The stock market's early optimism took a hit as tech stocks began to fade, dragging down US stock futures. This sudden downturn in the tech sector has raised concerns among investors about the broader market's stability. In this article, we'll delve into the reasons behind the decline, analyze the impact on the market, and discuss potential long-term implications.

Tech Stocks Take a Tumble

The recent drop in US stock futures can be attributed to the sudden decline in tech stocks. Companies like Apple, Microsoft, and Amazon, which have been leading the market for years, saw their shares fall sharply. This decline was driven by several factors, including concerns about rising inflation, increasing interest rates, and a potential slowdown in economic growth.

Inflation and Interest Rates Concerns

One of the primary reasons for the tech stock downturn is the growing concern about inflation and the possibility of higher interest rates. As the economy continues to recover from the COVID-19 pandemic, the Federal Reserve has been under pressure to control inflation. This has led to speculation that the central bank may increase interest rates sooner than expected, which could negatively impact tech companies that rely heavily on borrowing.

Economic Growth Concerns

Another factor contributing to the decline in tech stocks is the growing concern about economic growth. As the global economy faces challenges such as supply chain disruptions and rising energy costs, investors are becoming increasingly cautious about the outlook for tech companies.

Impact on the Market

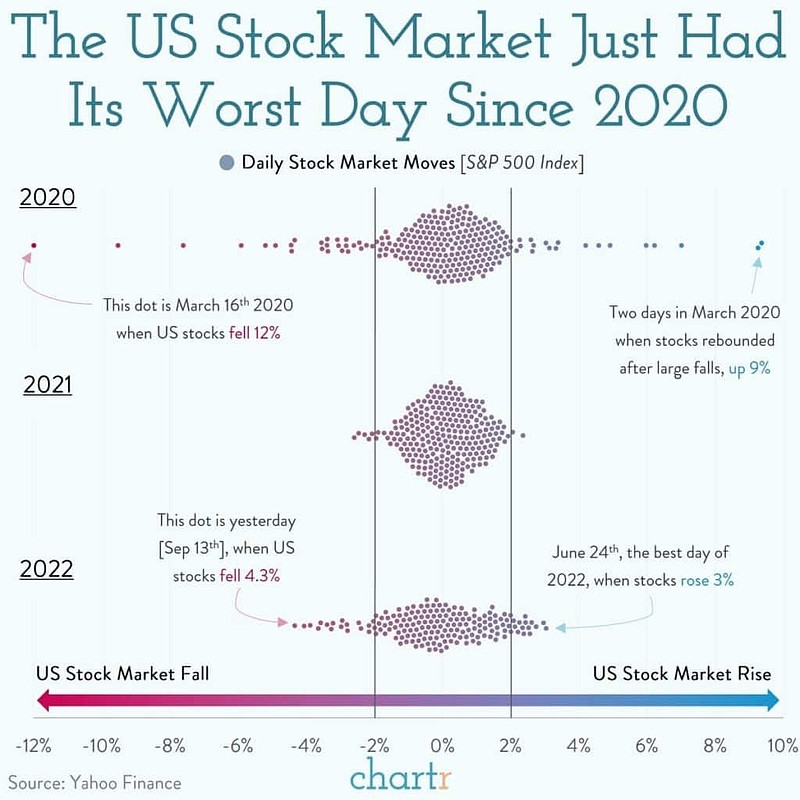

The decline in tech stocks has had a significant impact on the broader market. As these companies are among the largest and most influential in the stock market, their decline has led to a widespread sell-off. This has caused the S&P 500 and the NASDAQ to fall, raising concerns about the stability of the market.

Long-Term Implications

While the recent decline in tech stocks is concerning, it's important to note that the market has seen similar downturns in the past. Historically, tech stocks have been volatile, and this recent decline may be a temporary setback. However, if the concerns about inflation, interest rates, and economic growth persist, it could have long-term implications for the market.

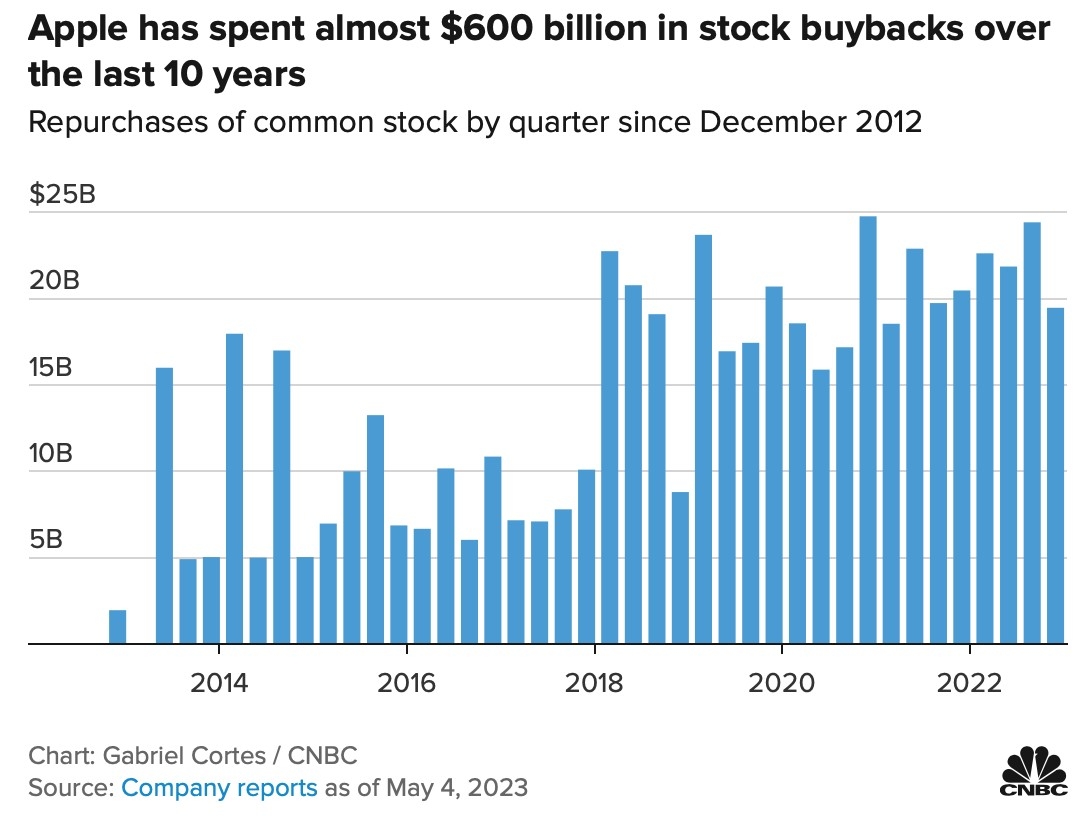

Case Study: Apple's Decline

One of the most notable examples of the tech stock downturn is Apple's recent decline. The tech giant's shares have fallen sharply, raising concerns about its future growth prospects. This decline has been attributed to several factors, including concerns about supply chain disruptions and the increasing competition in the smartphone market.

Conclusion

The recent drop in US stock futures as tech stocks fade is a reminder of the volatility of the stock market. While the downturn is concerning, it's important to keep a long-term perspective and consider the underlying factors driving the decline. As always, investors should conduct thorough research and consult with a financial advisor before making any investment decisions.

Dow Jones Utilities: A Comprehensive Guide ? Us stock news