In the fast-paced world of finance, staying informed about US stock announcements is crucial for investors. Whether you're a seasoned trader or just starting out, understanding the significance of these announcements can make a significant difference in your investment decisions. This article delves into the key aspects of stock announcements, highlighting what you need to know to make informed choices.

Understanding Stock Announcements

Stock announcements refer to the official communications made by companies regarding their financial performance, business developments, and other significant events. These announcements can come in various forms, including earnings reports, dividend declarations, and mergers and acquisitions.

Earnings Reports

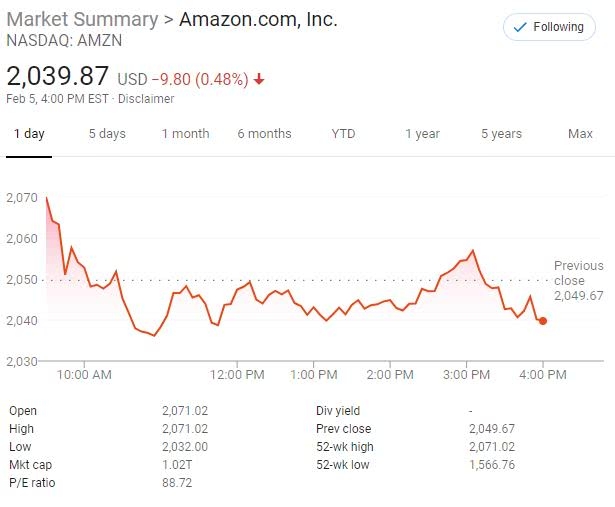

One of the most critical US stock announcements is the earnings report. This document provides a comprehensive overview of a company's financial performance over a specific period, typically quarterly. It includes key metrics such as revenue, net income, earnings per share (EPS), and cash flow.

Key Takeaways from Earnings Reports:

- Revenue and Net Income: These figures indicate the company's overall financial health. A consistent increase in revenue and net income is generally a positive sign.

- EPS: This metric measures the company's profitability on a per-share basis. A rising EPS is often a good indicator of a company's financial strength.

- Cash Flow: Positive cash flow indicates that the company has sufficient liquidity to invest in growth opportunities and pay off debts.

Dividend Declarations

Dividend declarations are another important type of US stock announcements. These announcements inform investors about the company's intention to distribute a portion of its profits to shareholders in the form of dividends.

Key Takeaways from Dividend Declarations:

- Dividend Yield: This metric represents the percentage return on an investment based on the dividend payment. A higher dividend yield can be attractive to income-seeking investors.

- Dividend Payout Ratio: This ratio indicates the percentage of earnings paid out as dividends. A lower payout ratio suggests that the company has more earnings available for reinvestment or other uses.

Mergers and Acquisitions

Mergers and acquisitions (M&As) are significant events that can have a substantial impact on a company's stock price. US stock announcements related to M&As provide information about the terms of the deal, the expected benefits, and potential risks.

Key Takeaways from M&A Announcements:

- Synergies: Companies often announce M&As to achieve synergies, such as cost savings or increased market share. Understanding the potential synergies can help investors assess the deal's benefits.

- Integration Risks: M&As can come with integration risks, such as cultural differences or operational challenges. Investors should consider these risks when evaluating the deal.

Case Study:

Consider a hypothetical scenario where Company A, a leading technology firm, announces a significant increase in its quarterly revenue and EPS. This announcement, along with positive comments from management, can lead to a surge in the company's stock price.

Conclusion:

Staying informed about US stock announcements is essential for investors looking to make informed decisions. By understanding the key aspects of these announcements, investors can better assess the financial health and growth prospects of companies they are considering investing in.

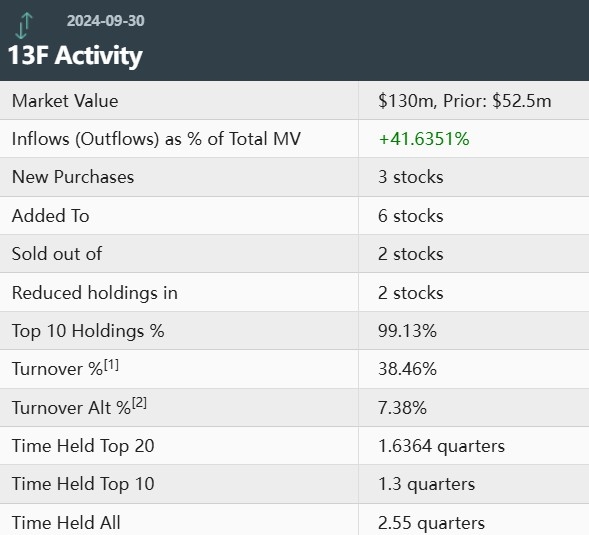

Understanding the Number of Stocks in the C? Us Stock data