The NASDAQ composite index took a nosedive today, sending shockwaves through the financial markets. But why did the NASDAQ drop today? In this article, we'll explore the possible reasons behind the sudden downturn and how it could impact investors.

Market Volatility

One of the primary reasons for the NASDAQ's decline is market volatility. Investors often react to unpredictable news and events, which can lead to sudden shifts in the stock market. Today's drop could be attributed to a variety of factors, including political uncertainty, economic data, or corporate earnings reports.

Political Uncertainty

Political events can have a significant impact on the stock market. In recent days, there has been increased uncertainty surrounding political events, which may have contributed to the NASDAQ's decline. For instance, news of political turmoil or policy changes can cause investors to sell off their stocks, leading to a downward spiral in the market.

Economic Data

Economic data can also play a crucial role in the stock market. Today, the release of negative economic data, such as a decline in consumer spending or rising unemployment rates, could have contributed to the NASDAQ's drop. Investors often use economic data to gauge the overall health of the economy and adjust their portfolios accordingly.

Corporate Earnings Reports

Another potential reason for the NASDAQ's decline is the release of corporate earnings reports. Companies with significant market capitalization often release their earnings reports on a quarterly basis, and these reports can have a significant impact on the stock market. If a company's earnings are below expectations, investors may sell off their stocks, leading to a drop in the NASDAQ composite index.

Technological Sector

The NASDAQ is heavily weighted with technology stocks, making it particularly sensitive to news and trends within the tech industry. Today's drop may have been influenced by negative news related to the technology sector, such as a slowdown in growth or regulatory scrutiny.

Impact on Investors

The NASDAQ's decline could have a significant impact on investors, particularly those with a significant portion of their portfolios in NASDAQ-listed stocks. While the market may bounce back, investors may experience short-term losses. It's important for investors to stay informed and adjust their portfolios accordingly.

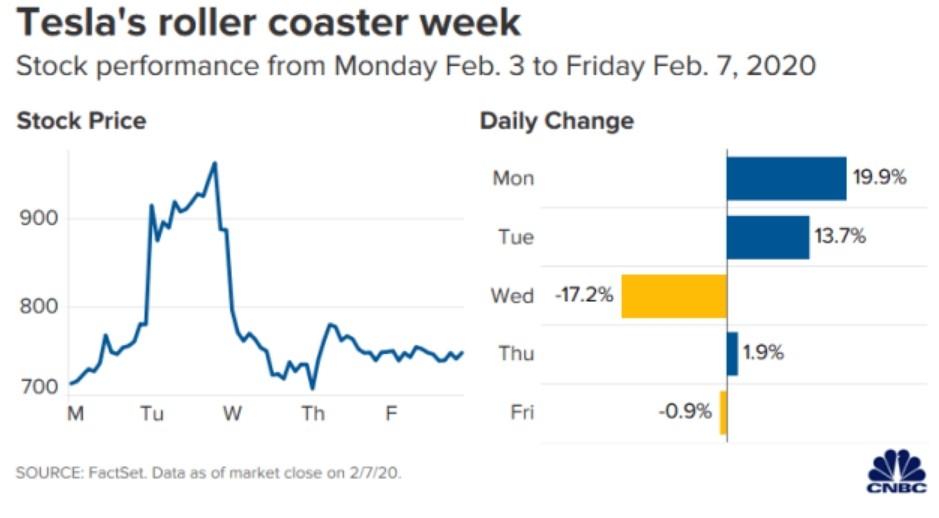

Case Studies

To illustrate the impact of market volatility, let's look at two recent case studies:

Facebook's (FB) Q2 2021 Earnings Report: In July 2021, Facebook reported a drop in revenue growth for the second quarter. This news led to a significant drop in the company's stock price, which in turn affected the NASDAQ composite index.

Tesla's (TSLA) Q2 2021 Earnings Report: In July 2021, Tesla reported a surprise loss for the second quarter, which caused its stock price to plummet. This drop also impacted the NASDAQ composite index, which is heavily weighted with technology stocks.

In conclusion, the NASDAQ's drop today can be attributed to a variety of factors, including market volatility, political uncertainty, economic data, and corporate earnings reports. As investors, it's crucial to stay informed and adjust our portfolios accordingly. While the market may experience short-term fluctuations, it's important to maintain a long-term perspective and focus on the underlying fundamentals of our investments.

Paramount Skydance Corporation Class B Comm? Us stock news