In recent times, the US banking sector has experienced a significant drop in stock prices. This article delves into the causes behind this decline and its potential implications for the financial market.

Causes of the US Bank Stock Drop

The drop in US bank stocks can be attributed to several factors. Firstly, the Federal Reserve's decision to raise interest rates has had a negative impact on the banking sector. Higher interest rates can lead to increased borrowing costs for consumers and businesses, thereby affecting banks' net interest margins.

Secondly, concerns about the economic outlook have also played a role. The slowing global economy and the ongoing trade tensions between the United States and China have raised concerns about the potential for a recession. This uncertainty has led investors to sell off bank stocks, as they anticipate a decline in banking profits.

Thirdly, the implementation of new regulations has put pressure on banks. The Dodd-Frank Wall Street Reform and Consumer Protection Act, for example, has imposed stricter capital and liquidity requirements on banks, which have increased their operational costs.

Implications of the US Bank Stock Drop

The decline in US bank stocks has several implications for the financial market. Firstly, it could lead to a decrease in the availability of credit. As banks' profits decline, they may be less willing to lend money, which could slow economic growth.

Secondly, the drop in stock prices could lead to a decrease in the value of retirement accounts and other investments held by individuals and institutions. This could have a negative impact on consumer confidence and spending.

Thirdly, the drop in bank stocks could lead to increased consolidation in the banking sector. As smaller banks struggle to stay afloat, they may be acquired by larger banks, which could reduce competition and potentially lead to higher fees and less customer service.

Case Studies

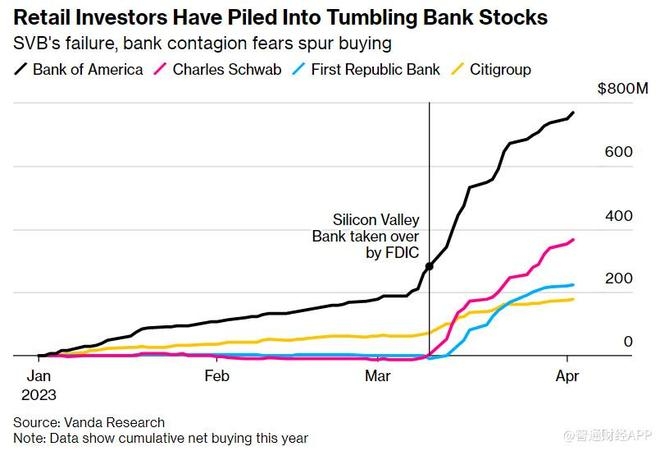

One notable example of a bank experiencing a stock drop is Bank of America. In the first quarter of 2023, the bank's stock dropped by 5% after it reported a decline in earnings. The drop was attributed to higher costs and lower revenue from interest rates.

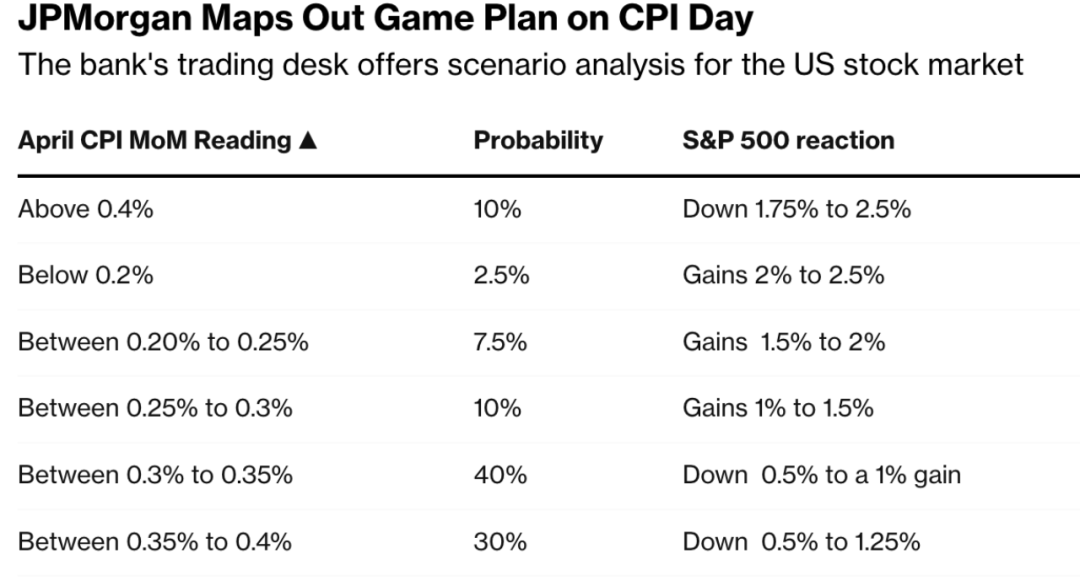

Another example is JPMorgan Chase, which saw its stock price drop by 7% in the same quarter. The decline was attributed to concerns about the economic outlook and the impact of higher interest rates on the bank's profits.

Conclusion

The drop in US bank stocks is a complex issue with several underlying causes. While it poses significant challenges for the financial market, it also presents opportunities for consolidation and innovation. As the economy continues to evolve, it will be important for investors and regulators to closely monitor the banking sector and take appropriate actions to ensure stability and growth.

Acadian Asset Management Inc. Common Stock:? Us stock news