Are you scratching your head, wondering why the stock market is on a roll today? Don't worry, you're not alone. The stock market is a complex and ever-changing entity, influenced by a multitude of factors. In this article, we'll delve into some of the key reasons why stocks might be up today. So, let's jump right in and uncover the secrets behind the rising tide.

Economic Indicators and Reports

One of the primary reasons for today's stock market rally could be the release of positive economic indicators and reports. For instance, if the latest unemployment numbers show a decline or if the Consumer Price Index (CPI) is lower than expected, investors often take these as signs of a healthy economy. As a result, they may buy more stocks, pushing prices up.

Central Bank Policies

Central banks play a significant role in the stock market. If the Federal Reserve or any other central bank decides to keep interest rates low or even lower them, it can stimulate borrowing and investment. This, in turn, can lead to increased stock prices. Additionally, if the central bank provides verbal support for the markets, it can instill confidence in investors, causing them to buy more stocks.

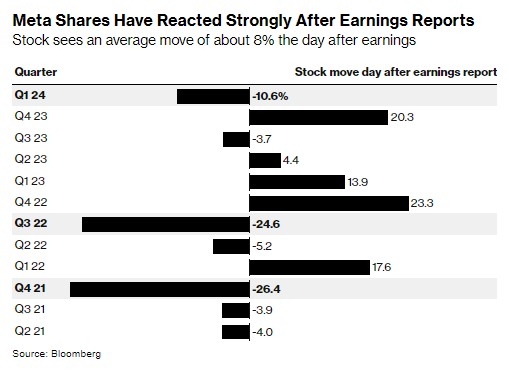

Corporate Earnings Reports

When companies release their earnings reports, investors pay close attention to the results. If a company's earnings exceed expectations, it can lead to a surge in stock prices. This is because strong earnings are a sign of a company's health and potential for growth. For example, if tech giant Apple reports better-than-expected earnings, investors may rush to buy shares, driving the stock price up.

Sector Rotation

Another reason for today's stock market rally could be sector rotation. Investors often shift their focus from one sector to another, based on various factors like economic trends, geopolitical events, or industry-specific developments. For instance, if there's a shift from the traditionally strong healthcare sector to the technology sector, it can lead to higher stock prices for tech companies.

Impact of Global Events

Global events can also have a significant impact on the stock market. For example, if there's a positive outcome in international trade negotiations or if there's a decrease in geopolitical tensions, it can boost investor confidence and lead to higher stock prices. Conversely, if there's a negative global event, it can have the opposite effect.

Case Study: The Tech Sector

Let's take a look at a recent case study to illustrate how global events can impact the stock market. In early 2021, the Biden administration announced plans to invest heavily in infrastructure. This led to a surge in stocks within the infrastructure sector, as well as related sectors like construction and materials. Similarly, if tech companies like Google, Amazon, and Microsoft report strong earnings, it can lead to a rally in the tech sector.

Conclusion

In conclusion, there are numerous factors that can contribute to a rise in the stock market. Whether it's economic indicators, central bank policies, corporate earnings, sector rotation, or global events, investors need to stay informed and adapt to the changing landscape. By understanding these factors, you can better navigate the stock market and make informed investment decisions.

GS YUASA CORP ORD: Revolutionizing the Batt? Us Stock data