In the ever-evolving world of financial markets, understanding the factors that influence stock values is crucial for investors. One such company that has captured the attention of many is Us Foods Holding Corp. With a market capitalization of over $20 billion, Us Foods is a significant player in the foodservice industry. This article delves into the various factors that contribute to the fluctuation of Us Foods stock value.

Market Dynamics and Stock Performance

Market Dynamics and Stock Performance

The stock value of Us Foods, like any publicly traded company, is influenced by a multitude of factors. The most prominent among these are market dynamics, which include economic conditions, industry trends, and consumer behavior. During economic downturns, the stock may experience a decline due to reduced consumer spending. Conversely, in periods of economic growth, the stock could see significant increases as businesses expand and consumer confidence rises.

Industry Trends

Industry Trends

The foodservice industry is highly competitive and subject to rapid changes. Emerging trends such as the rise of health-conscious consumers and the increasing popularity of plant-based diets can have a significant impact on Us Foods stock value. For instance, if a new trend emerges that favors organic or locally sourced ingredients, Us Foods' ability to adapt to this trend could positively influence its stock value.

Consumer Behavior

Consumer Behavior

Consumer behavior is another crucial factor that can influence Us Foods stock value. Changes in consumer preferences can lead to shifts in demand for certain types of foodservice products. For example, if there is a surge in demand for convenience foods, Us Foods, with its diverse product offerings, could benefit significantly.

Financial Performance

Financial Performance

The financial performance of Us Foods is also a key driver of its stock value. Consistent growth in revenue and profit margins can boost investor confidence and lead to an increase in stock price. Conversely, negative financial news, such as a decline in earnings or a significant loss, can cause the stock to plummet.

Case Studies

Case Studies

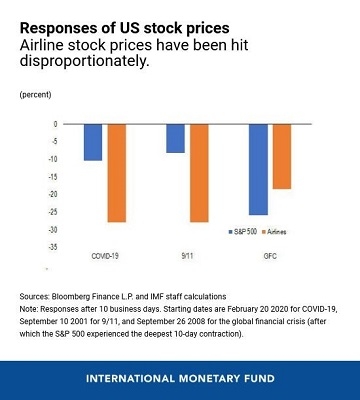

To illustrate the impact of these factors, let's consider a few case studies. In 2018, Us Foods announced a significant expansion into the online foodservice market. This move was seen as a strategic response to the growing demand for online ordering and delivery services. As a result, the stock experienced a significant surge in value. Similarly, in 2020, during the COVID-19 pandemic, Us Foods' ability to adapt to the changing market conditions and meet the increased demand for foodservice products helped to stabilize its stock value.

Conclusion

Conclusion

Understanding the fluctuation of Us Foods stock value requires a comprehensive understanding of market dynamics, industry trends, consumer behavior, and financial performance. By analyzing these factors, investors can make more informed decisions about their investments in Us Foods. Whether you're a seasoned investor or just starting out, keeping a close eye on these factors can help you navigate the complex world of stock market investing.

Understanding S&P 500 Holdings by M? Us Stock price