Investing in the US stock market can be a lucrative venture for both domestic and international investors. However, navigating through the myriad of exchanges and platforms can be daunting. This guide will help you understand the different exchanges available to buy US stocks, their features, and how to choose the right one for your investment needs.

Understanding the US Stock Market

The US stock market is one of the largest and most diversified in the world. It offers a wide range of investment opportunities across various sectors and industries. To participate in this market, you need to open a brokerage account and choose an exchange to buy US stocks.

The Most Popular Exchanges to Buy US Stocks

NYSE (New York Stock Exchange)

- Overview: The NYSE is the oldest and most iconic stock exchange in the United States. It is home to many of the largest and most well-known companies in the world.

- Features: Offers direct access to trading for individual investors, institutional traders, and market makers.

- Best for: Investors looking for liquidity and access to a wide range of stocks.

NASDAQ (National Association of Securities Dealers Automated Quotations)

- Overview: NASDAQ is the second-largest stock exchange in the United States, known for its technology and growth stocks.

- Features: Offers electronic trading, which provides faster execution and lower transaction costs.

- Best for: Investors interested in technology and growth stocks.

AMEX (American Stock Exchange)

- Overview: AMEX is a smaller exchange that focuses on smaller and mid-sized companies.

- Features: Offers a range of trading options, including cash, options, and futures.

- Best for: Investors looking for exposure to smaller and mid-sized companies.

BATS Global Markets

- Overview: BATS is a global electronic exchange that offers trading in stocks, options, and futures.

- Features: Offers direct access to trading and low transaction costs.

- Best for: Investors looking for low-cost trading and direct access to the market.

Direct Edge

- Overview: Direct Edge is a low-cost electronic exchange that offers trading in stocks, options, and futures.

- Features: Offers direct access to trading and low transaction costs.

- Best for: Investors looking for low-cost trading and direct access to the market.

Choosing the Right Exchange

When choosing an exchange to buy US stocks, consider the following factors:

- Liquidity: Look for exchanges with high liquidity, as this ensures that you can buy and sell stocks without significantly impacting the price.

- Transaction Costs: Compare the transaction costs of different exchanges to find the most cost-effective option.

- Features: Consider the features offered by each exchange, such as direct access to trading, low transaction costs, and access to a wide range of stocks.

- Regulatory Compliance: Ensure that the exchange is regulated and compliant with all relevant laws and regulations.

Case Study: Investing in US Stocks through NASDAQ

Imagine you are an investor interested in technology stocks. NASDAQ is an excellent choice for you, as it is home to many of the largest and most well-known technology companies, such as Apple, Microsoft, and Amazon. By opening a brokerage account and choosing NASDAQ as your exchange, you can gain access to these companies and potentially benefit from their growth.

In conclusion, choosing the right exchange to buy US stocks is crucial for your investment success. By understanding the different exchanges available and considering your investment needs, you can make an informed decision and start your journey into the US stock market.

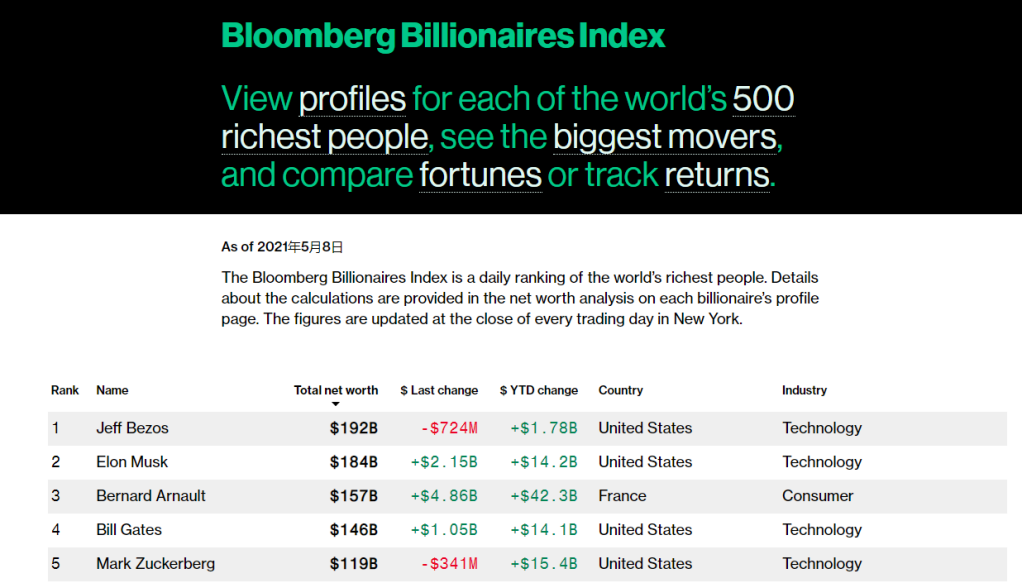

iShares US Preferred Stock ETF Dividend: Ma? Us Stock data