Introduction

As we approach the end of 2025, investors are eagerly anticipating the US stock market's performance for the month of October. The stock market is a complex and dynamic entity, influenced by a myriad of factors such as economic indicators, geopolitical events, and corporate earnings. In this article, we will delve into the key factors that are likely to shape the US stock market in October 2025, providing insights and analysis to help investors make informed decisions.

Economic Indicators

One of the primary factors influencing the stock market is economic indicators. As of early October 2025, the US economy is expected to be on a steady growth trajectory. Key indicators to watch include:

- GDP Growth: The US GDP is forecasted to grow at a moderate pace, reflecting a robust economic environment.

- Inflation: While inflation has been a concern in recent years, it is expected to remain under control in October 2025.

- Unemployment Rate: The unemployment rate is expected to remain low, indicating a healthy job market.

These economic indicators suggest that the overall economic environment is favorable for the stock market, potentially leading to positive returns.

Corporate Earnings

Corporate earnings are another crucial factor that can significantly impact the stock market. As we approach October 2025, investors are closely monitoring earnings reports from major companies across various sectors. Key sectors to watch include:

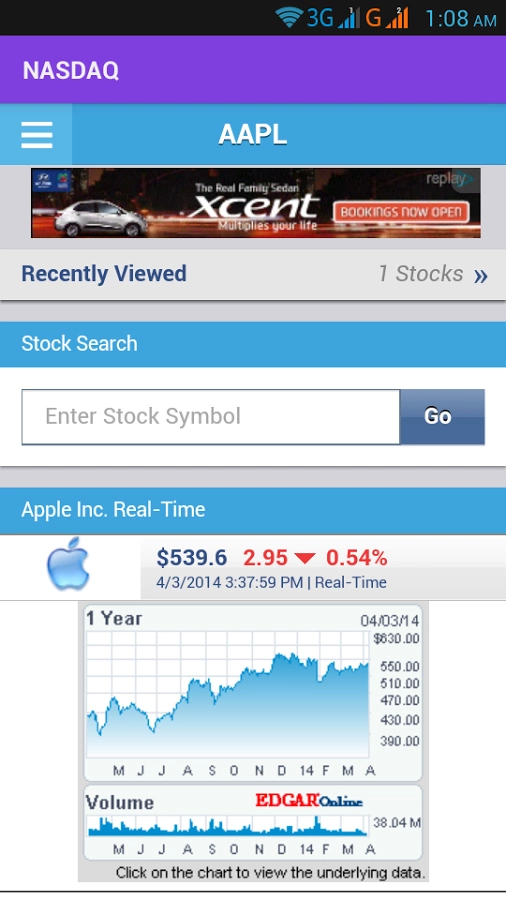

- Technology: The technology sector has been a major driver of the stock market's growth in recent years. Companies like Apple, Microsoft, and Google are expected to release strong earnings reports, further boosting investor confidence.

- Energy: The energy sector is also expected to perform well, driven by increased oil and gas production and favorable commodity prices.

- Healthcare: The healthcare sector is poised for growth, with advancements in medical technology and increased demand for healthcare services.

Geopolitical Events

Geopolitical events can have a significant impact on the stock market, causing volatility and uncertainty. In October 2025, investors should be aware of the following geopolitical risks:

- Trade Tensions: Trade tensions between the US and other major economies, such as China, remain a concern. Any escalation in trade disputes could negatively impact the stock market.

- Political Stability: The political landscape in various countries, including the US, could also influence market sentiment. Investors should keep an eye on political developments and their potential impact on the stock market.

Sector Analysis

In addition to economic indicators and corporate earnings, sector analysis is crucial for understanding the potential direction of the stock market. Here are some key sectors to consider in October 2025:

- Consumer Discretionary: This sector, which includes companies in industries such as retail and entertainment, is expected to benefit from strong consumer spending.

- Financials: The financial sector is likely to perform well, driven by increased lending activity and higher interest rates.

- Real Estate: The real estate sector is expected to experience growth, supported by low interest rates and rising demand for housing.

Conclusion

In conclusion, the US stock market is expected to perform well in October 2025, driven by strong economic indicators, positive corporate earnings, and favorable sector trends. However, investors should remain vigilant about geopolitical risks and trade tensions. By closely monitoring these factors and conducting thorough research, investors can make informed decisions and navigate the complexities of the stock market.

YSASF Stock: A Comprehensive Analysis and I? Us Stock data