In recent years, there has been a significant increase in the interest of Chinese investors in the US stock market. This trend has sparked a lot of debate and speculation among market analysts. In this article, we will delve into the reasons behind this growing interest and explore the potential implications for the US stock market.

Why Is China Investing in US Stocks?

There are several factors contributing to China's growing investment in US stocks:

Economic Growth: China's economy has been growing at a rapid pace, making it one of the largest economies in the world. As the country's wealth increases, Chinese investors are looking for new investment opportunities abroad, and the US stock market is a prime candidate.

Diversification: The US stock market is considered one of the most diversified and stable markets in the world. By investing in US stocks, Chinese investors can diversify their portfolios and reduce their exposure to the risks associated with the domestic market.

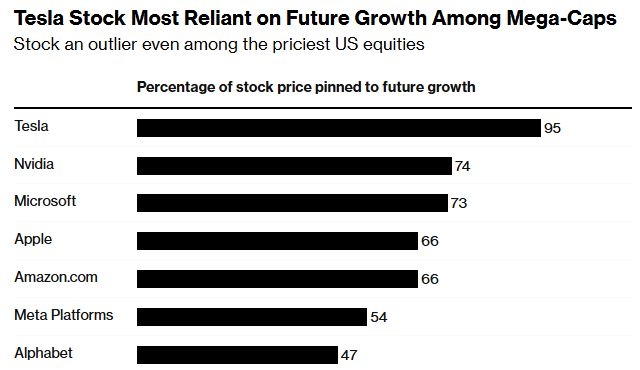

Technological Advancements: The US is home to some of the world's leading technology companies. Chinese investors are particularly interested in these companies, as they represent some of the fastest-growing sectors in the global economy.

Political Stability: The US is considered a politically stable country, which is attractive to foreign investors. This stability provides a level of confidence that may not be present in some other markets.

The Impact on the US Stock Market

The influx of Chinese investment into the US stock market has several potential implications:

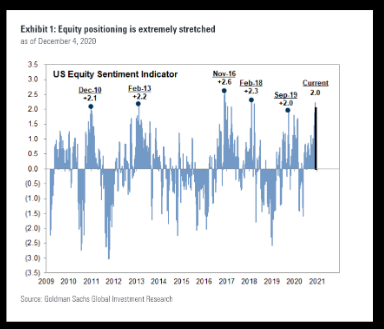

Increased Liquidity: The entry of Chinese investors into the US stock market can increase liquidity, making it easier for companies to raise capital and potentially leading to higher stock prices.

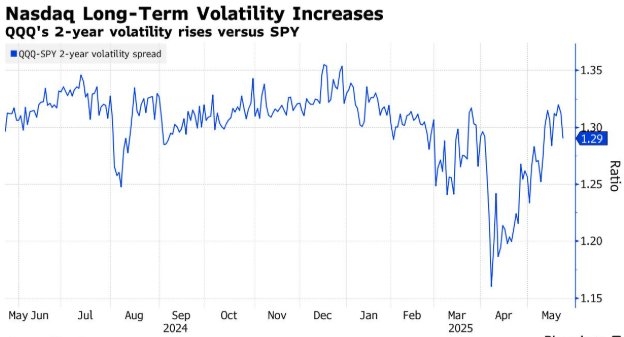

Market Volatility: While increased investment can lead to higher prices, it can also make the market more volatile. This is because Chinese investors may react differently to market news compared to local investors.

Corporate Governance: As Chinese investors gain a larger presence in the US stock market, they may influence corporate governance practices. This could lead to changes in how companies are run and managed.

Case Studies

To better understand the impact of Chinese investment in the US stock market, let's look at a couple of case studies:

Baidu: Baidu, a Chinese search engine company, has been a popular investment choice for Chinese investors. In 2019, Baidu's stock price saw a significant increase, driven in part by Chinese investment.

Alibaba: Another Chinese tech giant, Alibaba, has also seen a surge in investment from Chinese investors. This has helped to drive the company's stock price higher and solidify its position as a global leader in e-commerce.

In conclusion, the growing interest of Chinese investors in the US stock market is a testament to the country's economic strength and the stability of the US market. While there are potential risks and challenges, the overall impact of Chinese investment could be positive for the US stock market. As the relationship between China and the US continues to evolve, it will be interesting to see how this trend develops in the coming years.

American Airlines Group Inc. Common StockNA? Us stock news