Are you interested in accessing stocks on the US stock exchange? Whether you're a seasoned investor or just starting out, navigating the world of stocks can be overwhelming. In this article, we'll delve into the ins and outs of accessing stocks on the US stock exchange, providing you with a comprehensive guide to help you make informed investment decisions.

Understanding the US Stock Exchange

The US stock exchange is a marketplace where investors can buy and sell shares of publicly-traded companies. The most prominent exchanges in the US include the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges offer access to a wide range of stocks, from large, well-established companies to small, emerging businesses.

How to Access the US Stock Exchange

Open a Brokerage Account: To access the US stock exchange, you'll need to open a brokerage account. A brokerage account allows you to buy and sell stocks on the exchange. There are many online brokers available, offering a variety of services and fees.

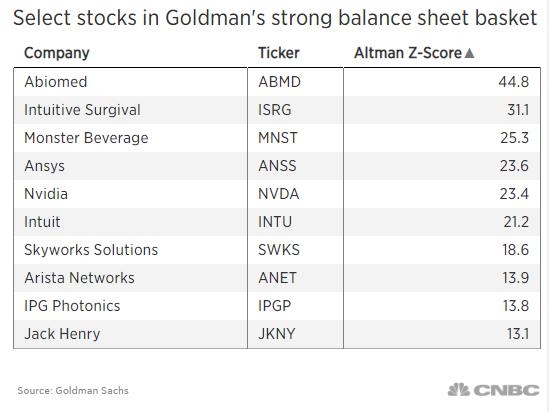

Research and Select Stocks: Once you have a brokerage account, it's time to research and select stocks. Look for companies with strong fundamentals, such as a high return on equity (ROE) and low debt-to-equity ratio.

Place an Order: After selecting a stock, you can place an order to buy or sell shares. You can choose between a market order (buying or selling at the current market price) or a limit order (buying or selling at a specific price).

Top Tips for Investing in US Stocks

Diversify Your Portfolio: Diversifying your portfolio can help reduce your risk. Invest in a mix of stocks across different sectors and industries.

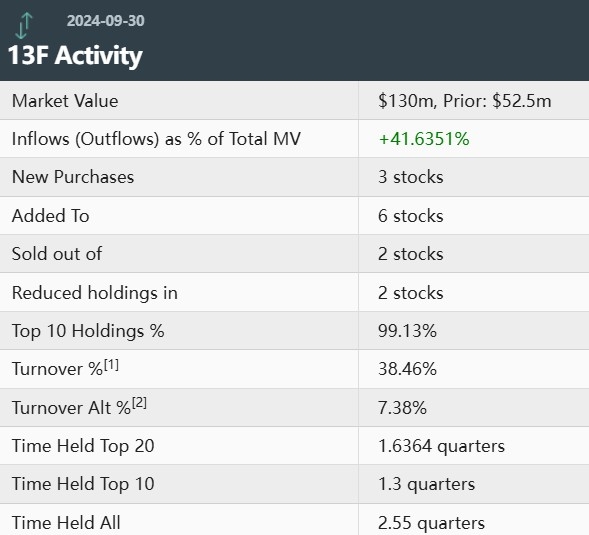

Stay Informed: Keep up with financial news and trends to stay informed about the market. This can help you make more informed investment decisions.

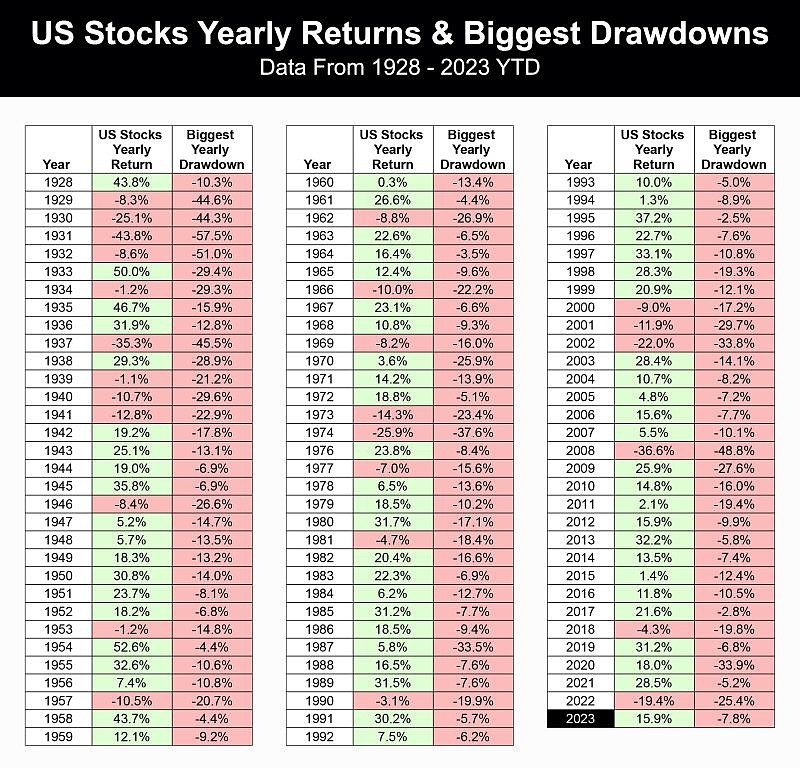

Understand the Risks: Investing in stocks carries risks, including the potential for loss of capital. Be sure to understand the risks before investing.

Use Stop-Loss Orders: A stop-loss order can help protect your investment by automatically selling a stock if its price falls below a certain level.

Consider Dividend Stocks: Dividend stocks can provide investors with regular income. Look for companies with a history of paying dividends and a strong financial position.

Case Study: Apple Inc.

Apple Inc. (AAPL) is a prime example of a successful US stock investment. Since its IPO in 1980, Apple has become one of the most valuable companies in the world. Investors who bought shares early on have seen significant returns, highlighting the potential of long-term stock investments.

In conclusion, accessing stocks on the US stock exchange can be a great way to grow your wealth. By following these tips and understanding the risks involved, you can make informed investment decisions and potentially achieve financial success. Remember to do your research and stay informed to make the most of your investment opportunities.

ProFrac Holding Corp. Class A Common Stock:? Us stock information