In the world of finance, understanding the main stock market indices is crucial for investors and traders alike. These indices serve as vital tools for analyzing market trends, making informed decisions, and evaluating the overall health of the economy. This article provides a comprehensive guide to the most prominent stock market indices, their significance, and how they can impact your investment strategy.

The S&P 500 (Standard & Poor's 500 Index)

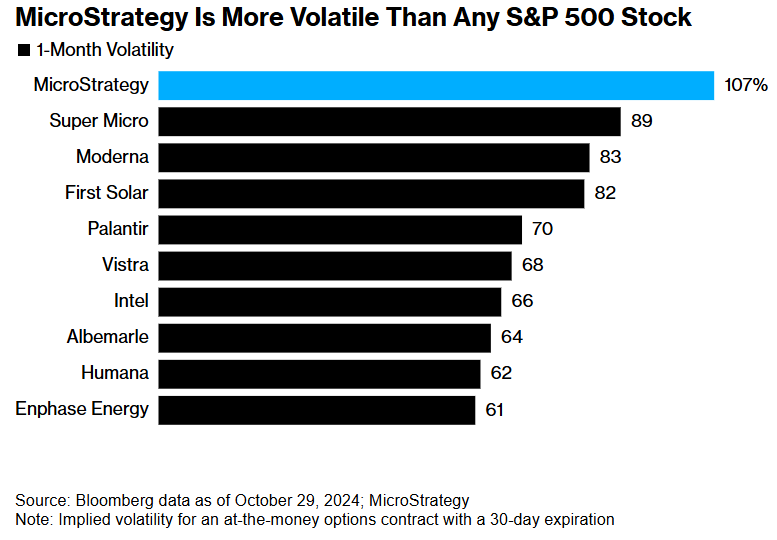

The S&P 500 is one of the most widely followed stock market indices in the United States. It consists of 500 large-cap companies across various sectors, representing approximately 80% of the total market capitalization of all U.S. stocks. This index is often used as a benchmark for the U.S. stock market and is a key indicator of market performance.

Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average is another well-known stock market index that tracks the performance of 30 large, publicly-traded companies in the United States. These companies represent a diverse range of industries, including finance, technology, and consumer goods. The DJIA is often considered a gauge of the broader market and is frequently used to assess the overall health of the U.S. economy.

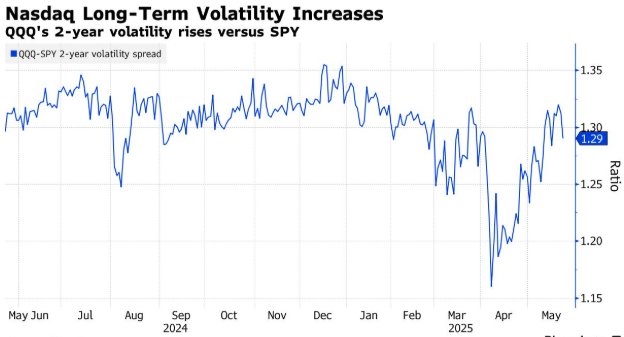

NASDAQ Composite Index

The NASDAQ Composite Index is a broad-based index that includes all domestic and international common stocks listed on the NASDAQ Stock Market. It is particularly known for its heavy representation of technology companies, making it a key indicator of the tech sector's performance. The NASDAQ Composite Index is often used to track the growth and innovation of the technology industry.

Russell 3000 Index

The Russell 3000 Index is a comprehensive index that includes the 3,000 largest U.S. companies, representing approximately 98% of the investable U.S. equity market. It provides a more comprehensive view of the market than the S&P 500 and is often used by investors to gain exposure to a broader range of companies.

Case Study: The 2008 Financial Crisis

One notable example of the impact of stock market indices is the 2008 financial crisis. During this period, the S&P 500 and other major indices experienced significant declines, reflecting the widespread panic and uncertainty in the market. Investors who closely followed these indices were able to anticipate the market's downward trend and adjust their investment strategies accordingly.

Conclusion

Understanding the main stock market indices is essential for investors looking to gain insight into market trends and make informed decisions. The S&P 500, Dow Jones Industrial Average, NASDAQ Composite Index, and Russell 3000 Index are just a few of the key indices that can help you navigate the complex world of finance. By staying informed and utilizing these indices, you can better position yourself for success in the stock market.

Aardvark Therapeutics Inc. Common Stock: S&? Us stock news