Investing in stocks is a popular way to grow wealth over time. However, one of the most common questions among investors is whether international stocks are riskier than those in the United States. In this article, we'll delve into this question, comparing the risks and rewards of investing in international and US stocks.

Understanding Risk in Stock Investments

Firstly, it's important to define what we mean by "risk" in the context of stock investments. Risk refers to the likelihood that an investment will not perform as expected, leading to potential losses. When it comes to stocks, there are several types of risks to consider:

- Market Risk: The overall risk of the stock market, which can be influenced by economic factors, political events, or natural disasters.

- Credit Risk: The risk that the company issuing the stock will not be able to meet its financial obligations.

- Liquidity Risk: The risk that it may be difficult to buy or sell a stock without significantly affecting its price.

- Operational Risk: The risk that the company's operations may not be successful, leading to poor financial performance.

Comparing International and US Stocks

When comparing international and US stocks, several factors come into play:

1. Economic and Political Stability

US Stocks: The United States is generally considered to have a stable economic and political environment. This stability can attract investors who are seeking lower-risk investments.

International Stocks: In contrast, some international markets may be more volatile due to political instability, economic uncertainty, or currency fluctuations. However, this doesn't mean that all international stocks are riskier. Many developed markets, such as those in Europe and Japan, offer stability similar to that of the United States.

2. Currency Fluctuations

Investing in international stocks means dealing with currency exchange rates. When the value of the US dollar strengthens, the returns from international stocks may be lower when converted back to USD. Conversely, when the dollar weakens, returns can be higher.

3. Company Size and Growth Opportunities

US Stocks: The United States is home to many large, established companies with strong market positions. These companies often offer dividends and steady growth.

International Stocks: International markets can offer exposure to smaller companies with high growth potential. However, this growth comes with increased risk due to higher volatility.

4. Diversification

US Stocks: Owning a mix of US stocks can help diversify your portfolio and reduce risk.

International Stocks: Including international stocks in your portfolio can provide further diversification and potentially enhance returns. However, this also increases the risk due to the factors mentioned earlier.

Case Studies

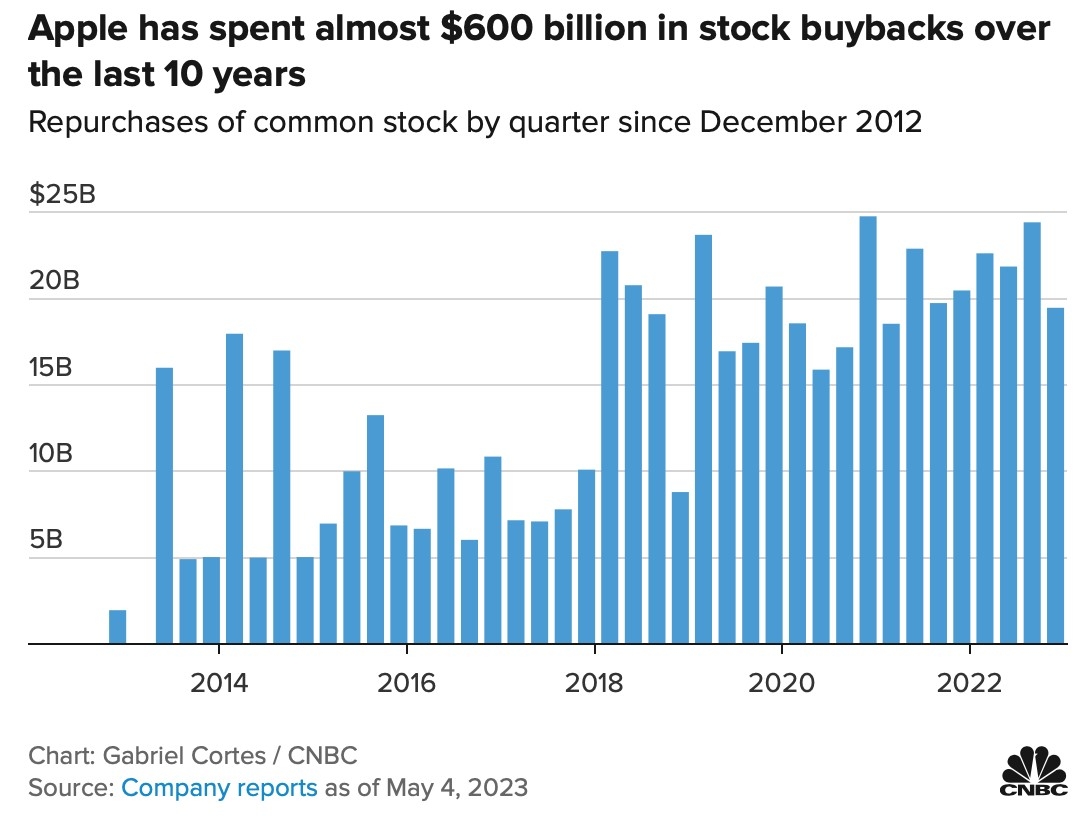

- Apple (AAPL): As one of the largest companies in the world, Apple offers stability and dividends. Investing in Apple can be considered lower-risk compared to smaller international companies.

- Tencent (TCEHY): Tencent, a Chinese technology giant, offers high growth potential but is subject to regulatory and economic risks within China.

Conclusion

While it's difficult to definitively say that international stocks are always riskier than US stocks, there are several factors to consider. It's crucial to assess your own risk tolerance and investment goals when deciding whether to invest in international or US stocks. By understanding the risks and rewards of each option, you can make a more informed decision and potentially build a well-diversified portfolio.

Abeona Therapeutics Inc. Common Stock: Trad? Us stock information