In the ever-evolving world of finance, the US Retail Stock Index stands as a crucial indicator for investors and market enthusiasts. This index, often abbreviated as the RSI, encapsulates the performance of the retail sector within the United States. By delving into its composition, historical trends, and future outlook, we can gain a deeper understanding of its significance and how it can influence investment decisions.

What is the US Retail Stock Index?

The US Retail Stock Index is a benchmark that tracks the performance of a basket of retail companies listed on major U.S. stock exchanges. These companies range from large department stores to specialty retailers, and even online e-commerce platforms. The index is designed to provide a snapshot of the retail industry's overall health and performance.

Composition of the RSI

The composition of the RSI is determined by various factors, including market capitalization, liquidity, and sector representation. It is crucial to note that the index is subject to periodic rebalancing to ensure it accurately reflects the retail landscape. Some of the key components of the RSI include:

- Department Stores: Companies like Macy's and Nordstrom, which offer a wide range of products.

- Specialty Retailers: Businesses focused on specific product categories, such as Best Buy and Home Depot.

- Online Retailers: E-commerce giants like Amazon and eBay, which have revolutionized the retail industry.

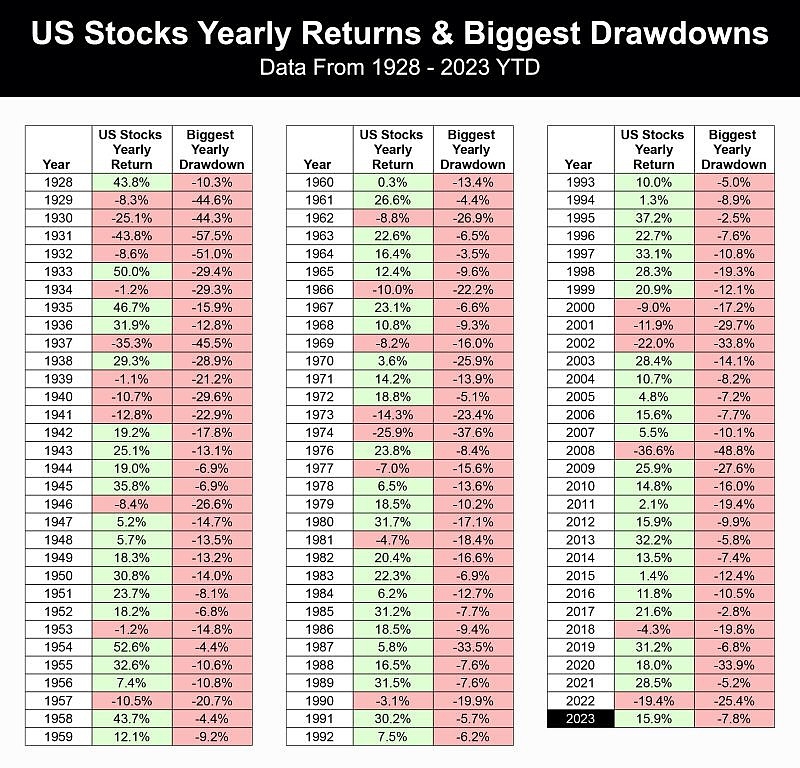

Historical Trends and Performance

Over the years, the US Retail Stock Index has exhibited a diverse range of trends and performance patterns. For instance, during the early 2000s, the index experienced significant growth due to the expansion of online retail and the rise of e-commerce. However, the financial crisis of 2008 led to a sharp decline in the index, reflecting the broader economic downturn.

In recent years, the RSI has been influenced by various factors, including changing consumer preferences, technological advancements, and the global pandemic. While some retailers have struggled to adapt to these challenges, others have thrived and emerged stronger.

Key Influences on the RSI

Several factors can impact the performance of the US Retail Stock Index:

- Economic Conditions: During periods of economic growth, the index tends to perform well, as consumer spending increases.

- Consumer Preferences: Changes in consumer preferences, such as a shift towards online shopping, can significantly impact the index.

- Technological Advancements: The adoption of new technologies, such as mobile payments and augmented reality, can drive growth in the retail sector.

- Global Events: Events like the global pandemic can have a profound impact on the retail industry and, consequently, the RSI.

Case Studies

To illustrate the impact of various factors on the US Retail Stock Index, let's consider a few case studies:

- Amazon: The e-commerce giant has been a significant driver of growth in the RSI. Its expansion into various product categories and the development of innovative technologies have helped it maintain its position as a market leader.

- Macy's: The department store chain has faced challenges in recent years, including a shift towards online shopping and increased competition. However, its efforts to adapt to these changes, such as investing in e-commerce and personalized shopping experiences, have helped stabilize its performance in the RSI.

- Home Depot: The home improvement retailer has seen steady growth in the RSI, driven by increasing consumer spending on home renovations and improvements.

Conclusion

The US Retail Stock Index is a vital tool for understanding the performance and trends of the retail industry in the United States. By analyzing its composition, historical trends, and key influences, investors and market enthusiasts can gain valuable insights into the sector's future outlook. As the retail landscape continues to evolve, staying informed about the RSI will be crucial for making informed investment decisions.

TESSENDERLO GRP NV ORD Stock Volume: A Comp? Us Stock price