In today's globalized market, investors are constantly seeking opportunities to diversify their portfolios. One such investment option that has gained popularity is the US tracking stock of CMI Ltd Australia. This article delves into the details of CMI Ltd Australia US tracking stock, offering valuable insights for potential investors.

Understanding CMI Ltd Australia US Tracking Stock

Firstly, it's important to understand what a tracking stock is. A tracking stock is a security that is designed to mirror the performance of a specific division or segment of a company. In the case of CMI Ltd Australia US tracking stock, it represents a stake in the Australian company's US operations.

Benefits of Investing in CMI Ltd Australia US Tracking Stock

1. Diversification: By investing in CMI Ltd Australia US tracking stock, investors can gain exposure to the Australian company's US operations without having to invest directly in the Australian stock market. This allows for diversification and exposure to a different market.

2. Performance Focus: As a tracking stock, CMI Ltd Australia US tracking stock focuses solely on the performance of the US operations. This means investors can evaluate the success of the company's US ventures independently from the broader Australian market.

3. Liquidity: Tracking stocks often offer higher liquidity compared to direct investments in the underlying company. This can be beneficial for investors looking to enter or exit their positions quickly.

4. Potential for Higher Returns: As the US market is often seen as more dynamic and growth-oriented, investing in CMI Ltd Australia US tracking stock could potentially offer higher returns compared to investing in the Australian stock market.

Key Factors to Consider

When considering an investment in CMI Ltd Australia US tracking stock, there are several key factors to keep in mind:

1. Financial Performance: Evaluate the financial performance of CMI Ltd Australia's US operations. Look at metrics such as revenue growth, profitability, and cash flow.

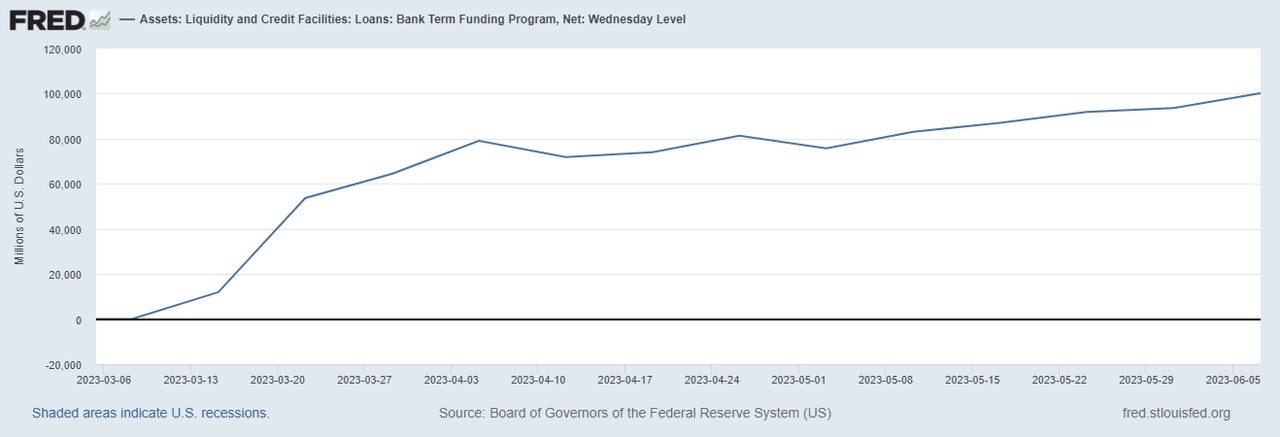

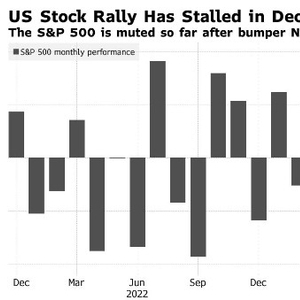

2. Market Conditions: Understand the current market conditions and how they may impact the performance of CMI Ltd Australia's US operations. Factors such as economic cycles, industry trends, and regulatory changes can all influence the company's performance.

3. Management: Assess the quality of management at CMI Ltd Australia. Strong leadership and a clear strategy can significantly impact the company's success.

4. Risk Assessment: Consider the risks associated with investing in CMI Ltd Australia US tracking stock. These risks may include market volatility, currency fluctuations, and regulatory changes.

Case Study: XYZ Corporation

To illustrate the potential benefits of investing in a tracking stock, let's consider a hypothetical case study of XYZ Corporation. XYZ Corporation is an Australian company with significant operations in the US. By investing in XYZ Corporation's US tracking stock, investors gained exposure to the dynamic US market while mitigating the risks associated with investing directly in the Australian stock market.

Over a period of five years, XYZ Corporation's US operations experienced significant growth, outperforming the broader Australian market. Investors who invested in the US tracking stock during this period saw substantial returns on their investment.

Conclusion

Investing in CMI Ltd Australia US tracking stock can be a strategic move for investors looking to diversify their portfolios and gain exposure to the dynamic US market. By understanding the key factors and conducting thorough research, investors can make informed decisions and potentially achieve significant returns.

ALRDF Stock: A Comprehensive Guide to Under? Us stock information