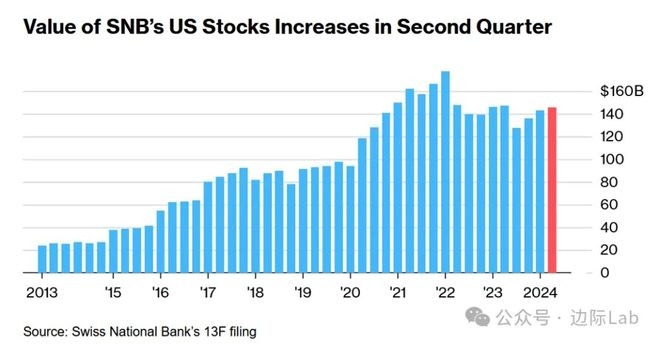

In recent years, there has been a growing debate about China's investment in the United States, particularly in the stock market. The question on everyone's mind is: "Is China buying up US stocks?" This article delves into the topic, exploring the reasons behind China's investment in the US stock market, the impact on the American economy, and the potential risks involved.

The Reason Behind China's Investment

China has been actively investing in the US stock market for several reasons. Firstly, the US stock market is one of the most advanced and liquid markets in the world, offering numerous investment opportunities. Secondly, the US dollar is the world's primary reserve currency, making it a stable and attractive investment destination for China. Lastly, China's economy has been growing rapidly, and the country's investors are seeking ways to diversify their portfolios and invest in foreign markets.

Impact on the American Economy

China's investment in the US stock market has had a significant impact on the American economy. Firstly, it has provided a major source of capital for US companies, enabling them to expand their operations and create jobs. Secondly, it has helped to stabilize the US stock market, as China's investors have been known to buy stocks during times of market turmoil. Lastly, it has contributed to the overall growth of the American economy, as Chinese investors have been purchasing a wide range of US assets, including real estate, bonds, and private equity.

The Risks Involved

While China's investment in the US stock market has brought numerous benefits, there are also potential risks involved. One of the primary concerns is the geopolitical risk. Tensions between the US and China could lead to trade wars or other conflicts that could negatively impact the stock market. Additionally, if China were to suddenly withdraw its investment, it could cause a significant sell-off in the US stock market, leading to a market crash.

Case Studies

To illustrate the impact of China's investment in the US stock market, let's look at a few case studies:

Billionaire Investors: Chinese investors have been known to purchase stakes in major US companies, such as Alibaba and Tesla. These investments have not only provided a significant source of capital for these companies but have also increased their global presence.

Real Estate: Chinese investors have been purchasing real estate in the US, particularly in major cities like New York and Los Angeles. This has helped to drive up property prices and has created job opportunities in the construction and real estate sectors.

Tech Industry: China's investment in the US tech industry has been substantial, with Chinese investors purchasing stakes in companies like Baidu and京东. This has not only provided capital for these companies but has also facilitated the transfer of technology and knowledge between the two countries.

In conclusion, while the question of "Is China buying up US stocks?" remains a topic of debate, it is clear that China's investment in the US stock market has had a significant impact on the American economy. As the relationship between the US and China continues to evolve, it will be interesting to see how this investment will affect both countries in the future.

AFINIDA INC Stock Trend Following: A Compre? Us Stock data