In the world of financial markets, futures trading has become an essential tool for investors seeking to hedge against price fluctuations or speculate on the future direction of assets. One of the most prominent players in this field is Jones Futures, a leading futures exchange that offers a wide array of trading opportunities. This article aims to provide a comprehensive guide to understanding Jones Futures, its products, and how they can be utilized in various trading strategies.

What is Jones Futures?

Jones Futures is a well-established futures exchange that facilitates the trading of financial futures contracts. These contracts are agreements to buy or sell an asset at a predetermined price on a specific future date. Jones Futures offers a diverse range of futures contracts, including those on commodities, currencies, and financial indices.

Key Features of Jones Futures

One of the primary reasons why Jones Futures has gained popularity among traders is its robust trading platform. The platform offers real-time quotes, advanced charting tools, and customizable trading strategies, making it easy for traders to analyze market trends and execute trades efficiently.

Diverse Range of Futures Contracts

Jones Futures offers a wide array of futures contracts, catering to the needs of various traders. Some of the most popular contracts include:

- Commodities: These include agricultural products like wheat, corn, and soybeans, as well as energy commodities like crude oil and natural gas.

- Currencies: Jones Futures offers futures contracts on major global currencies, allowing traders to speculate on exchange rate movements.

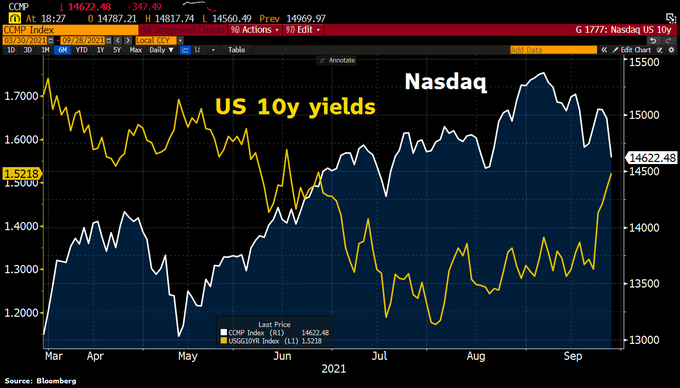

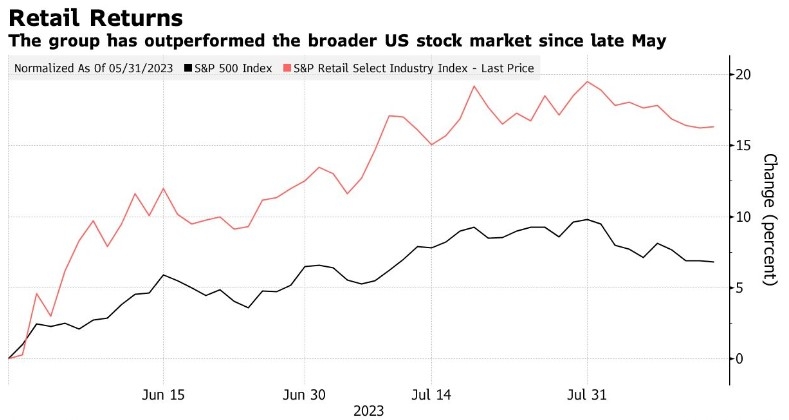

- Financial Indices: These contracts are based on popular stock market indices, such as the S&P 500, NASDAQ 100, and DJIA.

Trading Strategies Using Jones Futures

Traders can utilize various strategies to trade futures contracts on Jones Futures. Here are a few popular strategies:

- Speculation: This involves taking a position in a futures contract with the expectation that the asset's price will move in your favor.

- Hedging: This involves taking a position in a futures contract to offset potential losses in a related asset, such as a portfolio of stocks.

- Arbitrage: This involves taking advantage of price discrepancies between two or more markets by simultaneously buying and selling the same asset in different markets.

Case Study: Successful Trading with Jones Futures

Let's consider a hypothetical scenario where a trader wants to hedge their portfolio of technology stocks against market volatility. The trader could take a short position in the NASDAQ 100 futures contract on Jones Futures, which would offset potential losses in their portfolio if the market were to decline.

By using Jones Futures, the trader could gain access to a liquid and transparent market, allowing them to execute their hedging strategy with ease.

Conclusion

Jones Futures is a vital player in the futures market, offering a diverse range of futures contracts and a robust trading platform. By understanding the various trading strategies available, traders can leverage Jones Futures to achieve their investment goals. Whether you're a speculator, hedger, or arbitrageur, Jones Futures provides the tools and resources needed to succeed in the futures market.

Canopy Growth US Stock: A Deep Dive into th? Us Stock data