Understanding the S&P 500 is crucial for anyone looking to invest in the U.S. stock market. This index is not just a number; it's a snapshot of the financial health and performance of the largest and most influential companies in the United States. Let's delve into what the S&P 500 is, how it's calculated, and its significance in the investment world.

What is the S&P 500?

The S&P 500 (Standard & Poor's 500) is a stock market index that tracks the performance of 500 large companies listed on stock exchanges in the United States. These companies represent a diverse range of industries and sectors, making the S&P 500 a comprehensive gauge of the U.S. stock market's health.

How is the S&P 500 Calculated?

The S&P 500 is calculated using a market capitalization-weighted approach. This means that the value of each company's shares in the index is weighted by its market capitalization, which is the total value of all its outstanding shares. The more shares a company has, the greater its influence on the index.

The Significance of the S&P 500

Benchmark for Investors: The S&P 500 is widely regarded as a benchmark for the U.S. stock market. Many investors use it as a reference point to measure the performance of their portfolios.

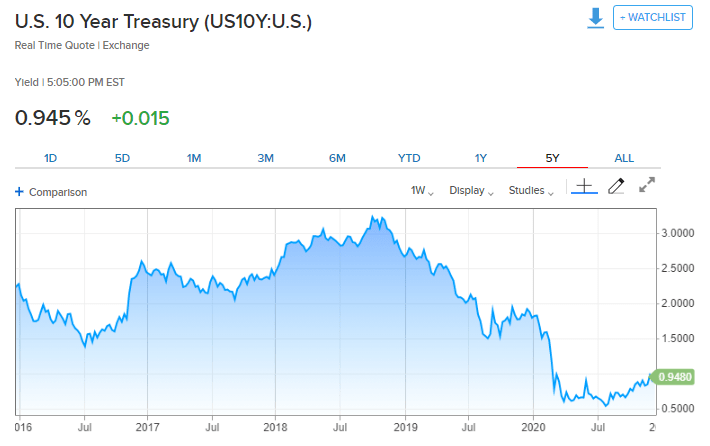

Market Health Indicator: The S&P 500 provides insights into the overall health of the U.S. economy. When the index is rising, it often indicates that the economy is doing well, and vice versa.

Investment Strategy: Investors often invest in the S&P 500 through exchange-traded funds (ETFs) or mutual funds that track the index. This allows them to gain exposure to a broad range of U.S. companies without having to pick individual stocks.

Why Invest in the S&P 500?

Diversification: Investing in the S&P 500 provides diversification, as it includes companies from various sectors and industries. This helps reduce the risk of investing in just one or two stocks.

Long-Term Growth: Over the long term, the S&P 500 has historically provided positive returns. This makes it an attractive option for investors looking for long-term growth.

Economic Stability: The companies in the S&P 500 are some of the largest and most stable in the U.S. economy. This provides a level of security for investors.

Case Study: The 2008 Financial Crisis

During the 2008 financial crisis, the S&P 500 experienced a significant downturn. However, it eventually recovered and reached new highs. This case study highlights the resilience of the S&P 500 and its ability to bounce back from adversity.

Conclusion

Understanding the S&P 500 is essential for anyone looking to invest in the U.S. stock market. It provides a comprehensive view of the largest and most influential companies in the United States. By investing in the S&P 500, investors can gain exposure to a diverse range of companies while benefiting from long-term growth and stability.

KNOIF Stock: The Ultimate Guide to Investin? Us stock news