Understanding the Role of the U.S. Government in Stock Ownership

Have you ever wondered whether the U.S. government can own stocks? This question might seem straightforward, but it delves into complex financial and legal territories. In this article, we will explore the intricacies of the U.S. government owning stocks, the potential benefits, and the legal framework surrounding it.

The U.S. Government as an Investor

Contrary to popular belief, the U.S. government is indeed allowed to own stocks. The government's investment portfolio is vast and diversified, encompassing stocks in various industries. This investment strategy is not just for show; it serves several purposes.

Strategic Investment and Financial Stability

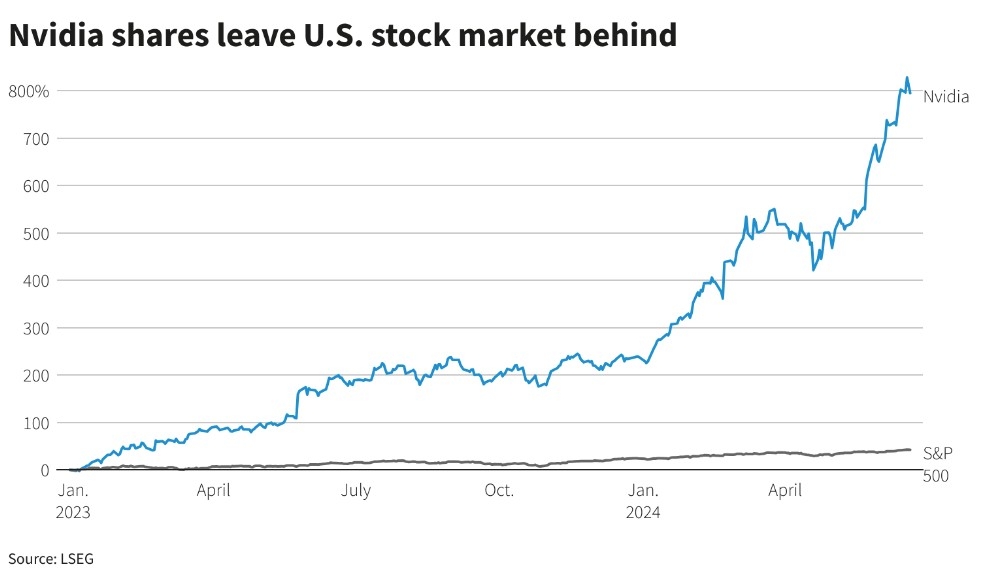

One of the primary reasons the U.S. government invests in stocks is to foster strategic investment and financial stability. By owning stocks in key sectors, the government can influence economic policies and support businesses that contribute to national interests. For example, the government's investment in technology stocks can help promote innovation and economic growth.

Case Study: U.S. Government's Investment in Technology Stocks

In 2011, the U.S. government invested $30 billion in General Motors. This move helped revitalize the struggling automaker and supported American jobs. Today, GM is one of the most valuable companies in the world, and the government has already recouped its investment.

Legal Framework

The legal framework surrounding the U.S. government's stock ownership is quite robust. The Federal Acquisition Regulation (FAR) outlines the rules and procedures for government investments. Additionally, the Office of Management and Budget (OMB) provides oversight to ensure transparency and accountability.

Benefits of Government Stock Ownership

Economic Growth and Job Creation

Investing in stocks can stimulate economic growth and job creation. When the government invests in companies, it not only supports their operations but also encourages other investors to participate, leading to increased market activity.

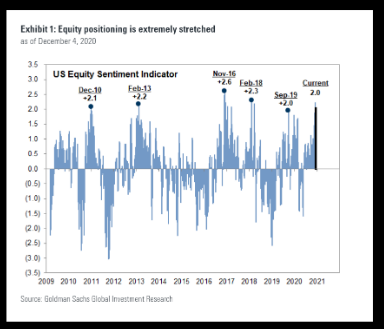

Stabilization of Financial Markets

Government stock ownership can help stabilize financial markets during times of crisis. By acting as a stabilizing force, the government can prevent panic selling and ensure market stability.

Risk Management

While investing in stocks carries risks, the U.S. government has mechanisms in place to manage these risks. Diversification and risk assessment are key components of their investment strategy.

Conclusion

In conclusion, the U.S. government can and does own stocks. This investment strategy serves multiple purposes, from fostering economic growth to stabilizing financial markets. While there are risks involved, the government has the expertise and legal framework to manage them effectively.

BPSCF Stock: A Comprehensive Guide to Under? Us stock news