The NASDAQ Composite Index has been a pivotal benchmark for the technology sector since its inception. Over the past decade, the index has undergone significant fluctuations, offering investors valuable insights into market trends and opportunities. In this article, we delve into a comprehensive analysis of the 10-year NASDAQ chart, highlighting key milestones, market trends, and potential investment opportunities.

Introduction

The NASDAQ Composite Index, often referred to as the "NASDAQ 100," is a stock market index that tracks the performance of the largest non-financial companies listed on the NASDAQ stock market. It represents a broad range of technology, biotechnology, telecommunications, and consumer services sectors.

Historical Overview

From the end of 2011 to the end of 2021, the NASDAQ Composite Index experienced remarkable growth, soaring from approximately 2,800 points to over 15,000 points. This impressive 5.3-fold increase was primarily driven by strong performances from leading technology companies like Apple, Amazon, Microsoft, and Facebook (now Meta).

Key Milestones

2007-2008 Financial Crisis: The NASDAQ Composite Index, like other global stock markets, faced significant volatility during the financial crisis. It plummeted from over 2,900 points in 2007 to less than 1,700 points in 2008. However, the index quickly recovered, reaching pre-crisis levels by early 2009.

2011-2013 Bull Market: The NASDAQ Composite Index experienced a robust rally from 2011 to 2013, with the index surging from around 2,800 points to nearly 3,400 points. This uptrend was fueled by strong performances from emerging tech companies like Facebook and LinkedIn.

2018 Tech Selloff: The NASDAQ Composite Index faced a significant selloff in 2018, primarily due to concerns about rising interest rates, trade tensions, and valuation concerns. The index plummeted from over 8,000 points to around 6,700 points.

2020-2021 Bull Market: The NASDAQ Composite Index witnessed another impressive rally from 2020 to 2021, driven by strong performances from leading technology companies and a surge in remote work and e-commerce. The index soared from approximately 9,300 points to over 15,000 points during this period.

Market Trends

Technology Leadership: The NASDAQ Composite Index has been primarily driven by strong performances from leading technology companies, with a particular emphasis on cloud computing, artificial intelligence, and cybersecurity.

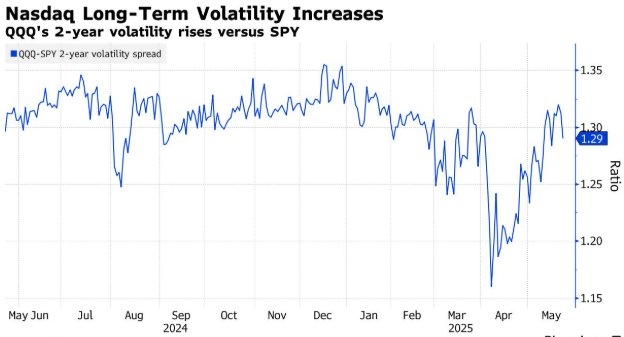

Market Volatility: The index has experienced significant volatility over the past decade, with periods of rapid growth followed by selloffs. This volatility has provided investors with numerous opportunities to capitalize on market trends.

Valuation Concerns: Despite strong growth, the NASDAQ Composite Index has faced valuation concerns, particularly during the 2018 selloff and the 2020-2021 bull market. These concerns have been driven by high valuations of some technology companies.

Case Studies

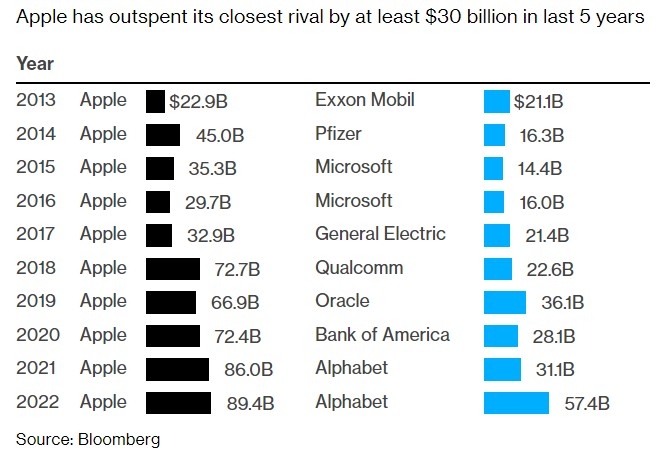

Apple Inc.: Apple Inc. has been a major driver of the NASDAQ Composite Index's growth over the past decade. From 2011 to 2021, Apple's stock price increased from around

400 to over 1800, making it one of the most valuable companies in the world.Amazon.com Inc.: Amazon has also played a crucial role in the NASDAQ Composite Index's growth, with its stock price surging from approximately

180 in 2011 to over 3,200 in 2021.Tesla Inc.: Tesla, another major tech giant, has seen its stock price skyrocket from around

30 in 2011 to over 1,000 in 2021. This impressive growth has contributed significantly to the NASDAQ Composite Index's performance.

Conclusion

The 10-year NASDAQ chart offers valuable insights into the technology sector's performance over the past decade. As investors continue to seek opportunities in this rapidly evolving market, a thorough understanding of market trends and key milestones is crucial. By analyzing the NASDAQ Composite Index, investors can make informed decisions and capitalize on potential growth opportunities in the technology sector.

RWAY Stock: A Deep Dive into the Investment? Us stock information