The stock market is a dynamic and often unpredictable realm where investors seek to gain insight into the financial health and potential growth of companies. In this article, we delve into the current status of Harvest Enterprises’ US stock price, offering a detailed analysis that covers key factors affecting the stock's performance.

Understanding Harvest Enterprises

Harvest Enterprises is a publicly-traded company operating in the United States, with a focus on agriculture, real estate, and renewable energy sectors. The company's diversified portfolio has been a key driver in its growth, providing a stable base of revenue streams. Its stock price reflects the market's perception of its long-term potential and current financial position.

Factors Influencing Harvest Enterprises Stock Price

Several factors can influence the stock price of Harvest Enterprises. Below are some of the primary factors to consider:

- Financial Performance: Harvest Enterprises’s financial performance is a crucial determinant of its stock price. Strong revenue growth, profitability, and a healthy balance sheet tend to drive the stock price upwards, while poor performance can lead to a decline.

- Economic Conditions: The state of the economy plays a significant role in the stock market. Harvest Enterprises may be impacted by fluctuations in economic growth, interest rates, and inflation. These factors can affect consumer spending and business investment, influencing the company's bottom line.

- Sector Trends: The company operates in multiple sectors, each with its own set of trends. For instance, agriculture may be affected by weather conditions, government policies, and technological advancements. Similarly, real estate and renewable energy sectors are influenced by regulatory changes and market demand.

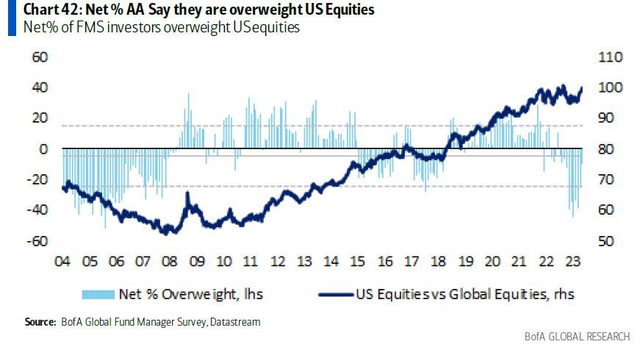

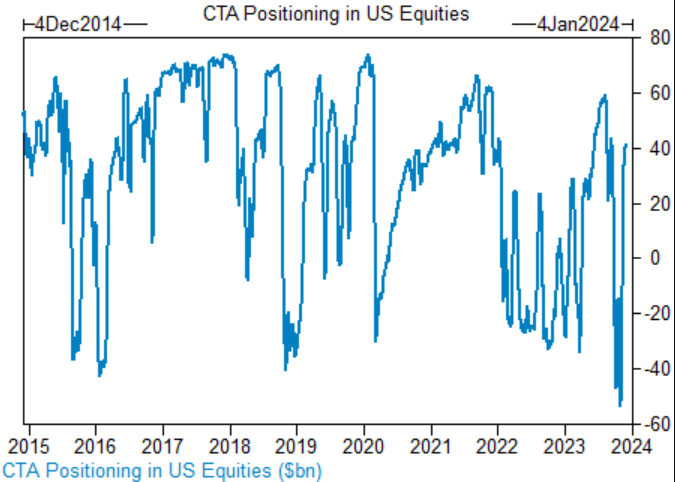

- Market Sentiment: Market sentiment refers to the overall attitude of investors towards a particular stock or the market as a whole. Positive sentiment can lead to increased demand for a stock, driving up its price, while negative sentiment can result in a decline.

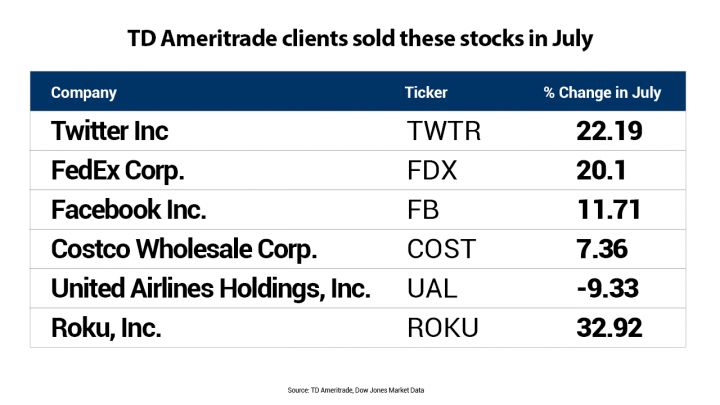

- Competition: Competition within the sectors in which Harvest Enterprises operates can also impact its stock price. Increased competition can lead to a decrease in market share and profits, negatively affecting the stock price.

Analyzing Harvest Enterprises Stock Performance

To understand Harvest Enterprises’s stock performance, let's take a look at some recent data:

- Revenue: Over the past fiscal year, Harvest Enterprises reported a revenue increase of 15%, driven by strong growth in its agriculture and renewable energy segments.

- Profitability: The company's net income has grown by 20% year-over-year, reflecting a healthy profit margin.

- Market Cap: Harvest Enterprises has a market capitalization of $5 billion, making it a significant player in the market.

Conclusion

While Harvest Enterprises’s stock price is subject to various factors, the company's solid financial performance and diversification across sectors indicate a promising future. Investors looking for a potential investment should carefully analyze the factors affecting the stock price and consider their own risk tolerance and investment goals.

UMRRF Stock: A Comprehensive Guide to Under? Us Stock price