In the ever-evolving world of global finance, the relationship between China and the United States has a significant impact on stock markets. The China-US stock news has been a major talking point for investors and financial analysts alike. This article delves into the latest developments, key trends, and potential implications for investors.

Economic Tensions and Trade Disputes

One of the most prominent factors affecting China-US stock news is the ongoing trade tensions between the two countries. The United States has imposed tariffs on various Chinese goods, and China has retaliated with its own tariffs. These trade disputes have caused uncertainty in the global markets, leading to fluctuations in stock prices.

Impact on the Chinese Stock Market

The Chinese stock market, particularly the Shanghai and Shenzhen exchanges, has been significantly affected by the trade tensions. Key sectors such as technology, consumer goods, and manufacturing have faced downward pressure. Companies that rely heavily on exports to the United States have also been hit hard.

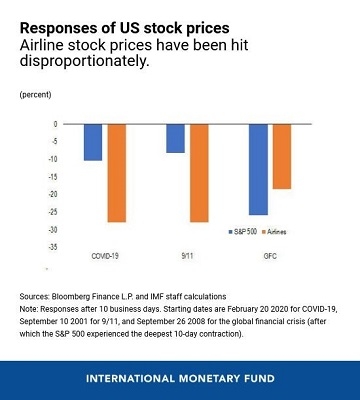

Impact on the US Stock Market

Similarly, the US stock market has not been immune to the impact of the trade disputes. Companies with significant exposure to the Chinese market have seen their shares decline. The technology sector, in particular, has been affected, as many US tech giants have significant operations in China.

Recent Developments

In recent months, there have been some positive signs of progress in the trade negotiations between the United States and China. Both sides have shown willingness to engage in talks and find a mutually beneficial solution. This has provided some relief to investors, leading to a slight upturn in stock prices.

Key Trends to Watch

As we move forward, there are several key trends that investors should keep an eye on in the China-US stock news:

Trade Negotiations: The outcome of the trade negotiations between the United States and China will have a significant impact on stock markets. A comprehensive trade deal could lead to a boost in stock prices, while a prolonged trade war could have the opposite effect.

Economic Growth: The economic growth in both China and the United States will be crucial in determining the direction of stock markets. Any signs of slowing economic growth could lead to a decline in stock prices.

Technological Advancements: The rapid advancements in technology, particularly in the fields of artificial intelligence and 5G, could provide new opportunities for growth in the stock markets.

Case Studies

To illustrate the impact of China-US stock news, let's look at two recent case studies:

Apple Inc.: Apple, one of the largest tech companies in the world, has significant operations in China. The imposition of tariffs on Chinese goods has led to a decline in Apple's stock price. However, the recent progress in trade negotiations has led to a slight recovery in its share price.

Tesla Inc.: Tesla has been expanding its operations in China, and the country is a key market for the company. The trade tensions have had a mixed impact on Tesla's stock, with fluctuations in its share price reflecting the uncertainty in the market.

In conclusion, the China-US stock news remains a critical area of focus for investors. The ongoing trade tensions, economic growth, and technological advancements will continue to shape the direction of stock markets in the coming months. As always, it's important for investors to stay informed and make informed decisions based on the latest developments.

Understanding the Investment Potential of A? Us Stock data