, the demand for ACbff's products and services has surged, leading to increased revenue and profitability.

Industry Dynamics

The technology industry is known for its rapid pace of innovation and competition. ACbff has managed to stay ahead of the curve by continuously investing in research and development. This has allowed the company to launch new products and services that cater to the evolving needs of its customers. As a result, ACbff has established itself as a leader in the industry, which has positively impacted its stock price.

Case Studies

To illustrate the impact of these factors on ACbff's stock price, let's consider a few case studies:

Product Launch: In 2020, ACbff launched a new line of products that were well-received by the market. This led to a surge in sales and a corresponding increase in the stock price.

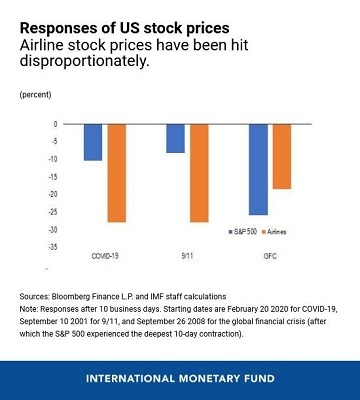

Economic Recovery: In 2021, as the global economy began to recover from the COVID-19 pandemic, ACbff's stock price experienced a significant uptick. This was due to the increased demand for technology solutions in various industries.

Mergers and Acquisitions: In 2022, ACbff acquired a smaller competitor, which expanded its market reach and product offerings. This acquisition was well-received by investors, leading to a rise in the stock price.

Conclusion

In conclusion, the ACbff stock price has been influenced by a combination of factors, including the company's financial performance, market trends, and industry dynamics. By understanding these factors, investors can make more informed decisions about their investments. As the technology sector continues to grow, ACbff's stock price is expected to remain strong in the coming years.

DMYYW Stock: A Deep Dive into the Rising St? Us Stock data