Introduction

The US stock market, often heralded as the world's most robust and transparent financial market, has been a cornerstone of American capitalism. However, recent criticisms suggest that it may be more akin to a Ponzi scheme than a legitimate investment platform. This article delves into the allegations, examining the underlying issues and potential consequences.

Understanding the Allegations

The term "Ponzi scheme" refers to a fraudulent investment operation where high returns are paid to early investors from funds contributed by later investors, rather than from the profits of a real business. Critics argue that the US stock market operates in a similar manner, with the rich getting richer at the expense of the average investor.

The Ongoing Debate

Proponents of the US stock market argue that it is a dynamic and efficient marketplace, driving economic growth and innovation. They point to the numerous regulatory bodies, such as the Securities and Exchange Commission (SEC), that monitor and regulate the market to ensure fair and transparent practices.

On the other hand, critics argue that the market is plagued by issues such as high levels of speculation, excessive leverage, and a lack of transparency. They contend that these factors create an environment ripe for manipulation and fraud.

Evidence of a Potential Ponzi Scheme

Several factors point to the possibility that the US stock market may be operating like a Ponzi scheme:

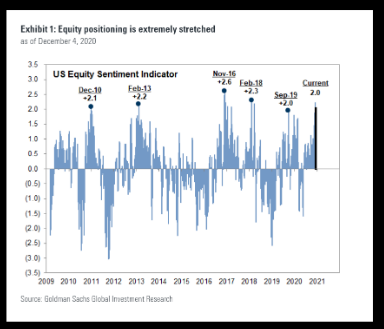

High Stock Prices: Many stocks are trading at record highs, which some critics argue is a sign of excessive speculation and unrealistic valuations.

High Levels of Debt: Many companies are using excessive debt to finance their operations and acquisitions, which raises concerns about their long-term sustainability.

The Role of Wall Street: Critics argue that Wall Street banks and investment firms manipulate the market to benefit themselves and their clients, often at the expense of the average investor.

The Impact of HFT: High-frequency trading (HFT) has become a significant component of the stock market. Critics argue that HFT can create volatility and instability, contributing to the potential for a Ponzi scheme-like environment.

Case Studies

Several high-profile cases have raised concerns about the US stock market's integrity:

Enron: The collapse of Enron in 2001 was a wake-up call for regulators and investors alike. The company's executives used accounting tricks to hide massive debt and inflate their stock price, ultimately leading to its bankruptcy.

Merrill Lynch: During the 2008 financial crisis, Merrill Lynch was forced to sell itself to Bank of America after suffering massive losses on toxic assets.

Facebook: In 2012, Facebook's initial public offering (IPO) was a disaster. The stock price plummeted after the IPO, raising concerns about the transparency and fairness of the process.

Conclusion

While it is difficult to conclusively determine whether the US stock market is a Ponzi scheme, the ongoing debate and evidence of potential issues suggest that further investigation is warranted. As investors and regulators continue to grapple with these concerns, it is crucial to remain vigilant and demand transparency and fairness in the market.

NAVIOS MARITIME S/ADR H: A Deep Dive into t? Us Stock price