As we approach the latter part of 2025, investors are eagerly analyzing the potential trends and developments that may shape the US stock market. This article delves into the October 2025 US stock market outlook, providing insights into key sectors and potential risks.

Economic Fundamentals and Policy Changes

The US economy has shown significant resilience over the past few years, and this trend is expected to continue into 2025. Growth rates are anticipated to remain stable, driven by strong consumer spending and a robust labor market. However, certain policy changes could impact market dynamics.

Inflation remains a key concern for investors and policymakers alike. While the Federal Reserve has taken measures to curb inflation, the pace of price increases has been slow. Any unexpected spikes in inflation could lead to increased interest rates, potentially affecting stock valuations.

Sector Outlooks

Several sectors are poised to perform well in the upcoming months. Here's a breakdown of the key sectors to watch:

Technology

The technology sector remains a dominant force in the US stock market. Companies like Apple, Microsoft, and Amazon are expected to continue their upward trajectory. Innovation and growth opportunities in areas such as cloud computing and artificial intelligence will likely drive investor confidence.

Healthcare

The healthcare sector is also set to benefit from growing demand for medical services and technological advancements. Biotech companies, in particular, are poised for significant growth as they continue to develop new drugs and therapies.

Energy

The energy sector is expected to see a bounce-back as demand for oil and natural gas rises. Renewable energy companies are also gaining traction, driven by the push towards sustainability.

Financials

The financial sector is expected to experience moderate growth, with banks and insurers benefiting from improved economic conditions. However, regulatory changes could impact profitability.

Risk Factors

Several risk factors could impact the US stock market in the coming months. Here are a few to keep an eye on:

- Geopolitical tensions: Escalating tensions between major economies could lead to market volatility.

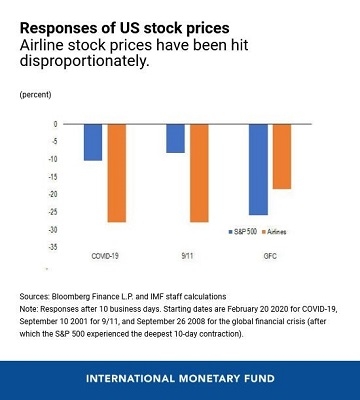

- COVID-19: The ongoing impact of the pandemic could disrupt supply chains and economic growth.

- Technological disruptions: Rapid advancements in technology could disrupt traditional industries, affecting stock valuations.

Case Studies

To provide a clearer picture of potential market movements, let's look at a few case studies:

- Facebook (now Meta Platforms): Despite facing criticism over privacy issues and changing consumer habits, Meta Platforms continues to generate significant revenue from its advertising platform.

- Tesla: The electric vehicle manufacturer has seen remarkable growth in recent years, driven by its innovative products and expanding global presence.

- UnitedHealth Group: The healthcare company has benefited from strong demand for its services, particularly in the areas of Medicare and insurance.

Conclusion

The October 2025 US stock market outlook presents a mix of opportunities and risks. Investors should stay informed and prepared for potential market fluctuations. By keeping a close eye on economic indicators, policy changes, and sector trends, investors can make informed decisions and navigate the market successfully.

TAISEI CORP ORD NEW Stock Gap Analysis? Us Stock price