The Wall Street Index is a term that often comes up in financial discussions, especially among investors and traders. It refers to a composite of stocks that are used to gauge the overall performance of the U.S. stock market. This article aims to provide a comprehensive guide to the Wall Street Index, covering its history, components, and how it impacts the financial world.

The History of the Wall Street Index

The concept of a stock market index dates back to the early 19th century. However, the first widely recognized index was the Dow Jones Industrial Average (DJIA), introduced in 1896. This index tracks the performance of 30 large companies listed on the New York Stock Exchange (NYSE) and is often considered the benchmark for the U.S. stock market.

Over the years, several other indexes have been created to provide a more comprehensive view of the market. One of the most notable is the S&P 500, which was introduced in 1957. This index includes 500 large companies from various sectors and is widely regarded as a key indicator of the U.S. stock market's performance.

Components of the Wall Street Index

The Wall Street Index typically includes a diverse range of companies across various sectors, such as technology, healthcare, finance, and consumer goods. Some of the most well-known indexes include:

- Dow Jones Industrial Average (DJIA): As mentioned earlier, this index tracks the performance of 30 large companies listed on the NYSE.

- Standard & Poor's 500 (S&P 500): This index includes 500 large companies from across the U.S. stock market.

- NASDAQ Composite Index: This index tracks the performance of all companies listed on the NASDAQ stock exchange, which is known for its focus on technology companies.

Impact of the Wall Street Index

The Wall Street Index has a significant impact on the financial world. It serves as a benchmark for investors to gauge the overall performance of the stock market and make informed investment decisions. Here are some key impacts of the Wall Street Index:

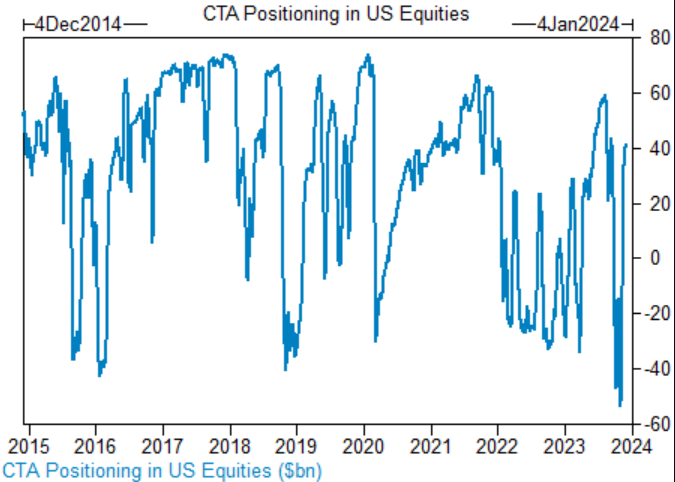

- Investor Confidence: The performance of the Wall Street Index can influence investor confidence. A rising index often indicates a positive outlook for the market, while a falling index can lead to increased uncertainty.

- Economic Indicators: The Wall Street Index is often used as an economic indicator to gauge the health of the U.S. economy. For example, a rising index can suggest strong economic growth, while a falling index can indicate economic challenges.

- Market Trends: The Wall Street Index can provide insights into market trends and sector performance. This information can be valuable for investors looking to allocate their assets effectively.

Case Study: The Impact of the S&P 500 on the Financial Crisis of 2008

One notable example of the impact of the Wall Street Index is the financial crisis of 2008. The S&P 500 experienced a significant decline during this period, reflecting the widespread financial turmoil. This decline had a profound impact on investors, leading to massive losses and a global economic downturn.

In conclusion, the Wall Street Index is a crucial tool for understanding the performance of the U.S. stock market. By tracking the performance of a diverse range of companies, it provides valuable insights into market trends and economic conditions. Whether you are an investor or a trader, understanding the Wall Street Index is essential for making informed financial decisions.

Artius II Acquisition Inc. RightsMarket-cap? Us Stock data