The financial markets are buzzing with anticipation as US stock futures take a positive turn ahead of the highly anticipated testimony by Federal Reserve Chairman Jerome Powell. Investors are closely watching for any clues regarding the Fed's monetary policy stance, which could have a significant impact on the stock market's direction.

Powell's Testimony: Key Takeaways

Chairman Powell's testimony is expected to provide insights into the Federal Reserve's plans for interest rates and other monetary policy measures. Here are some key takeaways that could influence the stock market:

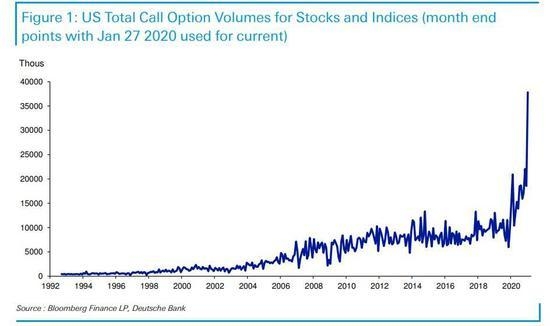

- Interest Rates: Markets are closely watching for any indication on whether the Fed plans to raise interest rates. A hint of a rate hike could send stock futures lower, while a sign of continued low rates could boost them.

- Inflation: Powell's comments on inflation will be closely scrutinized. If he indicates that inflation is under control, it could be positive for stocks.

- Economic Growth: The Fed Chairman's views on the state of the US economy will also be important. Optimism about economic growth could support stock futures.

Stock Market Performance

US stock futures have been on a rollercoaster ride in recent weeks, reflecting the uncertainty surrounding the Fed's policies. However, ahead of Powell's testimony, futures are pointing to a positive start for the week.

Key Sectors to Watch

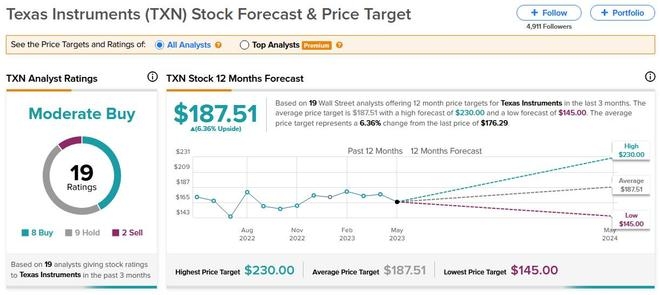

Several sectors are likely to be affected by Powell's testimony. Here's a closer look at some key sectors to watch:

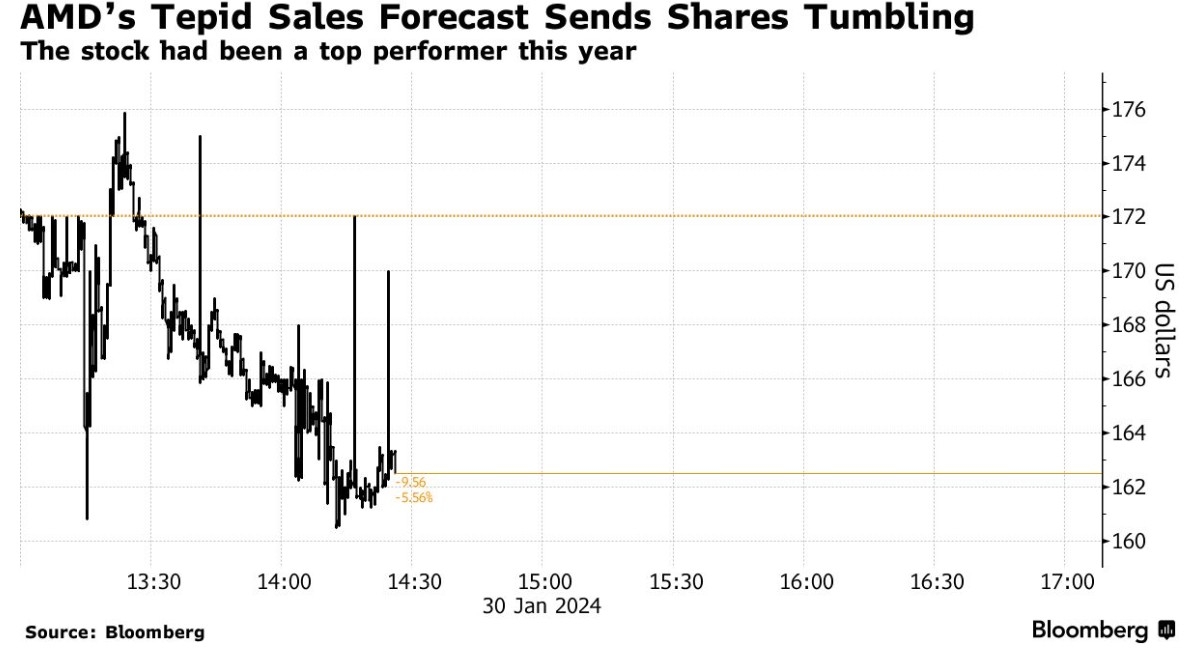

- Tech Stocks: Tech companies have been among the biggest winners in the stock market, but they could be vulnerable to any sign of higher interest rates.

- Financial Stocks: Financial stocks, particularly banks, could be positively affected by higher interest rates.

- Consumer Discretionary Stocks: Companies in the consumer discretionary sector, such as retailers and restaurants, could be impacted by inflation and consumer spending patterns.

Case Studies

To illustrate the potential impact of Powell's testimony, let's look at two recent case studies:

- Interest Rate Hike in 2018: In December 2018, the Federal Reserve raised interest rates for the fourth time that year. In the days leading up to the announcement, stock futures fell, reflecting investor concerns about higher rates. However, the market quickly recovered after the Fed's statement, indicating that the rate hike was expected and manageable.

- Inflation Concerns in 2021: In early 2021, inflation began to rise above the Fed's target rate, raising concerns about future rate hikes. As a result, stock futures fell, particularly in sectors sensitive to inflation. However, once the Fed indicated that it would continue to support the economy, the market stabilized.

Conclusion

As US stock futures move higher ahead of Powell's testimony, investors are keeping a close eye on the Fed's plans. The testimony is expected to provide valuable insights into the Fed's monetary policy stance, which could have a significant impact on the stock market's direction. With the potential for higher interest rates and inflation concerns, investors will be watching closely for any signs of change in the Fed's stance.

Atlantic American Corporation Common Stock:? Us Stock data