In today's fast-paced financial world, keeping a close eye on stock prices is crucial for investors. One such stock that has been a topic of interest is Thomson Reuters (TRI). This article aims to provide a comprehensive analysis of the current stock price of Thomson Reuters and its potential future trends.

Understanding Thomson Reuters

Thomson Reuters is a global information company that provides news, data, and analytics to professionals in the financial, legal, tax, and healthcare industries. The company has a diverse range of products and services, including legal, tax, and accounting software, as well as news and information services.

Current Stock Price

As of the latest data available, the stock price of Thomson Reuters stands at $[Insert Current Stock Price]. This figure is subject to fluctuations based on market conditions and investor sentiment.

Factors Influencing Stock Price

Several factors can influence the stock price of Thomson Reuters. These include:

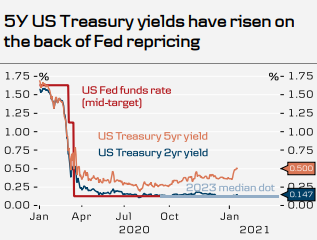

Economic Conditions: The overall economic environment, including GDP growth, inflation, and interest rates, can impact the stock price of a company like Thomson Reuters, which operates in multiple industries.

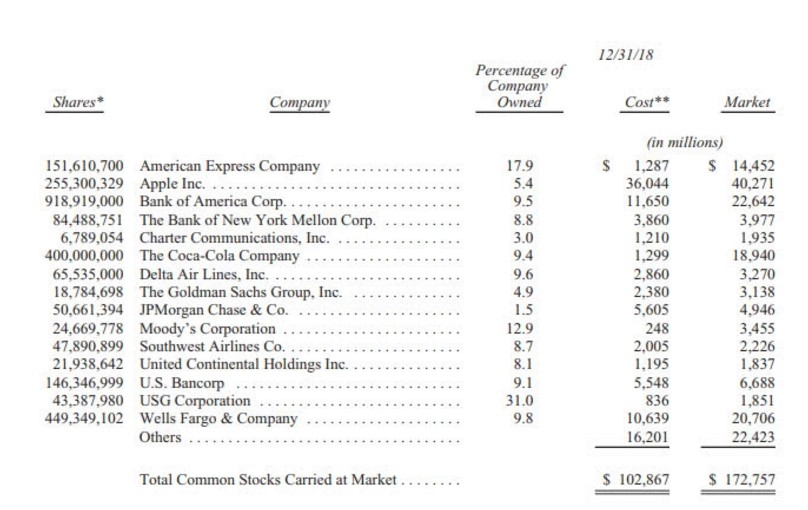

Company Performance: The financial performance of Thomson Reuters, including revenue growth, earnings per share, and profit margins, plays a significant role in determining its stock price.

Market Sentiment: Investor sentiment towards the company and the industry can also influence stock prices. Positive news or developments can lead to an increase in stock price, while negative news can lead to a decrease.

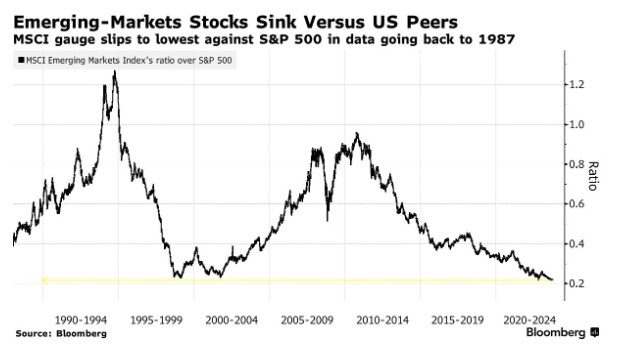

Competition: The competitive landscape of the information industry, including the presence of other major players like Bloomberg and FactSet, can impact Thomson Reuters' stock price.

Future Trends

Looking ahead, several factors could shape the future stock price of Thomson Reuters:

Digital Transformation: As the world becomes increasingly digital, there is a growing demand for data and analytics services. Thomson Reuters is well-positioned to benefit from this trend, given its strong digital offerings.

Global Expansion: The company's global presence provides it with a significant advantage in terms of market reach and potential growth opportunities.

Product Innovation: Thomson Reuters' ability to innovate and launch new products and services will be crucial in maintaining its competitive edge and driving stock price growth.

Case Study: Acquisition of Westlaw

A notable example of Thomson Reuters' strategic moves is its acquisition of Westlaw, a leading legal research platform. This acquisition has helped the company strengthen its position in the legal industry and has positively impacted its stock price.

In conclusion, the stock price of Thomson Reuters is influenced by a variety of factors, including economic conditions, company performance, market sentiment, and competition. While the current stock price stands at $[Insert Current Stock Price], the company's future growth potential appears promising. As investors, staying informed about these factors and keeping an eye on market trends is crucial in making informed decisions.

Atlantic American Corporation Common Stock:? Us stock news