Are you looking to invest in the stock market but worried about the high prices of popular stocks? Fear not! There are plenty of low-priced US stocks that offer great potential for growth. In this article, we'll explore some of the best low-priced US stocks to buy in 2023 and provide insights into why they might be worth your investment.

1. Amazon.com, Inc. (AMZN)

Despite its current high market capitalization, Amazon remains a great investment opportunity. The company's low price-to-earnings (P/E) ratio suggests that it is undervalued. With its robust e-commerce platform and expanding cloud computing services, Amazon is well-positioned to continue its growth trajectory.

2. Microsoft Corporation (MSFT)

Microsoft is another low-priced US stock that offers a strong investment case. The tech giant has a diverse portfolio of products and services, including cloud computing, gaming, and productivity software. Its low P/E ratio indicates that it may be undervalued, making it an attractive investment for long-term growth.

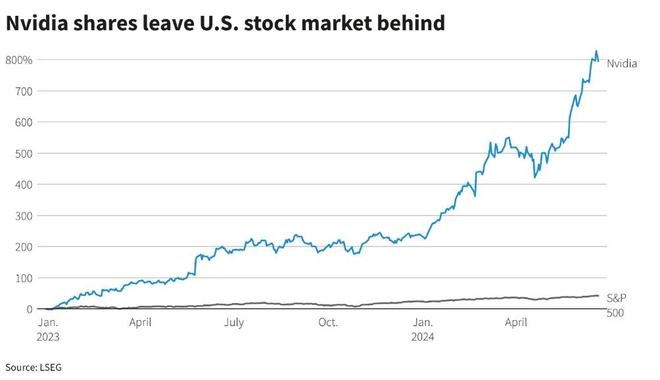

3. NVIDIA Corporation (NVDA)

NVIDIA is a leader in the semiconductor industry, with a focus on graphics processing units (GPUs). The company's low price-to-book (P/B) ratio suggests that it is undervalued. With its expanding presence in the AI and autonomous vehicle markets, NVIDIA has a strong potential for growth.

4. Intel Corporation (INTC)

Intel is a well-established player in the semiconductor industry, with a long history of innovation. The company's low price-to-earnings growth (PEG) ratio indicates that it may be undervalued. With its focus on developing advanced chips for data centers and AI applications, Intel has a promising future.

5. Tesla, Inc. (TSLA)

Tesla is a leader in the electric vehicle (EV) market and has a strong presence in renewable energy. The company's low price-to-sales (P/S) ratio suggests that it may be undervalued. With its growing market share and expanding product line, Tesla has a strong potential for growth.

Case Study: NVIDIA Corporation (NVDA)

Let's take a closer look at NVIDIA as a case study. In the past five years, NVDA's stock price has seen significant growth, nearly quadrupling in value. This growth can be attributed to the company's strong financial performance and expanding market presence. By investing in NVDA, investors can benefit from the company's strong growth potential in the semiconductor industry.

Conclusion

Investing in low-priced US stocks can be a great way to uncover hidden gems in the market. By carefully analyzing companies with strong fundamentals and growth potential, investors can make informed decisions and potentially achieve significant returns. Remember to do your research and consult with a financial advisor before making any investment decisions.

MEDAF Stock: A Comprehensive Guide to Under? Us stock news