Today's financial markets saw a significant downturn, as stocks plummeted across the board. This article delves into the reasons behind the sudden nosedive, its potential impact on investors, and strategies to navigate these turbulent times.

What Caused the Stock Market Drop?

Several factors contributed to the stock market's sudden downturn. Key among them were:

- Global Economic Concerns: As the COVID-19 pandemic continues to spread, concerns about economic recovery have grown. This uncertainty has led to a sell-off in many stocks, as investors seek safer assets.

- Political Instability: Ongoing political tensions, particularly in the United States, have added to market volatility. The possibility of policy changes, such as tax hikes or increased regulations, has investors on edge.

- Earnings Reports: Several companies reported weaker-than-expected earnings, further fueling the sell-off. Investors are becoming increasingly wary of companies that have not yet fully recovered from the pandemic's impact.

Impact on Investors

The stock market downturn can have several implications for investors:

- Potential for Losses: Investors holding stocks may see their portfolio values decline significantly. This can be particularly devastating for those nearing retirement or relying on their investments for income.

- Market Timing Challenges: The stock market's volatility makes it challenging to predict future trends. Investors must carefully weigh their decisions and consider their risk tolerance.

- Opportunities for Value Investors: Despite the downturn, some sectors and individual stocks may still offer attractive valuations. Value investors can take advantage of this opportunity by identifying undervalued companies.

Navigating Turbulent Times

To navigate the current stock market environment, consider the following strategies:

- Diversify Your Portfolio: Diversification can help reduce the impact of market downturns. Investing in a mix of stocks, bonds, and other assets can help stabilize your portfolio.

- Review Your Investment Strategy: Regularly review your investment strategy to ensure it aligns with your goals and risk tolerance. Adjustments may be necessary to reflect the current market conditions.

- Stay Informed: Keep up with financial news and developments to stay informed about market trends and potential risks.

- Seek Professional Advice: Consider consulting with a financial advisor to help you make informed investment decisions.

Case Study: Tesla and Apple

One example of how the stock market downturn can affect individual companies is the case of Tesla and Apple. Both companies saw their stock prices plummet in recent days, mirroring the broader market downturn.

Tesla's stock fell as investors grew concerned about the company's ability to meet demand for its electric vehicles. Additionally, questions about the company's long-term profitability remain.

Apple's stock decline can be attributed to several factors, including concerns about global supply chain disruptions and a potential slowdown in demand for its products.

These examples illustrate how even the largest and most successful companies can be impacted by market downturns.

In conclusion, the stock market's recent downturn is a reminder of the volatility that can be expected in today's financial markets. By staying informed, diversifying your portfolio, and seeking professional advice, you can navigate these turbulent times and potentially benefit from future market recoveries.

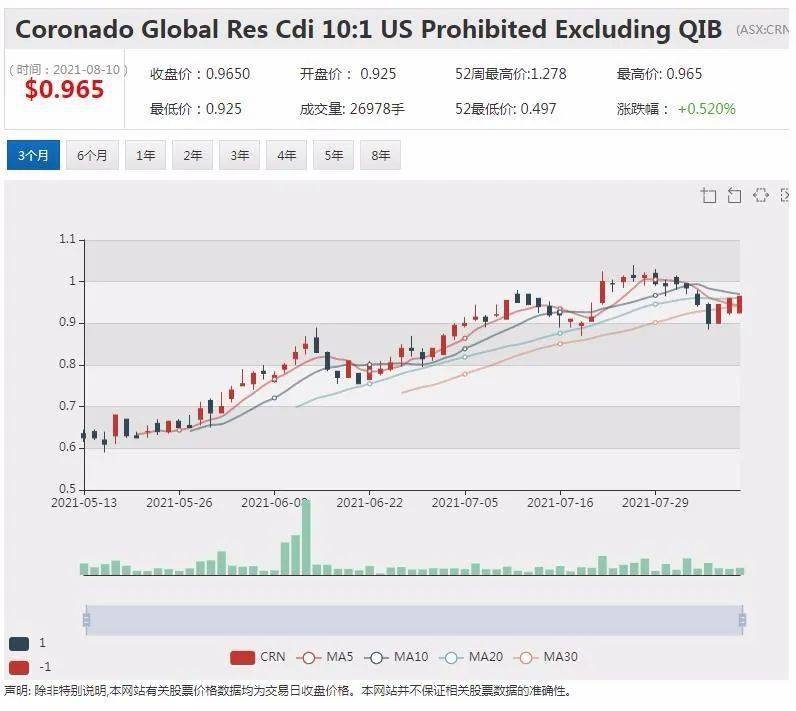

YASKAWA ELECTRIC CORP Stock Rounding Bottom? Us Stock price