The stock market is a dynamic entity, constantly shifting with the economic and political landscapes. As we delve into the summary for April 7, 2025, it's clear that investors had a mix of optimism and caution to navigate the day's trading activities.

Market Overview: The U.S. stock market opened on a cautiously optimistic note, with major indices showing slight gains early in the trading day. However, as the day progressed, investors seemed to weigh the economic data and geopolitical concerns, leading to a more volatile session.

Dow Jones Industrial Average: The Dow Jones Industrial Average (DJIA) opened with a gain of 0.3%, but by the end of the day, it had slipped to a 0.1% loss. The index was largely influenced by the performance of its tech-heavy components, which experienced significant fluctuations.

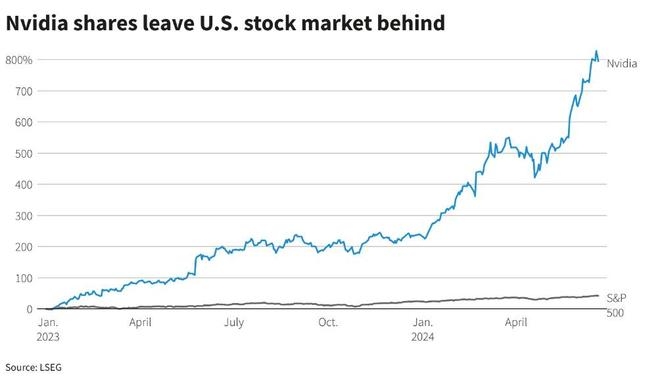

S&P 500: The S&P 500 index, representing a broader segment of the market, showed a similar pattern. It opened with a gain of 0.2% but ended the day with a marginal loss of 0.05%. The index was heavily influenced by the tech sector, which contributed to the overall volatility.

NASDAQ Composite: The NASDAQ Composite, known for its tech-heavy composition, saw a more pronounced volatility. It opened with a gain of 0.5% but ended the day with a loss of 0.8%. The tech sector's performance was a key driver of the index's movement.

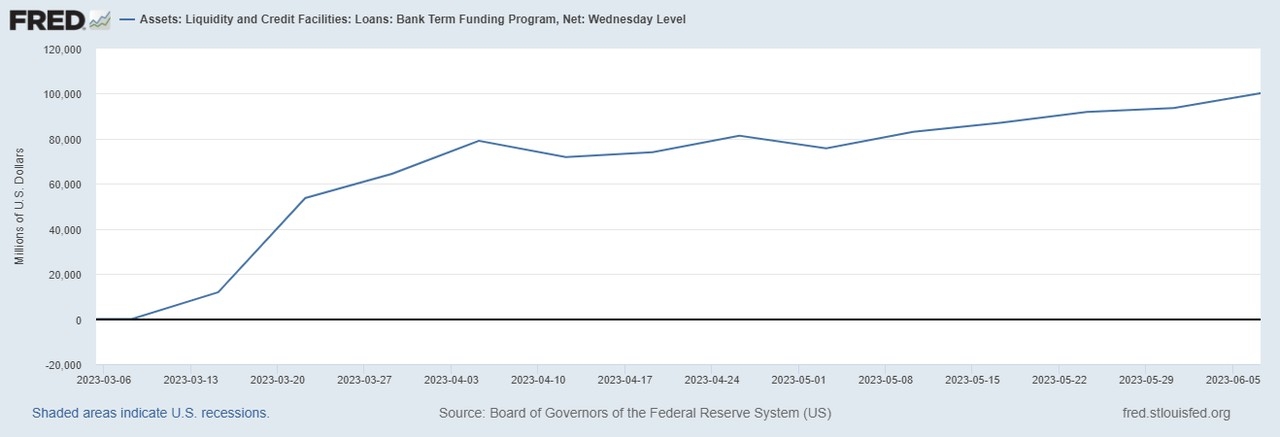

Key Economic Data: The day's trading was also influenced by several key economic data points. The Consumer Price Index (CPI) for March came in slightly higher than expected, leading some investors to question the Federal Reserve's future monetary policy. Additionally, the Initial Jobless Claims for the week ending April 2nd were reported at 220,000, slightly higher than the previous week's figure.

Geopolitical Concerns: Geopolitical tensions also played a role in the market's movements. The escalating situation in a Middle Eastern region raised concerns about global oil supply, which in turn affected energy stocks and the broader market.

Sector Performance: Technology: The tech sector experienced significant volatility throughout the day. Companies like Apple, Microsoft, and Amazon saw their shares fluctuate as investors weighed the sector's growth prospects against economic uncertainties.

Energy: The energy sector was the standout performer, with many energy stocks posting gains. This was largely due to the rising oil prices and concerns about global oil supply.

Financials: The financial sector closed mixed, with some banks posting gains while others saw losses. The overall performance was influenced by the latest economic data and interest rate expectations.

Case Study: One notable case study from the day was the performance of Tesla, Inc. (TSLA). The electric vehicle (EV) manufacturer saw its shares surge early in the day on rumors of a new product launch. However, as the day progressed, the stock ended with a loss, reflecting the broader market's volatility.

Conclusion: April 7, 2025, was a day of mixed emotions for the U.S. stock market. While some sectors saw gains, others experienced significant volatility. Investors will need to closely monitor economic data and geopolitical developments to navigate the market in the coming days.

JOHNSON MATTHEY S/ADR Stock: A Deep Dive in? Us stock information