Introduction:

The stock market can be a rollercoaster of emotions, with prices fluctuating based on a multitude of factors. If you're scratching your head, wondering why the stocks went up today, you're not alone. This article delves into the reasons behind the surge and what it means for investors.

1. Economic Indicators:

One of the primary reasons for today's stock market surge could be the release of positive economic indicators. For instance, if the latest GDP report showed stronger economic growth than expected, it could boost investor confidence and lead to higher stock prices. Similarly, if the unemployment rate dropped or consumer spending increased, it might signal a healthy economy, pushing stocks up.

2. Corporate Earnings:

Strong corporate earnings reports can also drive stock prices higher. If a company beats its earnings estimates, investors may perceive it as a sign of strong performance and future growth, leading to increased demand for its stock.

3. Market Sentiment:

Market sentiment plays a crucial role in stock market movements. If investors are optimistic about the future of the market or a particular sector, they may be more willing to buy stocks, pushing prices up. Conversely, if there's widespread pessimism, it could lead to a sell-off and lower stock prices.

4. Government Policies:

Government policies can significantly impact the stock market. For example, if the government announces new tax cuts or stimulus packages, it could boost investor confidence and lead to higher stock prices. Similarly, regulatory changes or trade agreements can also influence market sentiment.

5. Technological Advancements:

Technological advancements, particularly in sectors like artificial intelligence, biotechnology, and renewable energy, can drive stock prices higher. If a company makes a groundbreaking discovery or a significant technological breakthrough, it could attract investor interest and lead to increased demand for its stock.

6. Global Economic Factors:

Global economic factors, such as the performance of major economies like China and the European Union, can also influence the stock market. If these economies are performing well, it could lead to higher demand for stocks and push prices up.

Case Studies:

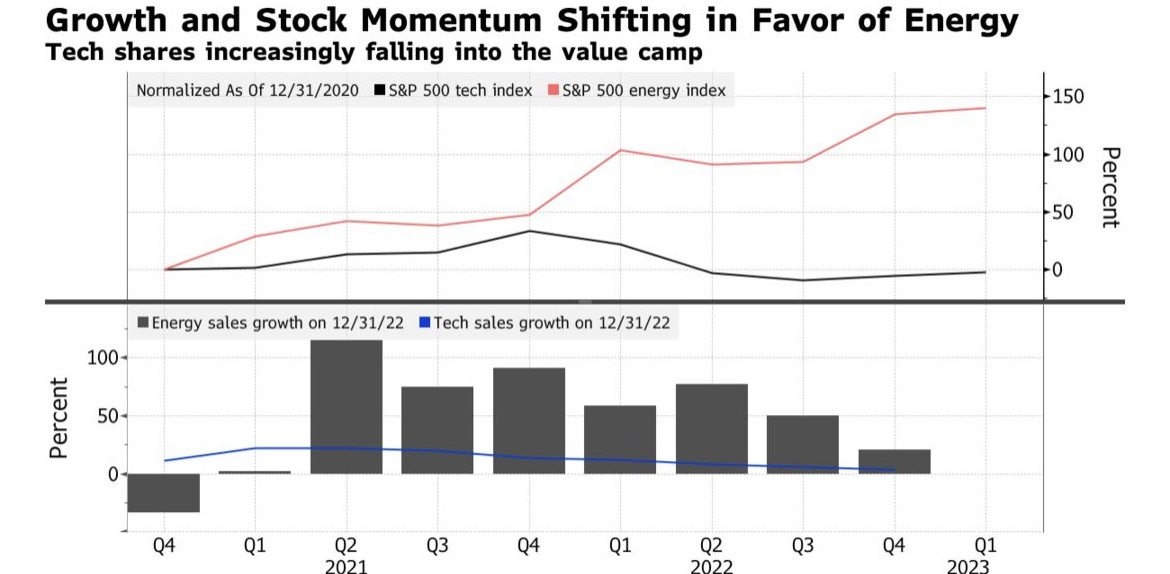

- Tech Sector: The surge in tech stocks can be attributed to the strong performance of major tech companies like Apple, Google, and Microsoft. Their impressive earnings reports and innovative products have led to increased investor interest in the sector.

- Energy Sector: The rise in energy stocks can be attributed to the increasing demand for renewable energy sources and the declining cost of solar and wind power. Companies in the sector have seen significant growth and have been able to attract investor attention.

Conclusion:

Understanding why the stocks went up today requires analyzing various factors, including economic indicators, corporate earnings, market sentiment, government policies, technological advancements, and global economic factors. By staying informed and keeping an eye on these factors, investors can make more informed decisions and potentially benefit from the stock market's movements.

Understanding the Investment Potential of A? Us Stock data