In the ever-evolving world of finance, investors are constantly seeking opportunities to diversify their portfolios. One popular choice is to compare the performance of U.S. stocks, often referred to as "Stoicks," with international stocks. This article delves into a comprehensive analysis of both, highlighting key differences, performance trends, and potential investment strategies.

Understanding U.S. Stocks (Stoicks)

U.S. stocks, or Stoicks, represent shares of publicly-traded companies based in the United States. These companies are listed on major exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ. Stoicks are often considered a benchmark for global stock markets due to the size and influence of the U.S. economy.

International Stocks

On the other hand, international stocks refer to shares of companies based outside the United States. These stocks can be found on various exchanges across the globe, including Europe, Asia, and Australia. International stocks offer investors exposure to different economies, industries, and currencies, providing a potential avenue for diversification.

Performance Trends

Over the past decade, the performance of Stoicks and international stocks has been relatively similar. However, there have been periods where one outperformed the other. For instance, during the global financial crisis of 2008, Stoicks experienced significant declines, while some international stocks held up better. Conversely, in recent years, Stoicks have outperformed international stocks, driven by strong economic growth and technological advancements in the United States.

Key Differences

Several factors differentiate Stoicks from international stocks:

- Economic Stability: The U.S. economy is generally considered more stable compared to some emerging markets. This stability can provide a sense of security for investors.

- Innovation and Technology: The United States is a global leader in innovation and technology, with many of the world's largest tech companies based in the country. This can drive strong performance for Stoicks.

- Currency Fluctuations: International stocks are subject to currency fluctuations, which can impact their performance. Stoicks, being denominated in U.S. dollars, are not directly affected by currency fluctuations.

Investment Strategies

When considering Stoicks vs. international stocks, investors should consider the following strategies:

- Diversification: A well-diversified portfolio can help mitigate risk by investing in both Stoicks and international stocks.

- Market Timing: Some investors may choose to invest in Stoicks during periods of strong economic growth and in international stocks during periods of emerging market growth.

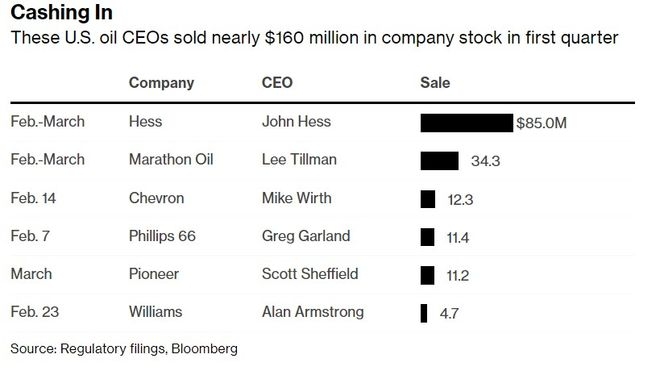

- Sector Rotation: Investors can also focus on specific sectors within Stoicks and international stocks, such as technology, healthcare, or energy.

Case Studies

To illustrate the performance of Stoicks and international stocks, let's consider two case studies:

- Apple Inc. (AAPL): As one of the largest tech companies in the world, Apple Inc. is a prime example of a Stoick. Over the past five years, AAPL has experienced significant growth, with a total return of approximately 60%.

- BHP Group Ltd. (BHP): BHP is an Australian mining company, representing an international stock. Over the same period, BHP has seen a total return of approximately 30%, demonstrating the potential for international stocks to outperform Stoicks.

In conclusion, Stoicks and international stocks offer unique opportunities for investors. By understanding the key differences and performance trends, investors can make informed decisions to diversify their portfolios and achieve their financial goals.

AAON Inc. Common Stock Halt: Treasury Stock? Us Stock data